Acquiring that powers every stage of your growth

Launch fast

- Built into the orchestration layer – just switch it on

- Fast onboarding and compliance – go live in as little as 1 day

- Immediate global payments acquiring

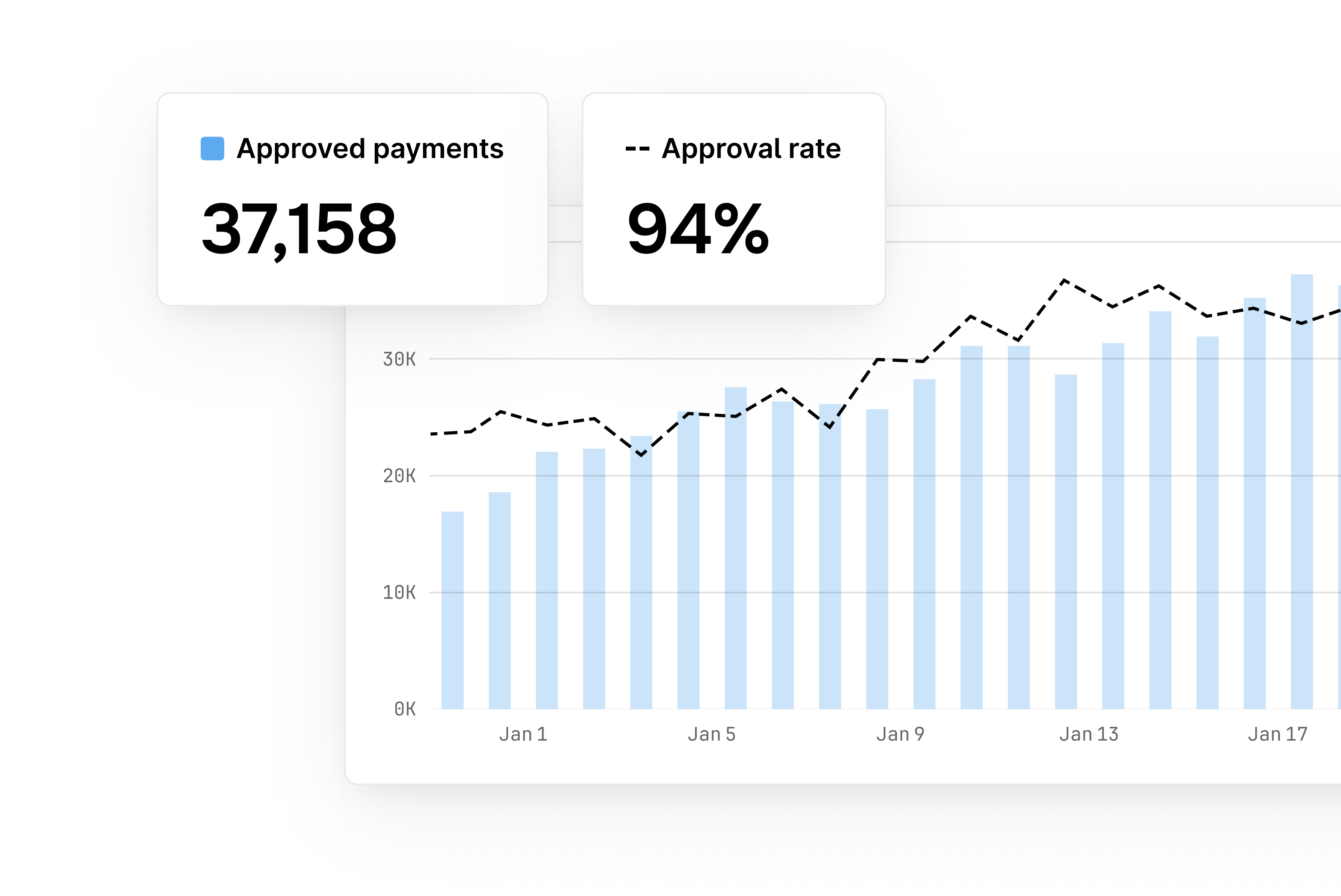

Convert more

- Dedicated team optimizing issuer approvals and routing

- ISO messaging and advanced card tech for better conversion

- Retries, SCA exemptions, and dynamic 3DS – all built in to reduce friction

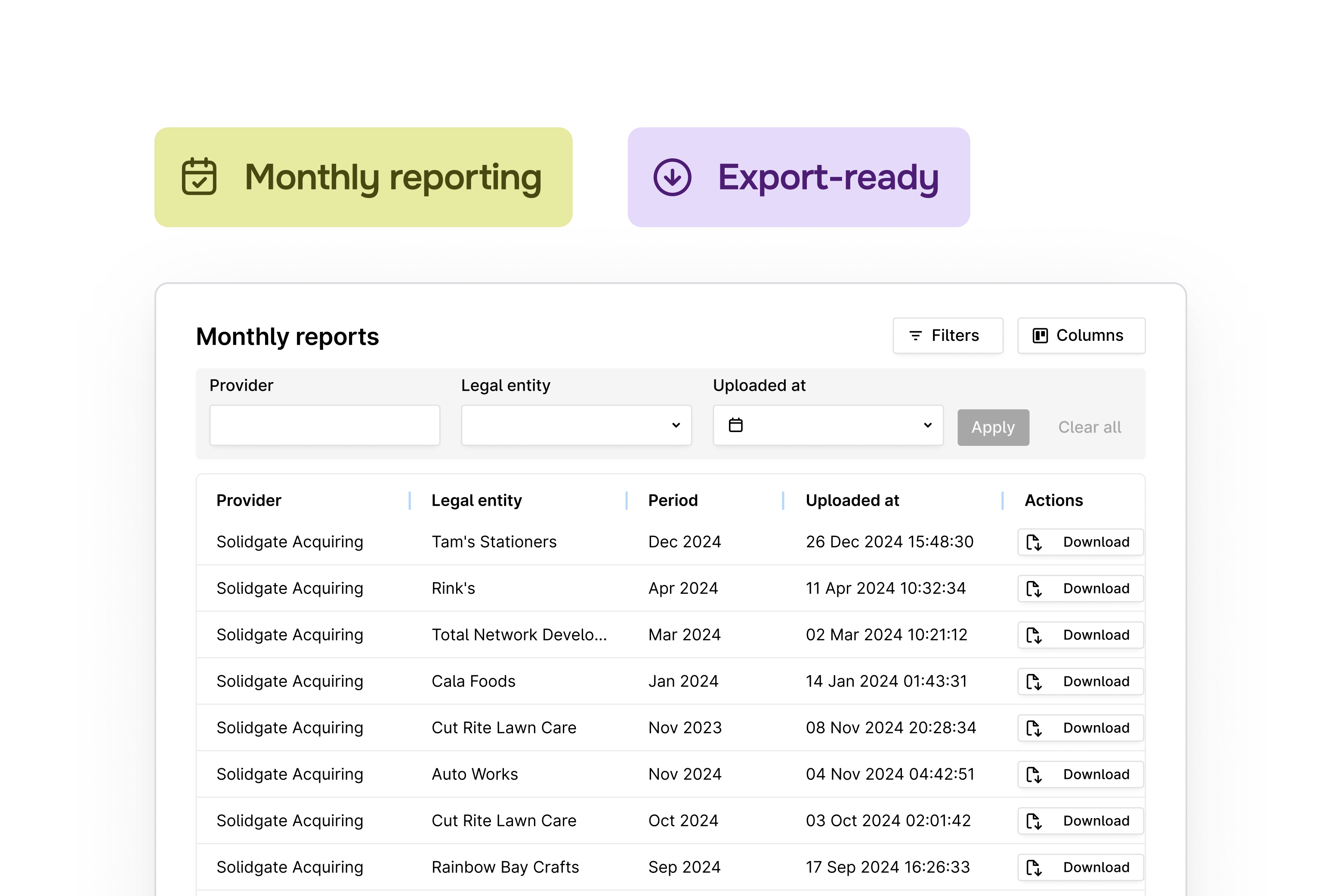

Manage finances better

- Multi-currency settlement to reduce FX losses and improve margin

- Real-time finance insights with transparent, export-ready reporting

- Faster payouts with full visibility into balances, flows, and timing

Built on the latest card acquiring standards

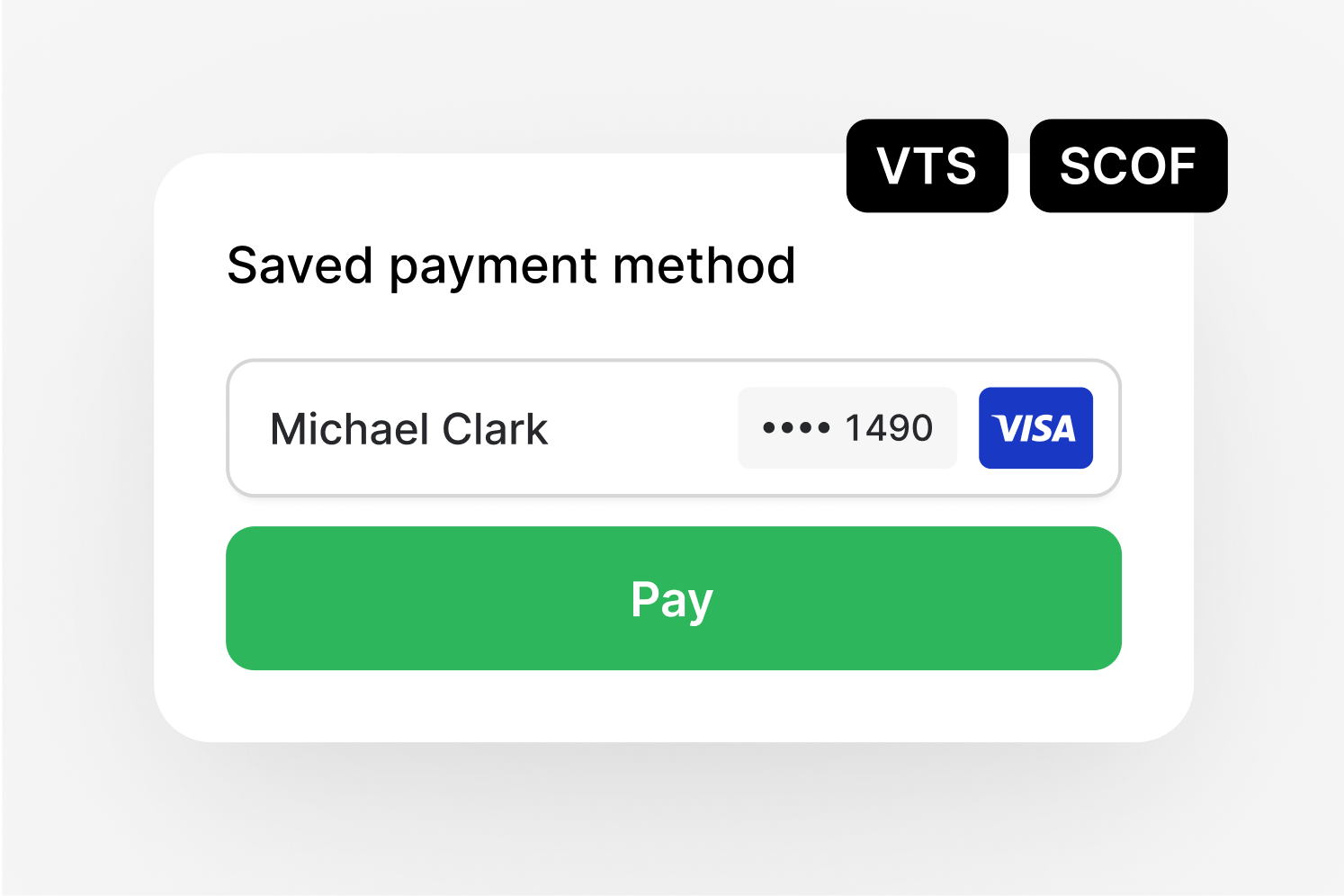

Network tokenization

Scheme-managed tokens that stay fresh and secure, reducing declines and supporting issuer-side validation.

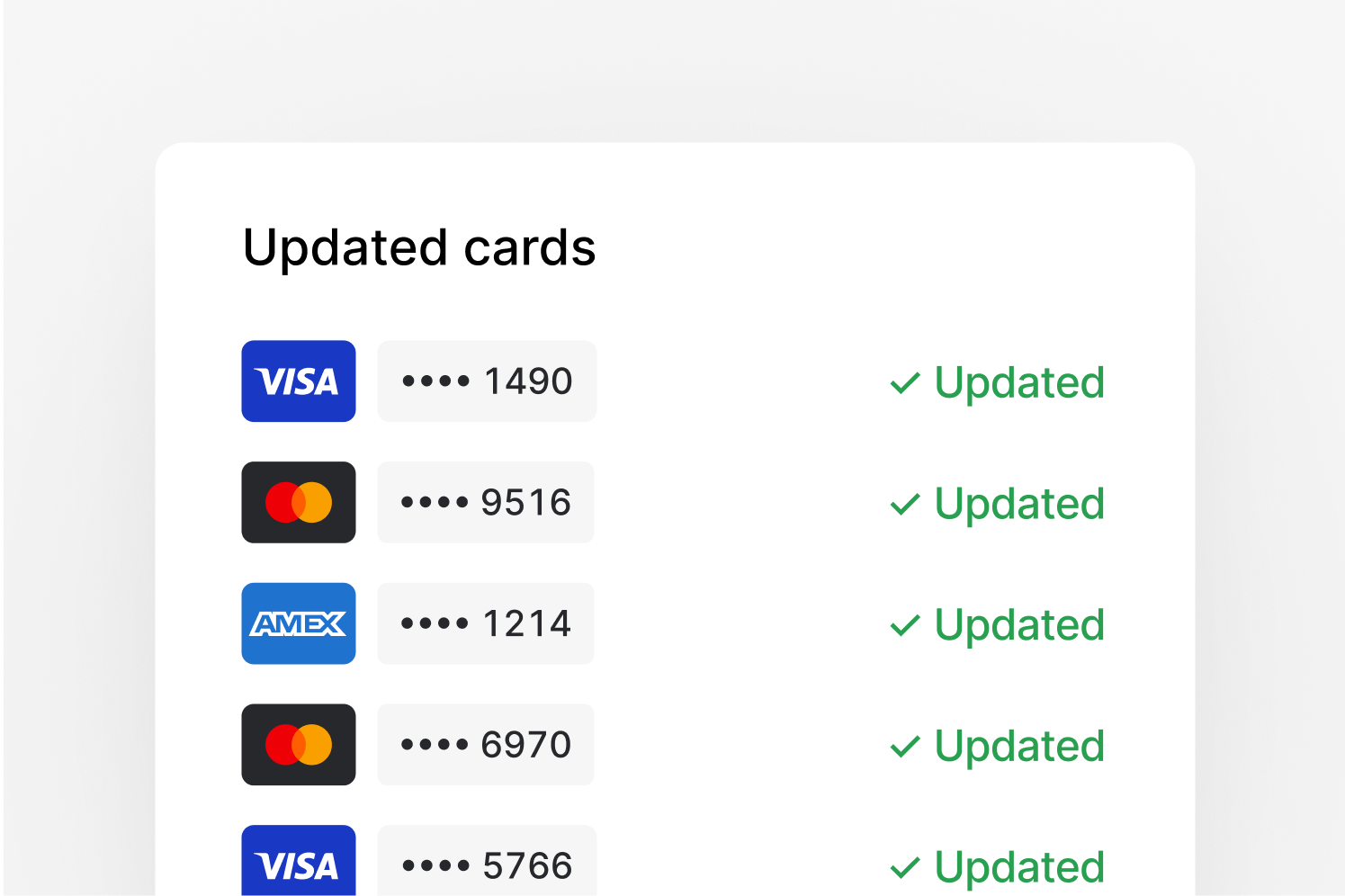

Account updater

Automatically refreshes expired or replaced cards to reduce failed charges and recurring payment drop-offs.

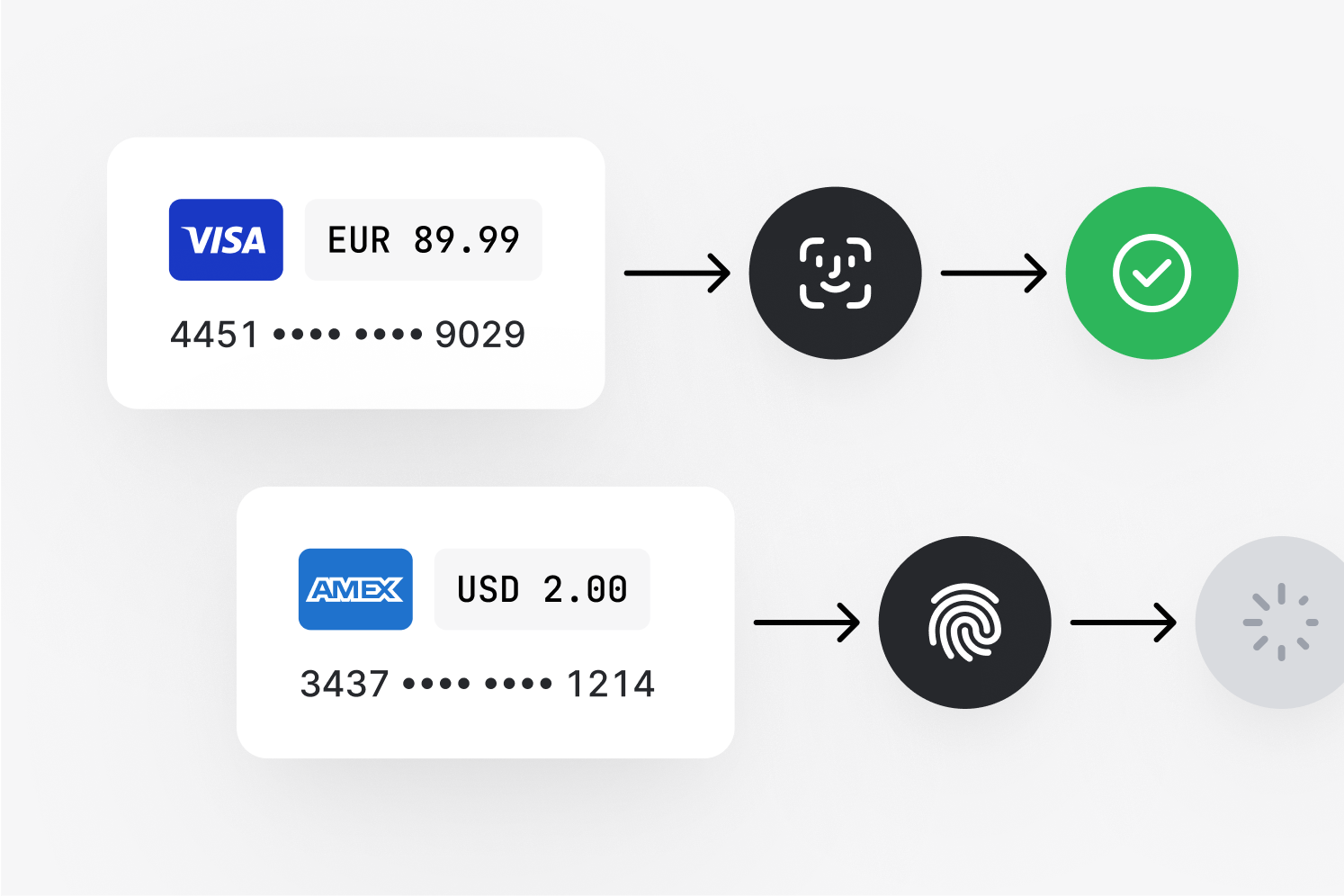

Adaptive 3DS

Applies friction only when needed with built-in exemptions and support for biometric authentication.

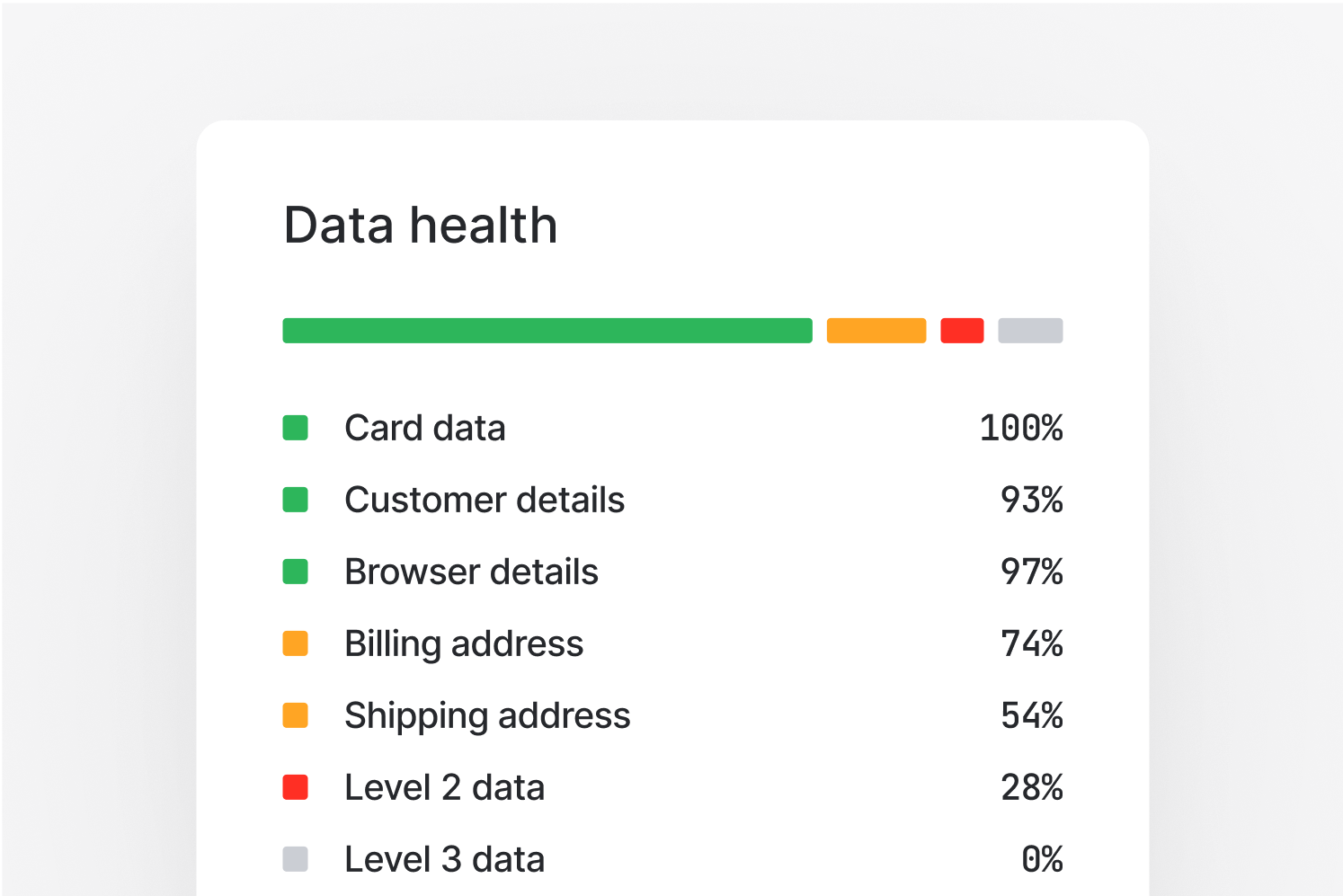

Level 2/3 data support

Send enriched purchase data to improve approval rates and lower interchange costs for your industry.

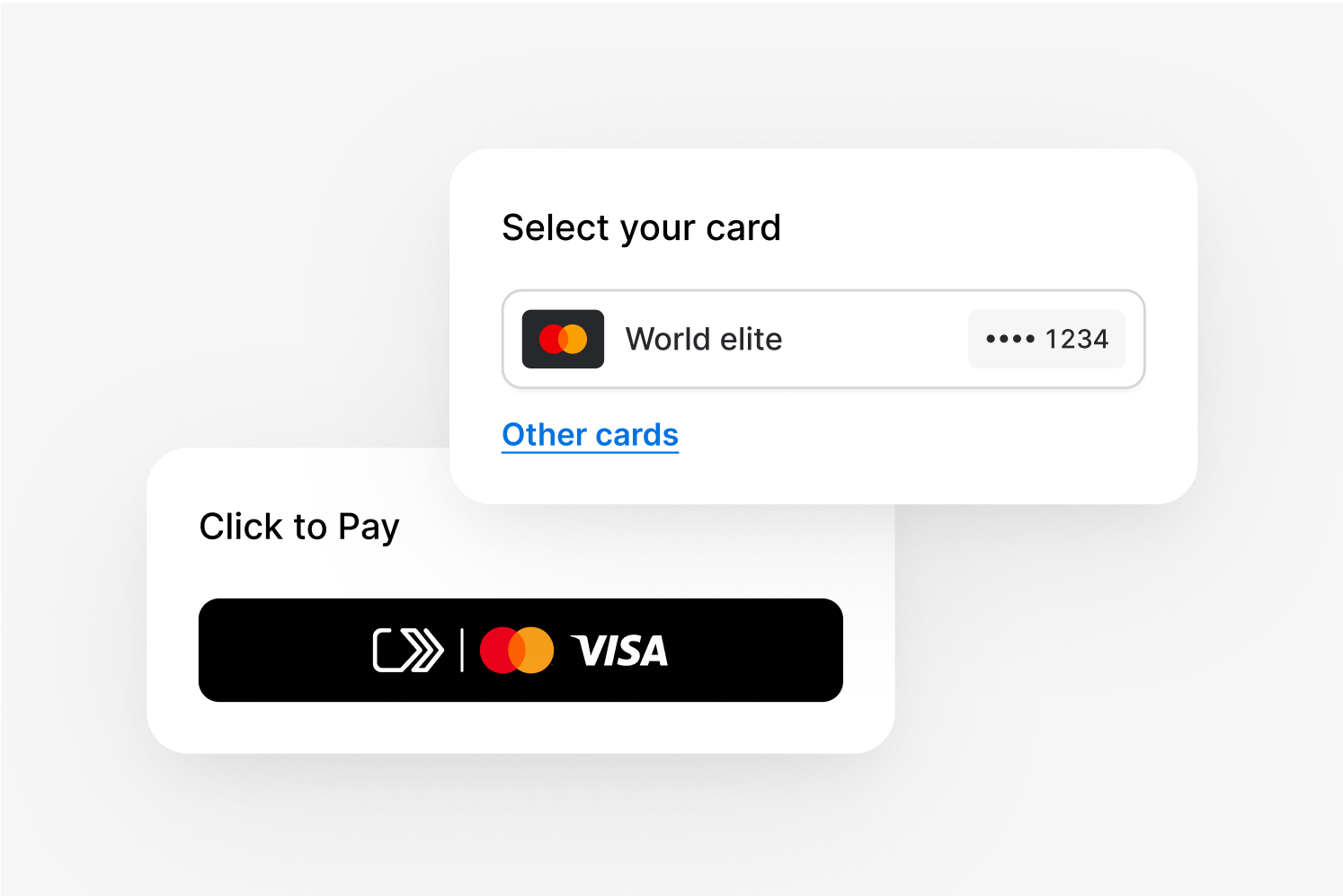

Click to Pay

Faster, passwordless checkout for returning users – no credentials or manual card entry needed.

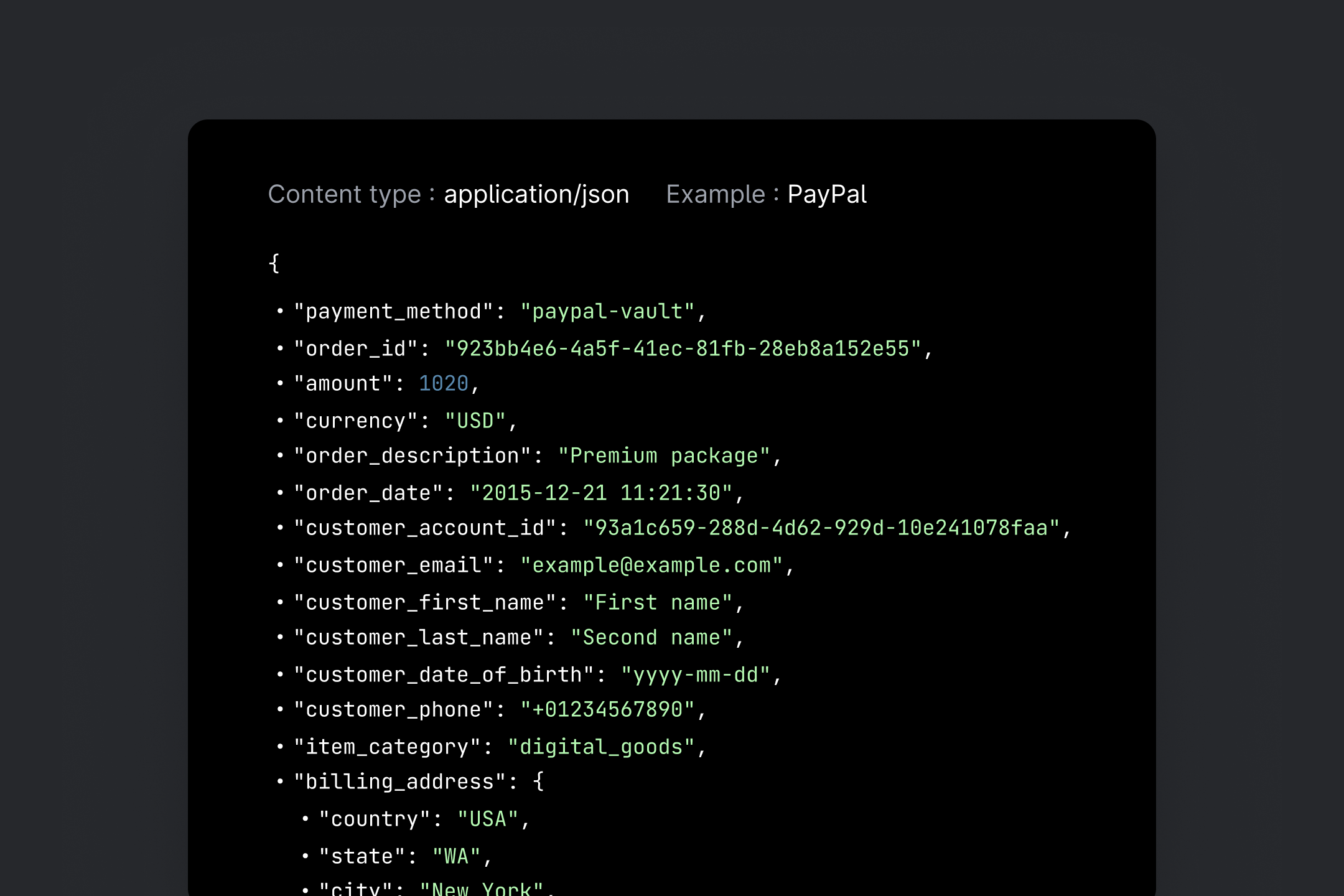

Integrate the way you want

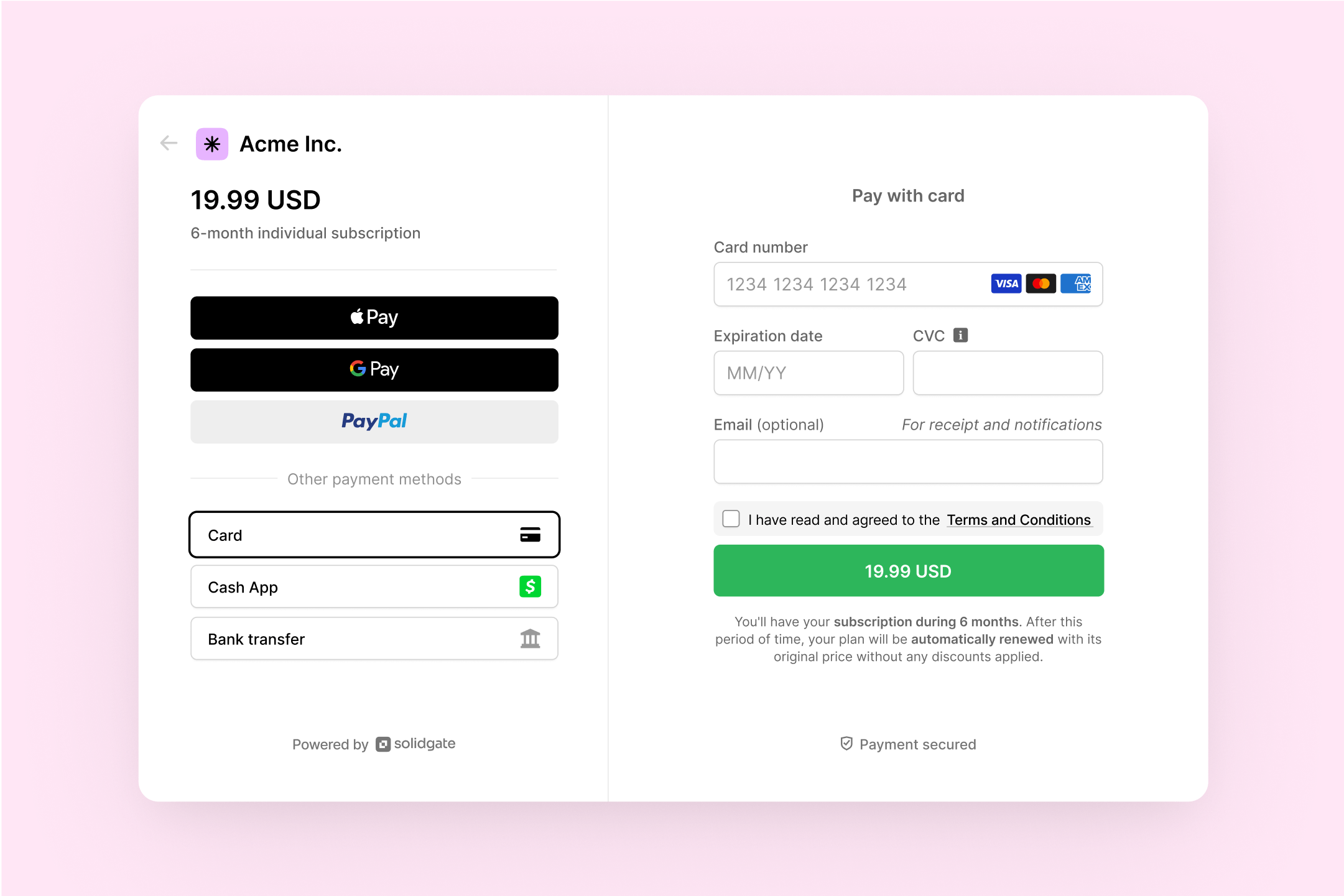

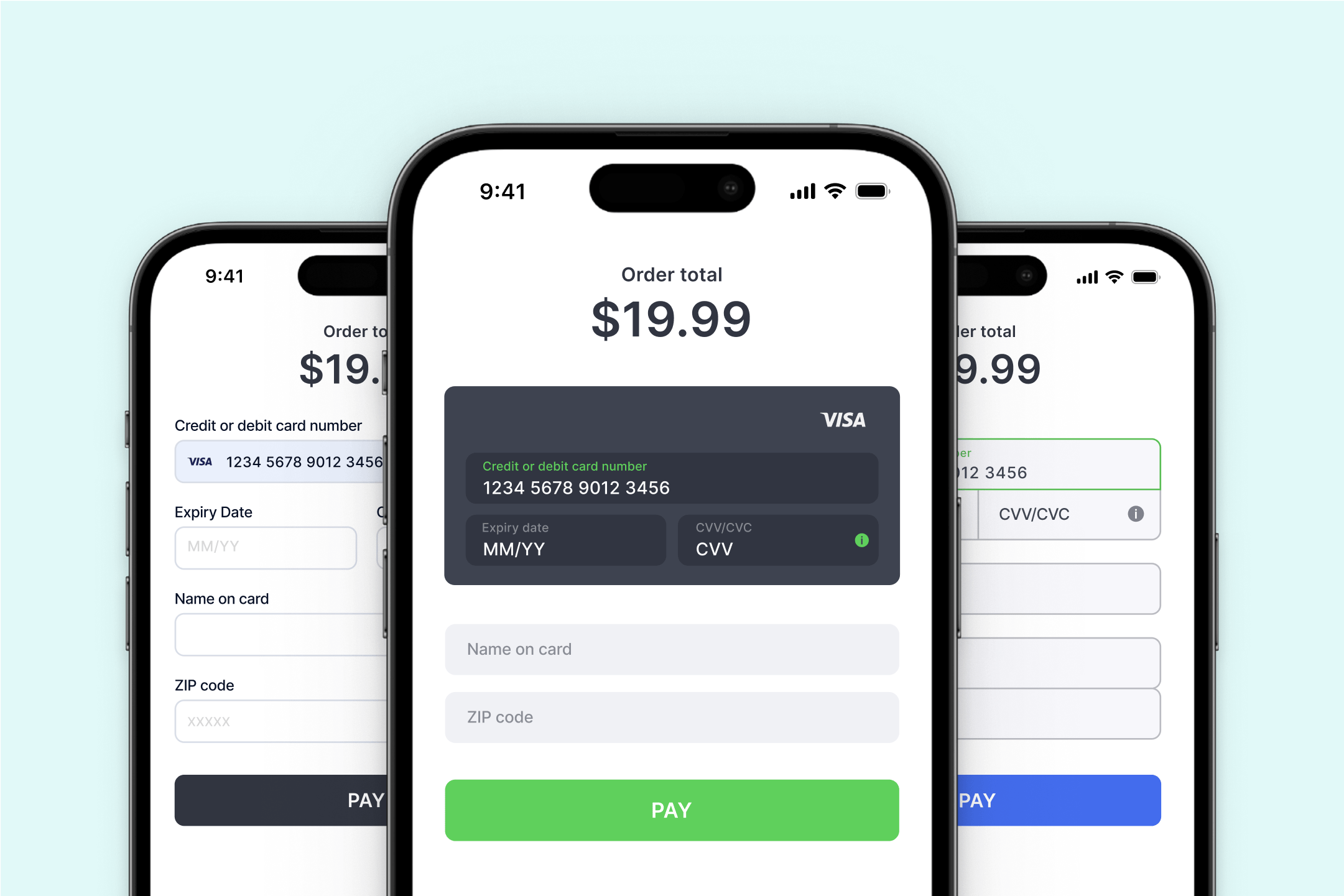

From hosted payment pages to full API control. Go live the way that works for your team.

Infrastructure you don’t have to think about

99.99% uptime SLA

Guaranteed availability across all supported regions – even during peak traffic and high load.

Multi-region infrastructure

Low-latency performance and automatic failover supported by an active-active global architecture.

Secure by design

Enterprise-grade infrastructure with tokenization, encryption, and full PCI DSS 4.0 compliance.

Frequently asked questions

- Smart routing to different acquirers/PSPs based on issuer performance

- Retries and cascading when a transaction initially fails

- SCA exemptions and adaptive 3DS to reduce friction

- Scheme features like network tokenization and account updater to keep credentials valid

- PCI DSS v4.0 (card data security)

- PSD2 / SCA in the EU

- ISO 27001:2022 for information security

- GDPR for data handling

- : send ready-to-use checkout links instantly

- : drop-in, PCI-compliant form with brand customization

- : full server-to-server integration for maximum control

- : Shopify, WooCommerce, and others

- Faster time to market – onboard and go live in as little as 1 day with no heavy integrations.

- Higher approval rates – we optimize issuer approvals with smart routing, retries, adaptive 3DS, and scheme tools like network tokenization and account updater.

- No lock-in – you can connect multiple acquirers or PSPs, migrate, and route transactions dynamically without being tied to one provider.

- Financial transparency – real-time reconciliation, multi-currency settlements, and export-ready reporting to reduce FX losses and simplify cash management.

- Enterprise-grade reliability – 99.99% uptime SLA, global multi-region infrastructure, and full PCI DSS v4.0 compliance.