Visa is making some big changes to its monitoring programs that will affect how global online merchants manage fraud and dispute metrics. Here’s the lowdown.

Summary: On April 1, 2025, Visa retired VDMP, VFMP, and the current VAMP and replaced them with one enhanced VAMP program. With this update, VAMP introduced a risk metric and its thresholds, which will roll out in three phases. These changes will require merchants to implement a more deliberate approach to dispute and fraud management to stay within the thresholds.

Struggling with VAMP compliance? Download our VAMP playbook and get clear, actionable steps to stay compliant.

Table of Contents

New Visa Acquirer Monitoring Program metrics and definitions

Come April 1, 2025, Visa is hitting refresh on its approach to fraud and dispute management. It will retire the Visa Dispute Monitoring Program (VDMP), the Visa Fraud Monitoring Program (VFMP) and the current Visa Acquirer Monitoring Program—Visa’s system for managing risk in the payment ecosystem—and combine them into one VAMP program. It will introduce a unified metric that counts both fraud and non-fraud disputes together.

The updated program introduces a new transaction count-based metric called the VAMP ratio. This metric combines reported fraud and non-fraud chargebacks into a single measurement, providing a clearer picture of overall risk.

Merchants will also need to account for a criterion called enumerated transactions. Similar to brute force attacks, these refer to unauthorized attempts to test payment card details by systematically guessing combinations of card numbers, CVV codes, and expiration dates to identify valid card information.

📌 New VAMP formula:

VAMP = (TC40) + (TC15) / Total sales count

Now includes all cardholder disputes (TC15) reason codes. *Previously, 10.XX reason codes were excluded.

*In this equation:

- Fraud notifications (TC40)—transactions flagged as fraud by issuers and reported to Visa;

- Disputes (TC15)—Visa chargebacks with all reason codes: 10, 11,12, and 13;

- Total sales count—settled card-not-present transactions.

Enumerated transactions—transactions, both approved and declined, that are linked to enumeration attacks.

Excluded:

- Disputes resolved through pre-dispute products, contingent on the timing of the data extract;

- TC 40 fraud qualified for Compelling Evidence 3.0, contingent on the timing of the data extract.

Beyond the VAMP Ratio itself, acquirers will still need to monitor key metrics like the Fraud Amount Ratio to stay on top of risk management, regulatory requirements, TRA exemptions, and reputation concerns. With this program, Visa aims to put more responsibility on acquirers to manage their portfolio’s risks.

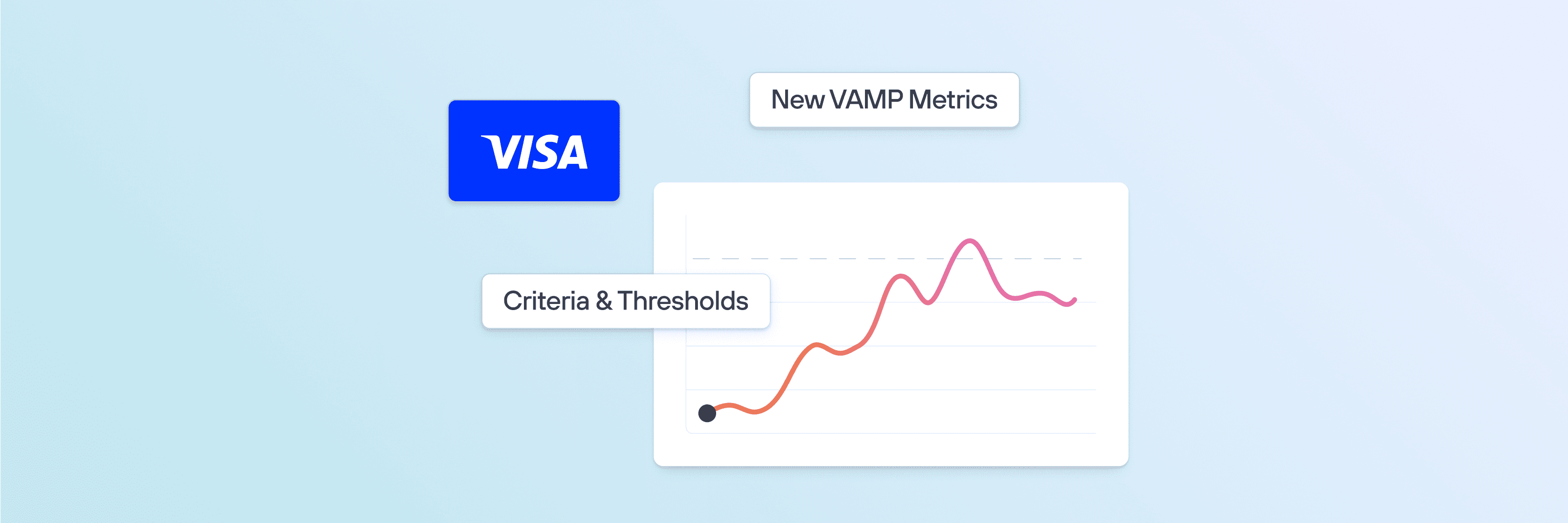

VAMP program thresholds for acquirers and merchants

The thresholds for the Visa monitoring metrics will change in three iterations: April 1, 2025, January 1, 2026, and April 1, 2026. Here are the updated thresholds for the EU and North America:

Non-compliance assessments and enforcement fees

If you exceed the thresholds, you will have a 3-month grace period to adjust your practices without incurring penalties. Starting from the 4th month, the enforcement fees will apply to each dispute and fraud alert for merchants and acquirers exceeding specified thresholds. These fines are intended to encourage both acquirers and merchants to behave responsibly regarding fraud and dispute management. Clients are eligible for a 3-month grace period for every 12 months they are not identified in the program.

Exit Criteria: A VAMP case is considered closed once the acquirer or merchant brings their performance back under the excessive threshold for the specific activity being monitored.

Advisory period

From April 1 to September 30, 2025, the updated Visa acquirer monitoring program will include an advisory period. During this time, acquirers, including Solidgate, will receive “Advisory” notifications if they or their merchants hit or exceed the program thresholds. Any identifications made during the Advisory Period are considered a breach of the MP thresholds.

How can you prepare for the Visa acquirer monitoring program?

Overall, this update serves as a reminder for merchants to use Prevention Alerts, as well as have strong monitoring, chargeback management, and antifraud practices in place. To stay in the green, implement the following strategies:

1. Sign up for Prevention Alerts: If your MIDs are leveraging Prevention Alerts, you can significantly reduce the VAMP ratio.

2. Set up PayPal Solidgate pre-dispute alerts: PayPal doesn’t cover most early dispute alerts for Visa transactions, leading to increased dispute volume. To avoid exceeding PayPal thresholds, you can set up Solidgate pre-dispute alerts for PayPal;

3. Setup Antifraud solution to fight enumeration attacks: Tools like Solidgate Antifraud help you identify and prevent potentially suspicious or risky activities without blocking legitimate customers;

4. Have clear refund, cancellation, and subscription policies: Having clear and transparent terms of service can save you from numerous payment disputes and help defend your case to the card issuers if a dispute occurs;

5. Make your terms of service agreement easy to find: Provide a full version of your ToS on the checkout page or as a pop-up with a requirement to agree to them before submitting the order;

6. Track shipping: Use carriers and services that provide online tracking and delivery confirmation whenever possible;

7. Keep detailed records of all customer interactions: Having IP addresses, timestamps, email correspondence, and order history can be valuable evidence in case of a chargeback dispute;

8. Immediately refund any payment you’re sure is fraud: Unless you’re covered by some form of liability shift, as with 3D Secure, a proactive refund will save you from increase in chargeback volume, extra fees, and other negative consequences;

9. Remove non-obvious write-offs: Don’t charge people in an ambiguous way;

10. Stay in touch with your acquiring bank: Regular contact will help you stay updated on your chargeback and fraud metrics and give you tips on improving them.

![[Survey] Success with

subscriptions: How businesses can meet customer expectations](https://solidgate.com/wp-content/uploads/2024/10/success-with-subscriptions.png)