Since the number of online shoppers and digital consumers increases daily, companies are investing time and effort in approaching this new demographic to generate more leads and capture more sales. The best way to accomplish these goals is to provide customers with a smooth purchasing experience.

That is why online payment processing services with multiple payment options have become a necessity today. Modern-day businesses must accept payments online in an optimized way not only to keep up with the latest digital business trends but to increase payment authorization and conversion rates, improve customer UX and bank relations.

Incorporating streamlined online payment processing is one of the trends that allows businesses to provide customers with the option to make online payments using their preferred payment methods.

In this article, we will cover the following things:

- Essential payment processing terms;

- How payment processing works;

- Different payment method categories.

Read on to find out more about payment processing. Let us first explore some essential payment processing terms, such as payment processor and payment gateway.

Table of Contents

Payment Processing Glossary

Payment processor

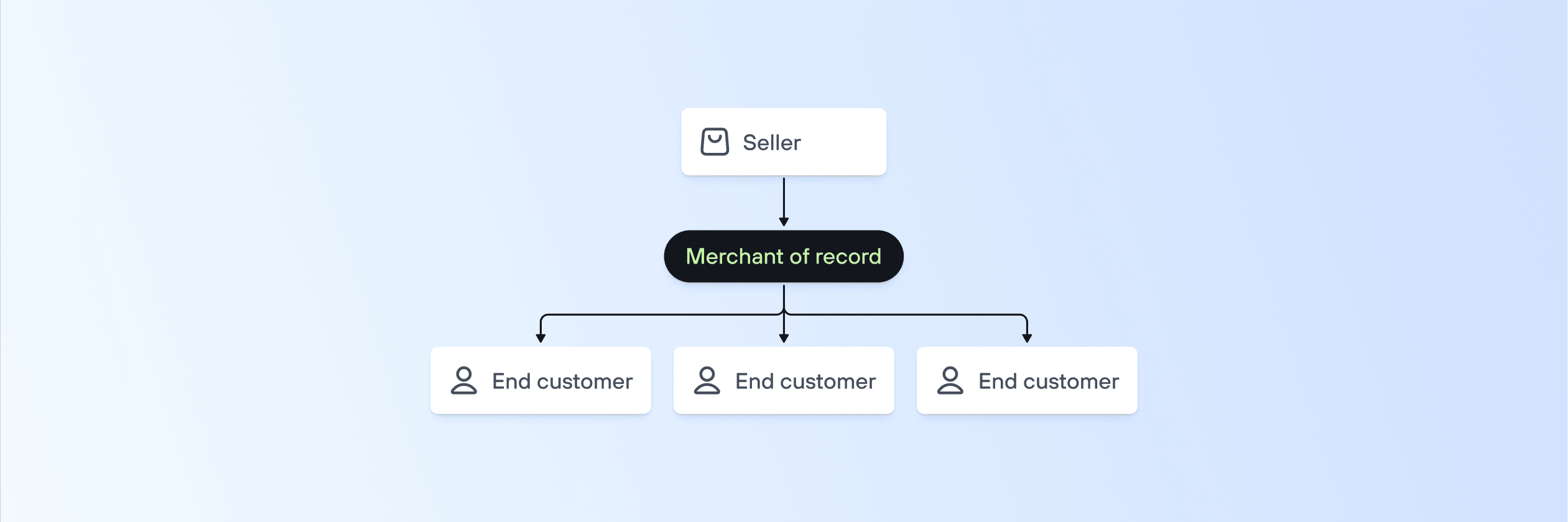

A payment processor is an intermediary between the financial institution and the merchant. It receives the cardholder’s information through a payment gateway and submits it to the acquirer, the merchant’s bank. A payment service provider (PSP) manages the critical steps of the online payment process, such as:

- Mediating between the merchant bank and the financial institution;

- Authorizing credit card transactions;

- Facilitation of the funds’ transfer.

A payment processor ensures the merchant receives the funds in their bank account on time by authorizing credit card payments. A payment processor also refers to a payment service provider or payment gateway. The best payment processing services include responsive customer support, PCI compliance assistance, cybersecurity solutions, card acquiring tools, and more.

Acquirer

Also known as a merchant bank or acquiring bank, the acquirer refers to the financial entity that allows a merchant to accept credit card payments and debit card transactions. The financial institution processes credit card transactions on the merchant’s end and settles revenue into the merchant’s account.

Issuer

The issuers, also known as the issuing banks or the customer’s banks, are financial institutions in charge of the credit card transaction process on the cardholder’s end. It ensures the acquiring bank receives the funds by collecting payments from cardholders, authorizing credit card payments, and approving online transactions.

How Does Payment Processing Work?

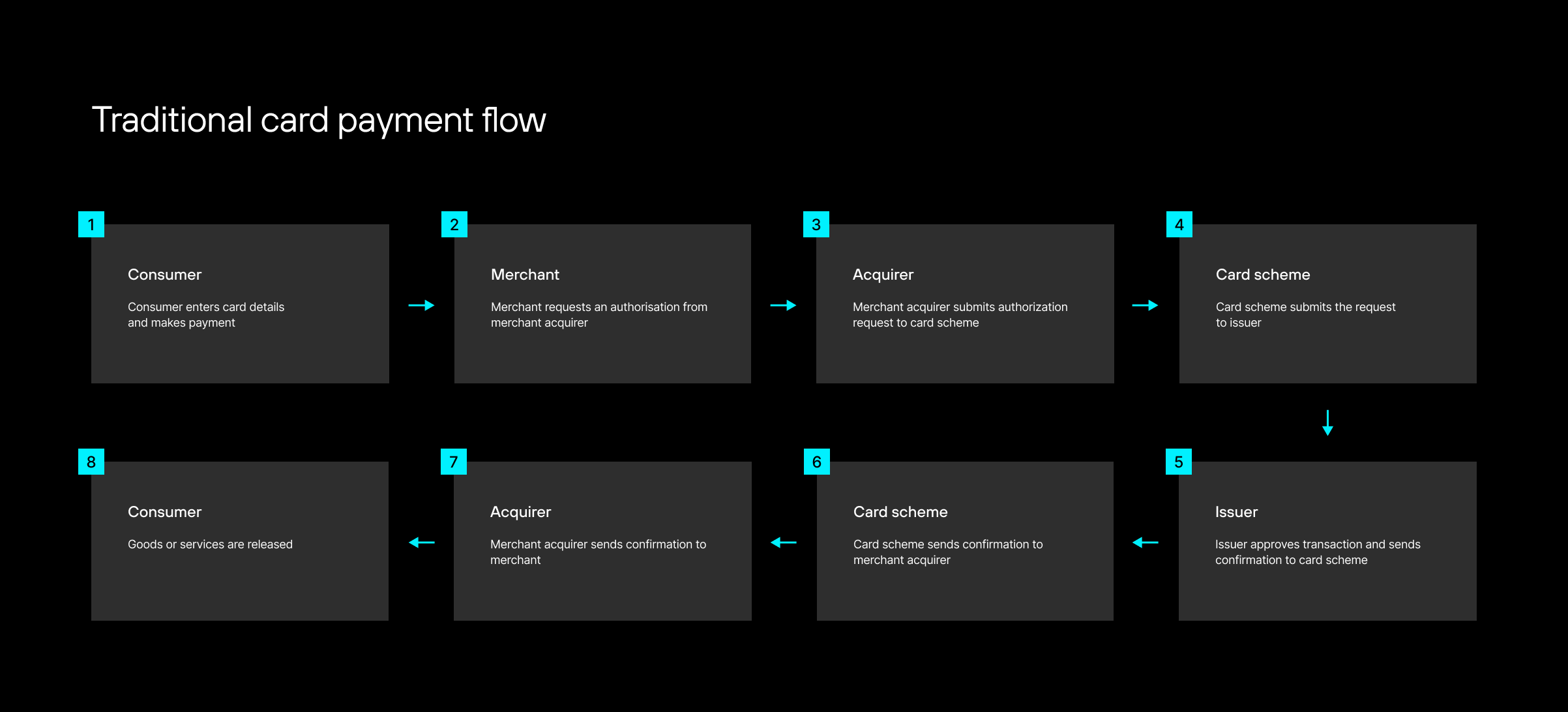

1) The consumer enters card details and makes a payment

A customer buys an item or a service with a credit or debit card. After checking out, customers provide their card details through a payment page, form, or link online, at a store terminal, or via another method. The information goes to the merchant through the payment gateway – a secure portal for authorizing card payments usually included in payment processing services.

2) The merchant requests authorization from the merchant acquirer

Upon submitting the information, the payment gateway forwards it to a payment processor. The payment processor receives the encrypted card data from the payment gateway and requests authorization approval from the acquiring bank to check if the payment is legit.

3) The merchant acquirer submits an authorization request to the card scheme

The acquiring bank forwards the authorization request to the card scheme; mostly, it’s either Visa or Mastercard.

4) The card scheme submits the request to the issuer

5) The issuer approves the transaction and sends a confirmation to the card scheme

The customer’s issuing bank checks the information to ascertain whether the customer has sufficient funds for the transaction and either approves or declines the transaction.

6) The card scheme sends the confirmation to the merchant acquirer

7) The merchant acquirer sends the confirmation to the merchant

8) Goods or services are released

Once the transaction is complete, the consumers can receive the required services or items.

Payment Method Categories Involved in Payment Processing

Giving your target audience multiple payment options, including modern and traditional, is the best way to grow your business and beat competitors. Since there’s no way around it, you should offer as many payment methods to your customers as possible. Here are the top seven payment method families to consider.

Cards

Debit and credit cards offer a quick and convenient way to make financial transactions. Debit cards use a bank account to withdraw money, while credit cards provide users with a credit limit they can spend on online and offline purchases.

The best way to accept credit cards is to incorporate a credit card payment system into your payment processing model. For accepting debit card payments, set up online payments for both web and mobile payments to accept transactions from debit cards.

Digital Wallets & Mobile Payments

In the case of card-present transactions, digital wallets use near-field communication (NFC) technology to make electronic payments and are linked to a card or bank account. A merchant must then have a credit card terminal or a Point of Sale system (POS) to process digital wallet payments. For online payments, NFC and POS are not required, the payment information is sent securely through tokenization.

Wallets also typically require additional customer verification (e.g., biometrics, SMS, passcode) to complete payment. Aside from debit and credit cards, digital wallets support digital currency, such as cryptocurrency. Mobile payments allow customers to make purchases using a device like a smartwatch or a smartphone. Mobile payment information is processed the same way as a digital wallet method and can require an app or a QR code.

Buy Now, Pay Later

Buy now pay later is a payment method that allows customers to buy items now and pay for them later. BNPL companies process these payments by charging 25% or more of the overall purchase sum upfront, allowing customers to pay off the rest through interest-free installments. Most companies require a soft credit check for approval, although some may ask for a hard credit pull.

Online Banking

When it comes to banking, merchants can use an open banking provider (OBP), utilize bank debits, bank redirects, or bank transfers. OBP replaces the function of the acquirer and the card network in a traditional card flow. Bank debits pull funds directly from your customer’s bank account. Bank redirects add a layer of verification to complete a bank debit payment. And bank transfers allow customers to push funds from their bank account to the merchant’s.

Vouchers, Prepayments, and Gift Cards

Gift cards, prepaid options, and vouchers are popular ways to reward consumer loyalty. Retailers commonly offer rewards to the highest-paying customers to encourage them to keep purchasing. Customers receive a voucher with a transaction reference number that they can scan and bring to an ATM, bank, convenience store, or supermarket to complete the payment in cash.

Selecting A Payment Processor

When choosing a payment processor, merchants should consider several factors including compatibility, PCI compliance, and fraud prevention to ensure they make the right choice for their business.

- Compatibility: It is important that a merchant’s payment processor is compatible with their website, e-commerce platform, and point-of-sale (POS) systems. Merchants need to double check that the payment processor offers easy integration options or provides APIs that can be used to connect their systems seamlessly.

- PCI Compliance: PCI compliance outlines security requirements for handling credit card information. A PCI compliant payment processor ensures that sensitive cardholder data is handled securely, reducing the risk of data breaches.

- Fraud Prevention: Merchant’s need to select a payment processor that offers robust fraud prevention measures and tools to protect against unauthorized transactions, chargebacks, and fraudulent activities. Look for features like address verification system (AVS), card verification value (CVV) checks, tokenization, and real-time fraud detection algorithms.

Difference Between A Payment Processor And A Credit Card Processor

A payment processor and a credit card processor are often used interchangeably, but they differ in the types of payments they can process and their scope.

A payment processor is a service provider that handles the entire payment transaction process. Payment processors like Stripe provide payment gateways, POS terminals and merchant accounts. Payment processors act as an intermediary between the merchant and the acquiring bank (also known as the merchant bank). They facilitate the transfer of funds from the customer’s bank account to the merchant’s account, ensuring a secure and smooth transaction. A payment processor can handle all kinds of payments including debit and credit cards, bank transfers, e-wallets, vouchers and real-time payments.

On the other hand, a credit card processor specifically focuses on handling credit card transactions. Credit card processors don’t typically provide payment gateways or merchant accounts and specialize in authorizing and settling credit card payments.

So, how does credit card payment processing work? Credit card processing involves several steps:

- Authorization: When a customer makes a purchase using a credit card, the merchant sends the transaction details to the credit card processor. The processor then verifies the validity of the credit card, checks for available funds, and obtains approval from the card issuer.

- Settlement: Once the transaction is authorized, the credit card processor initiates the settlement process. It transfers the funds from the customer’s credit card issuer to the merchant’s bank account. This typically occurs within a few business days.

- Security: Throughout the process, credit card processors employ encryption and other security measures to protect sensitive customer data, ensuring secure transmission and storage of information.

Credit card processors play a crucial role in enabling businesses to accept credit card payments and providing a secure and efficient payment experience for both merchants and customers. They help facilitate transactions, manage funds, and ensure compliance with industry regulations.

A Merchant Account: What Is It?

A merchant account with a bank is a type of bank account specifically designed for businesses to accept and process credit and debit card payments. It allows businesses to securely collect funds from customer transactions made using credit or debit cards by acting as an intermediary, drawing money from your customers’ accounts, and crediting your merchant account.

Without a merchant account, businesses would have to rely solely on cash or check payments, limiting their ability to serve a wider customer base. When a customer makes a payment using a card, the funds are transferred from the customer’s account to the merchant’s account via the payment processor associated with the merchant account. This process involves verification, authorization, and settlement, ensuring that the funds are securely transferred to the business.

How Safe Is The Processing Of Credit Cards?

Credit card processing is safe if a merchant works with a high payment processor. However, no system is entirely foolproof, and there is over $10 billion worth of credit card fraud every year in the US alone. These are the main risks involved in credit card processing:

- Data Breaches: One of the significant risks is the potential for data breaches. If a merchant’s or payment processor’s systems are compromised, sensitive credit card information can be accessed by unauthorized individuals.

- Cardholder Data Theft: Criminals may attempt to steal credit card information directly from cardholders by employing various methods such as phishing, skimming devices, or malware.

- Chargebacks: Chargebacks occur when a cardholder disputes a transaction and requests a refund from the issuing bank. Merchants are then required to provide evidence to justify the validity of the transaction. Excessive chargebacks can lead to financial losses and additional fees

- Fraudulent Transactions: Despite security measures in place, there is always a risk of fraudulent transactions slipping through. This can occur when stolen card information is used for unauthorized purchases.

- Non-compliance Penalties: Non-compliance with industry regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), can result in penalties and fines.

Reputable credit card processors fight to mitigate the above risks by employing these measures:

- Encryption: Encryption converts the cardholder’s information into a coded format, making it difficult for unauthorized parties to intercept.

- PCI Compliance: PCI compliance ensures the implementation of robust security measures, such as secure network infrastructure, regular system updates, and protection against data breaches.

- Tokenization: Instead of storing actual card numbers, merchants and payment processors replace them with unique tokens preventing credit card numbers from being exposed during a data breach.

- Fraud Detection and Prevention: Fraud detection systems analyze various factors, such as transaction patterns, cardholder behavior, and velocity checks, to identify potentially fraudulent activities.

Advantages Of Processing Payments

Payment processing is a game changer for businesses. Processing payments can significantly increase sales, attract new customers, improve cash flow, reduce fraud and help a business expand into new markets.

- Increased Sales and Revenue: By accepting various payment methods, including credit and debit cards, businesses can attract a broader customer base as many consumers prefer the convenience of card payments over cash.

- Faster and More Secure Transactions: Payment processing enables businesses to process transactions quickly and securely. Payment processors facilitate instant authorization and settlement, allowing businesses to receive funds promptly.

- Streamlined Operations: Payment processing solutions often integrate with other business systems, such as point-of-sale (POS) systems, e-commerce platforms, and accounting software. This integration streamlines operations by automatically recording and reconciling transactions, reducing manual data entry.

- Reduced Risk of Bad Checks: Accepting checks as a form of payment comes with inherent risks, such as bounced or fraudulent checks. Payment processing mitigates these risks by providing secure and reliable electronic payment options.

- Detailed Transaction Reporting: Payment processors offer comprehensive reporting and analytics tools. These tools provide businesses with detailed insights into their transaction history, sales trends, and customer behavior, allowing them to tailor their solutions.

- Global Reach: Payment processing solutions enable businesses to accept payments from customers worldwide, allowing them to explore new markets and supercharge their growth.

- Easier Financial Management: Regular settlements and automated reporting simplify financial management tasks and allow businesses to more accurately forecast cash flow.

Top 3 Services For Processing Payments

Square

Square is used by over 2 million merchants globally, processes close to $200 billion annually, and mainly specializes in helping small to medium businesses across various industries. Square has a user-friendly interface, a quick setup, and transparent pricing. Notable features include point-of-sale (POS) solutions, e-commerce integration, mobile payments, powerful analytics, and robust fraud prevention which includes live transaction monitoring. Additionally, Square offers unique tools like Square Capital, providing small businesses with access to funding.

PayPal

With over 400 million active accounts worldwide and an annual processing volume exceeding $1 trillion, PayPal has become a trusted choice for businesses and individuals alike. PayPal offers a seamless payment experience with its user-friendly interface, allowing customers to send, receive, and manage funds easily. It provides a range of special features, such as PayPal One Touch for quick checkouts, invoicing solutions, and buyer/seller protection programs.

Payment Depot

Payment Depot is an amazing low-cost credit card processor owned by Stax. It may not have as many features as PayPal or Stripe, but for a low monthly fee, merchants only have to pay the interchange fees charged by Mastercard and Visa, and there is no markup. Payment Depot also provides 24/7 customer support, free fraud detection, and PCI compliance. Payment Depot works with over 6,000 businesses and is a great choice for merchants who process at least $10,000 a month.

Conclusion

Most consumers abandon in-person transactions due to the convenience that online shopping offers them. That change in their behavior forces millions of merchants to look for the best ways to provide customers with a frictionless purchasing experience without endangering their operations.

In a modern-day digital business landscape, processing online payments while complying with the latest privacy standards is more of a challenge than business owners would expect them to be. They also have to think about the safety of customers’ financial information. That’s why retailers need payment processing solutions like Solidgate to secure revenues generated from each card transaction and transfer funds from the consumers’ credit accounts to the merchant’s bank with ease.

Solidgate is an online payment processing platform. We ensure the buyers get a seamless purchasing experience while online businesses get paid online. Our fintech solutions optimize payment routes, improve conversion, beat fraud and chargebacks. In the long run, we’re a merchant’s ultimate money-making machine, helping you enter new markets and scale aggressively wherever you are.