One platform. Every layer you need.

Grow your payment stack, boost conversion rates, and cut ops overhead with one unified platform.

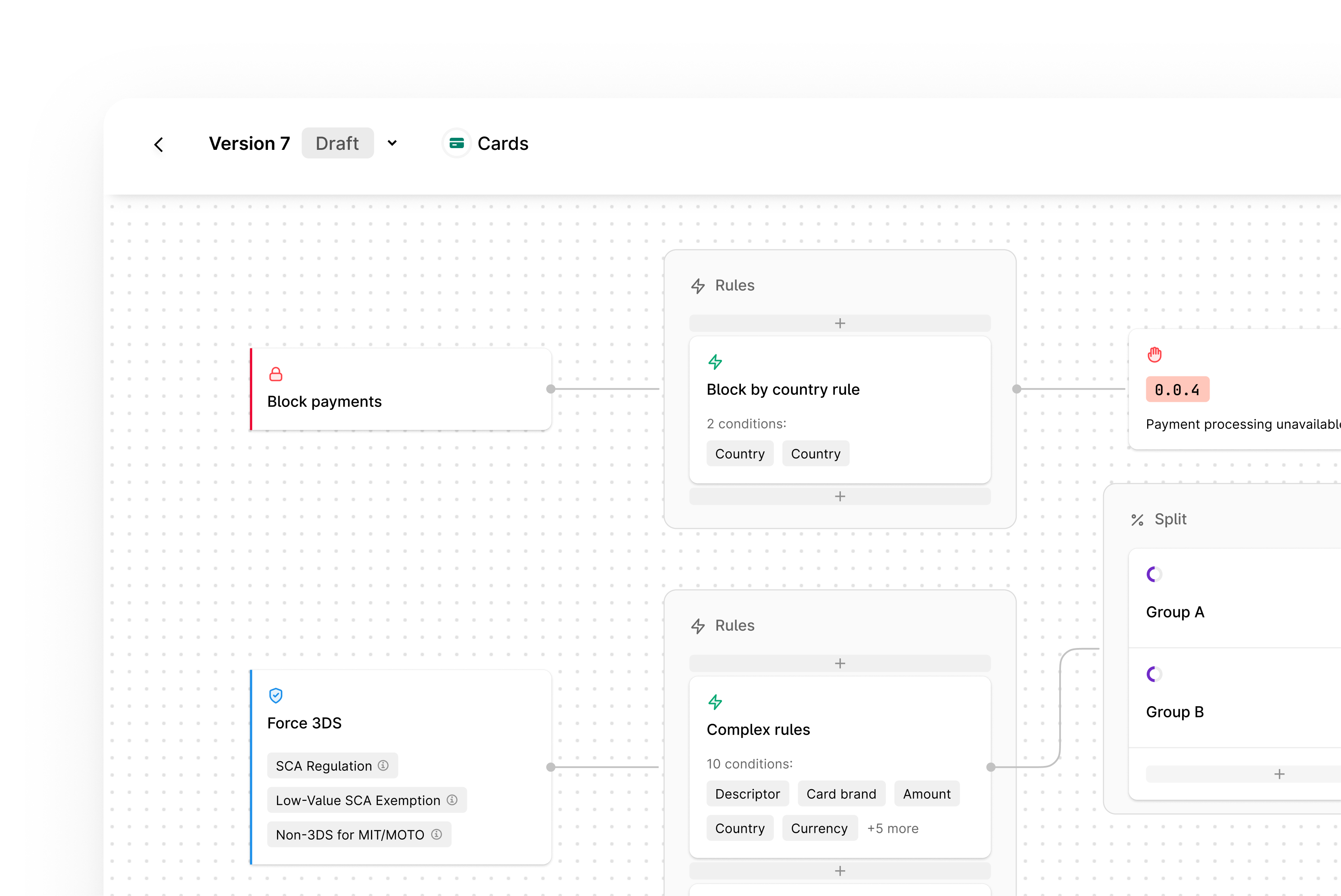

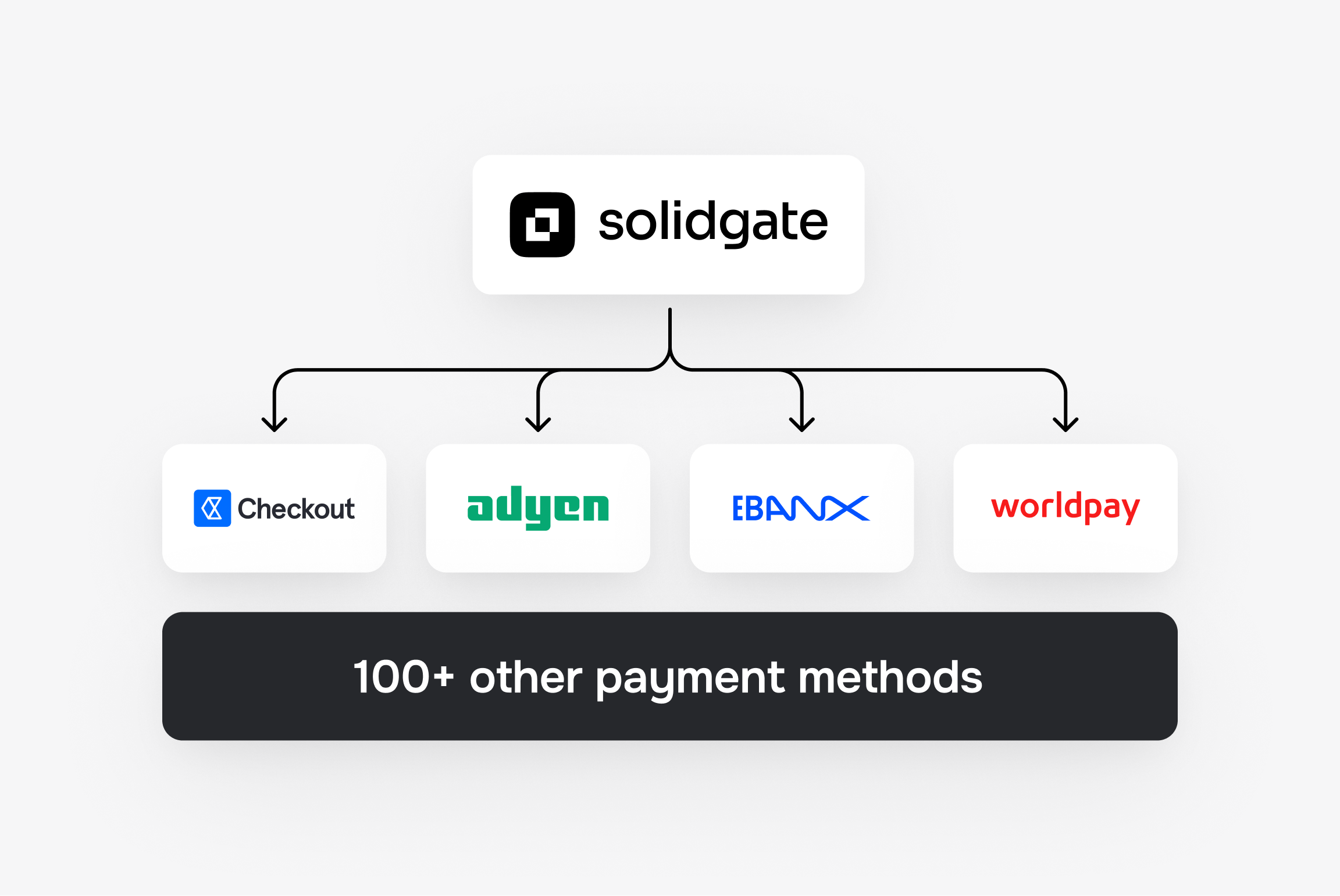

Orchestration

Connect and orchestrate multiple payment providers without the usual complexity.

Payments

Expand your payment stack to achieve world-class performance.

Products

Don't build. Just use.

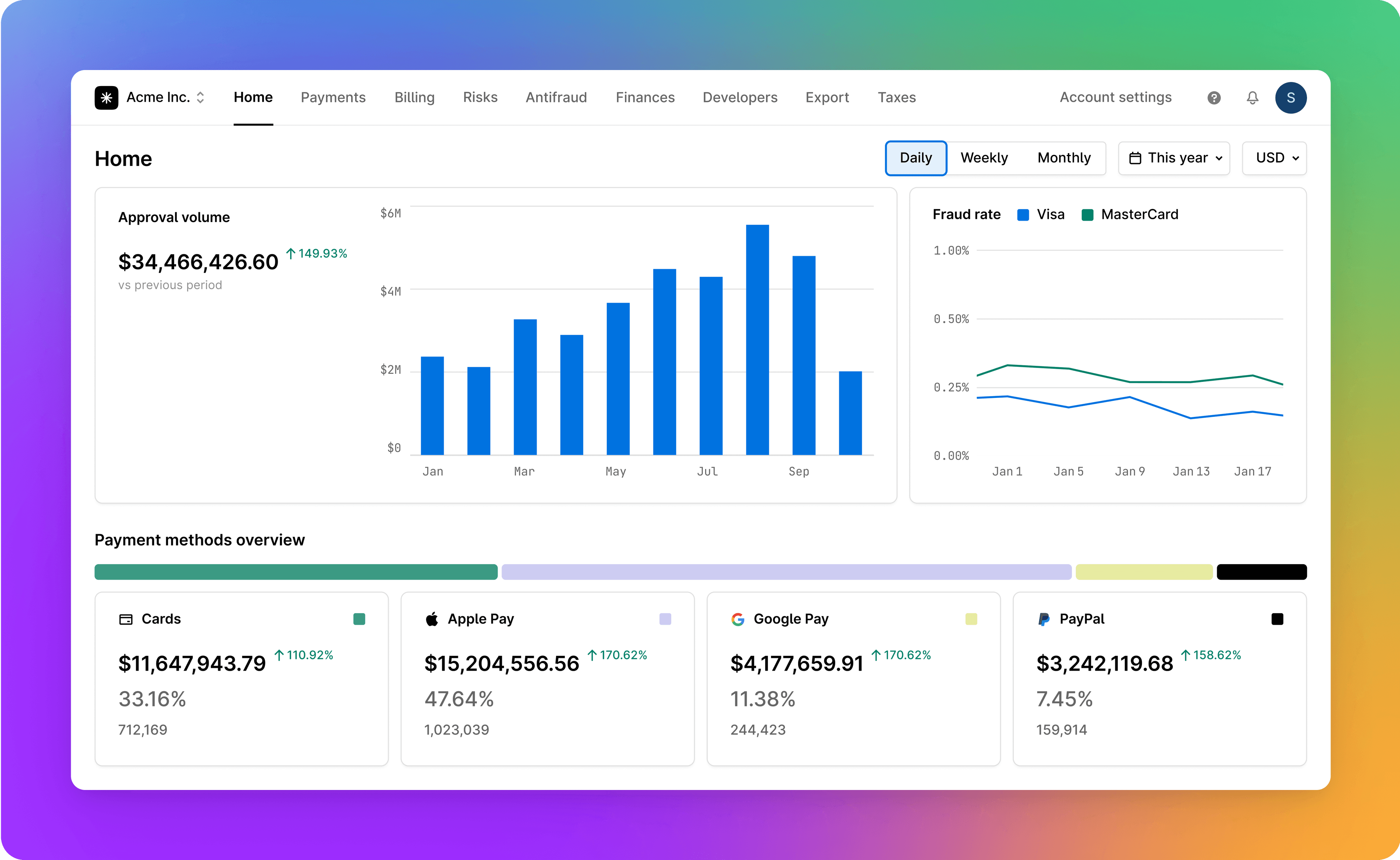

Results that compound

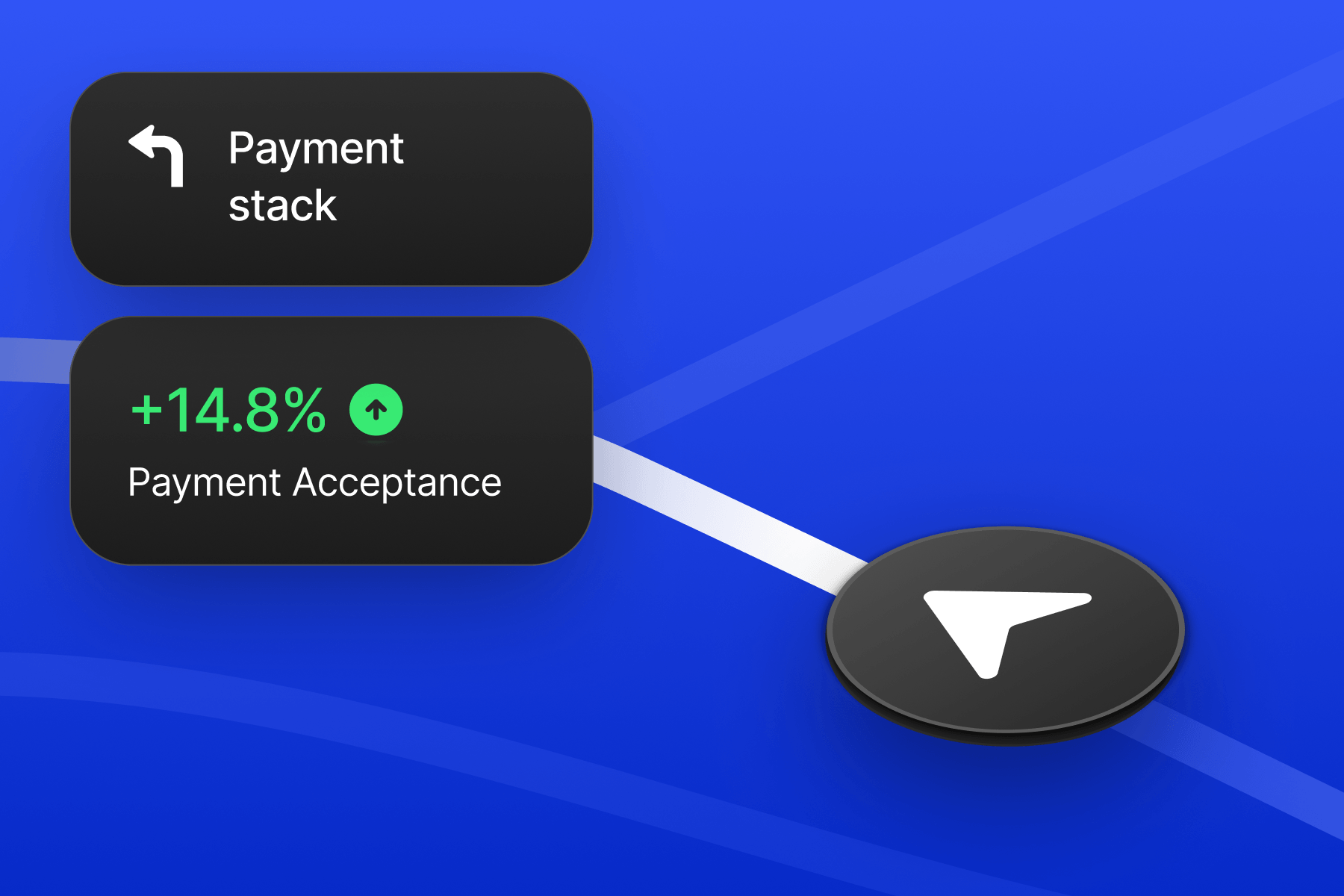

Streamline your payment stack

- Plug in new providers in minutes instead of months

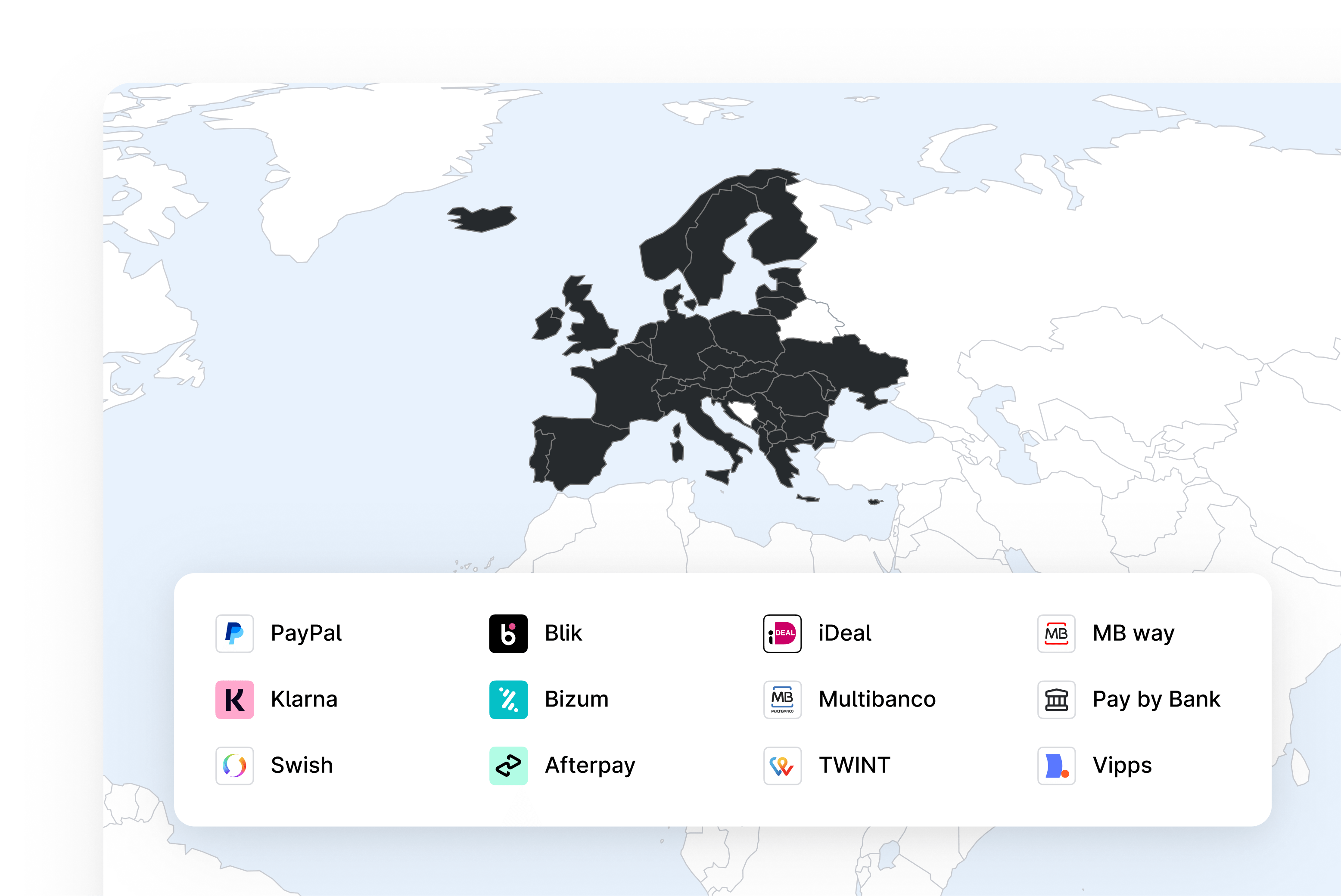

- Expand into new markets with local payment methods

- Swap or scale providers without disruption

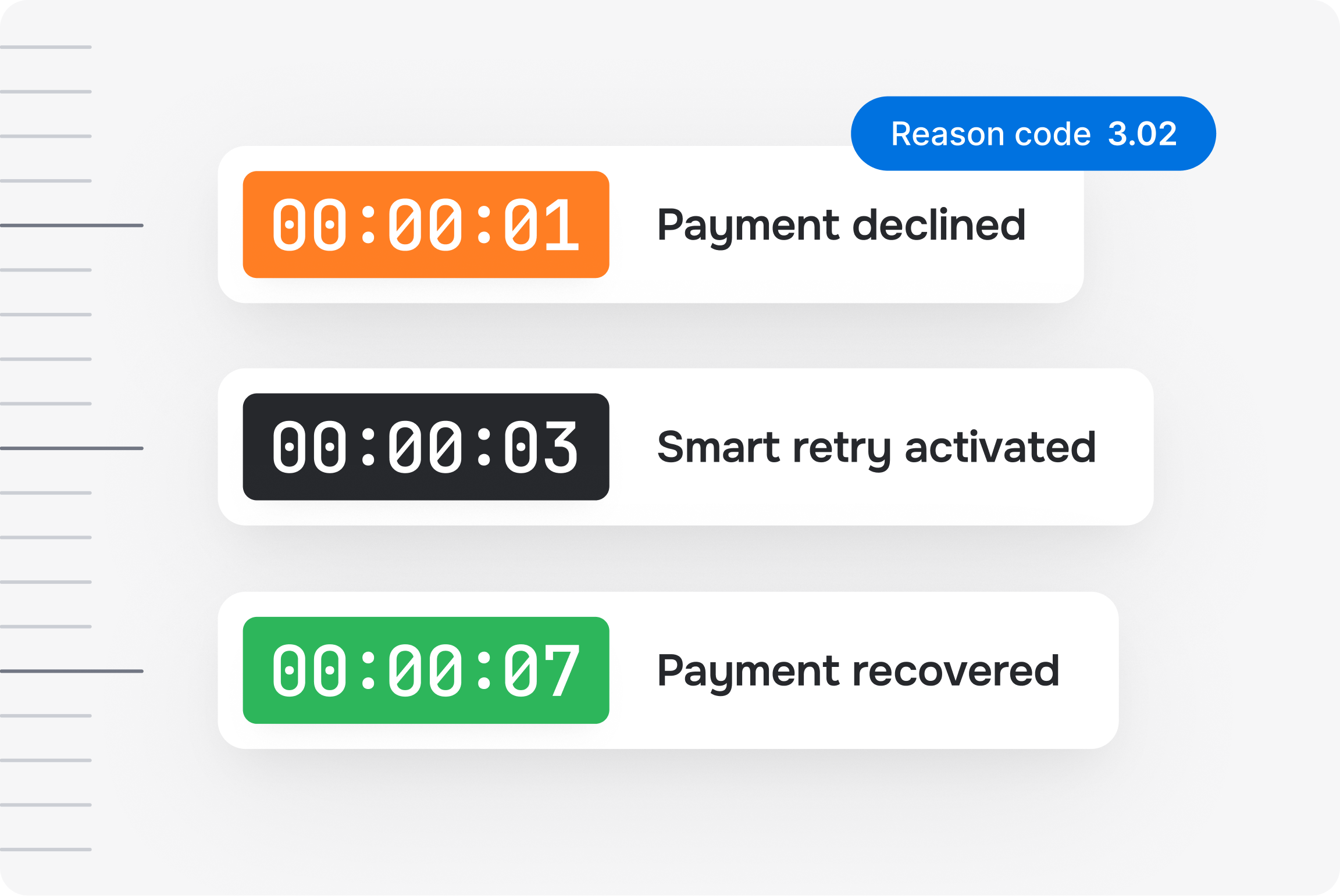

Capture more revenue

- Increase conversion and reduce costs with smart routing and real-time failover

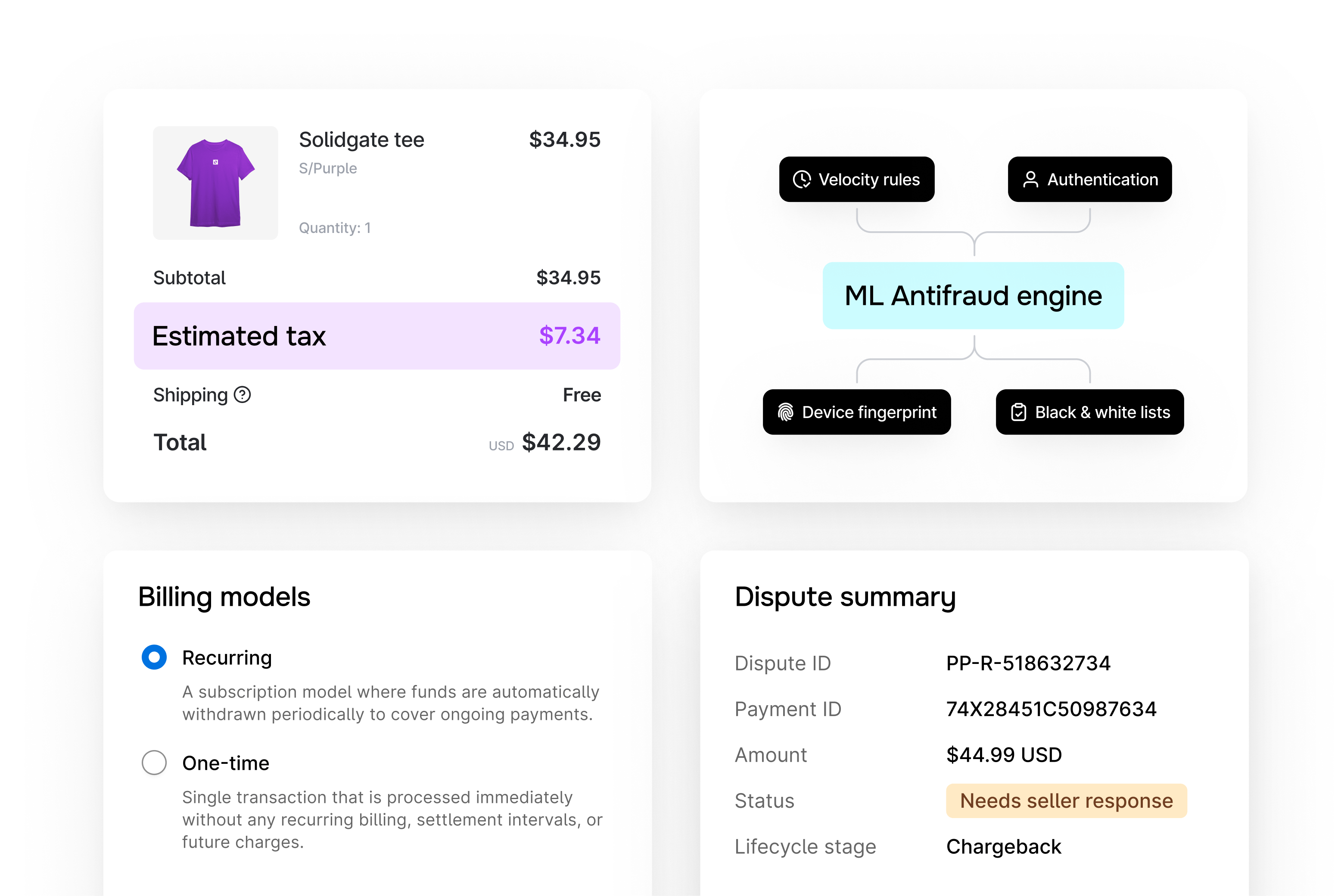

- Power subscriptions, trials, and usage-based billing without building from scratch

- Minimize chargeback losses with built-in prevention and dispute management

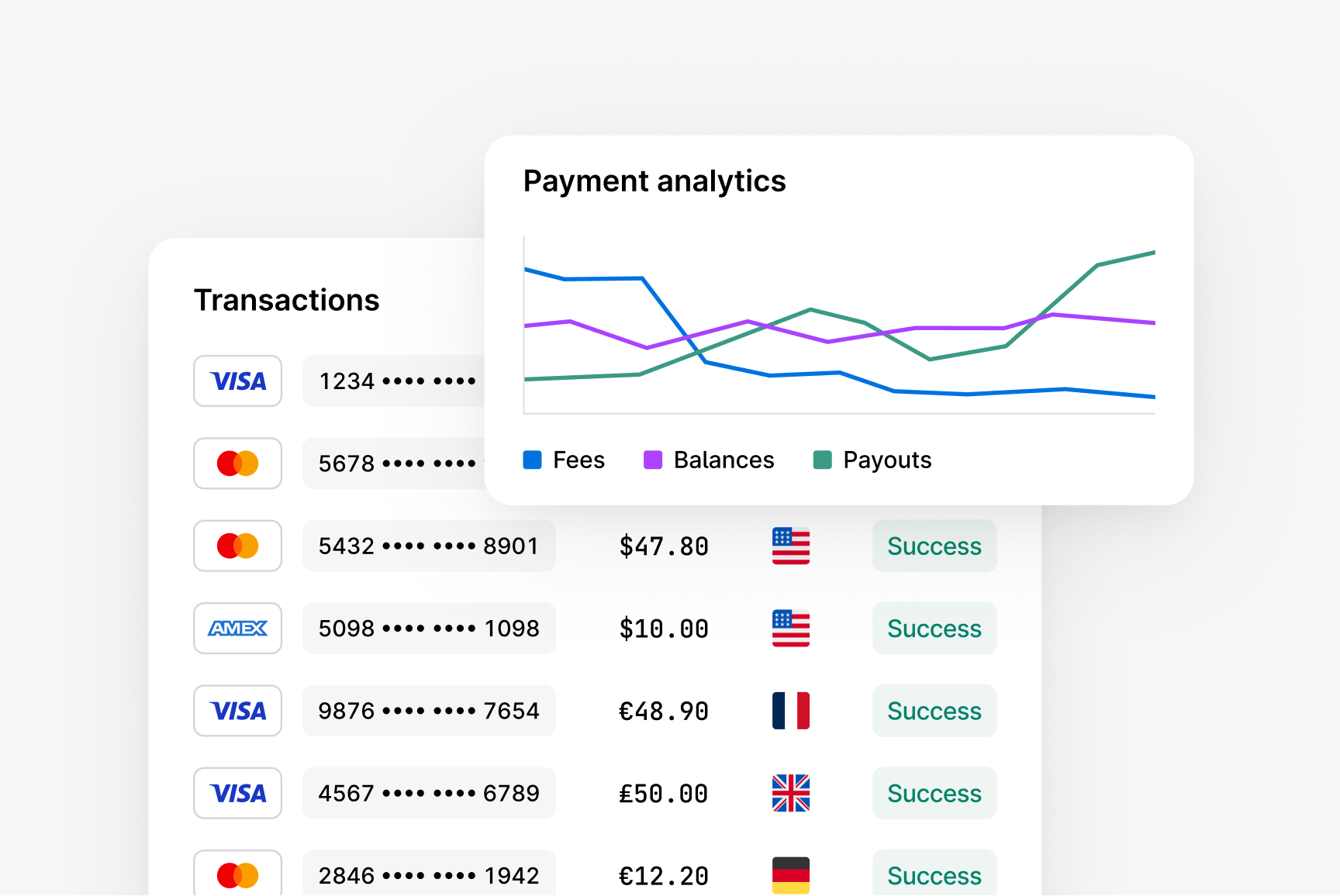

Free up your team

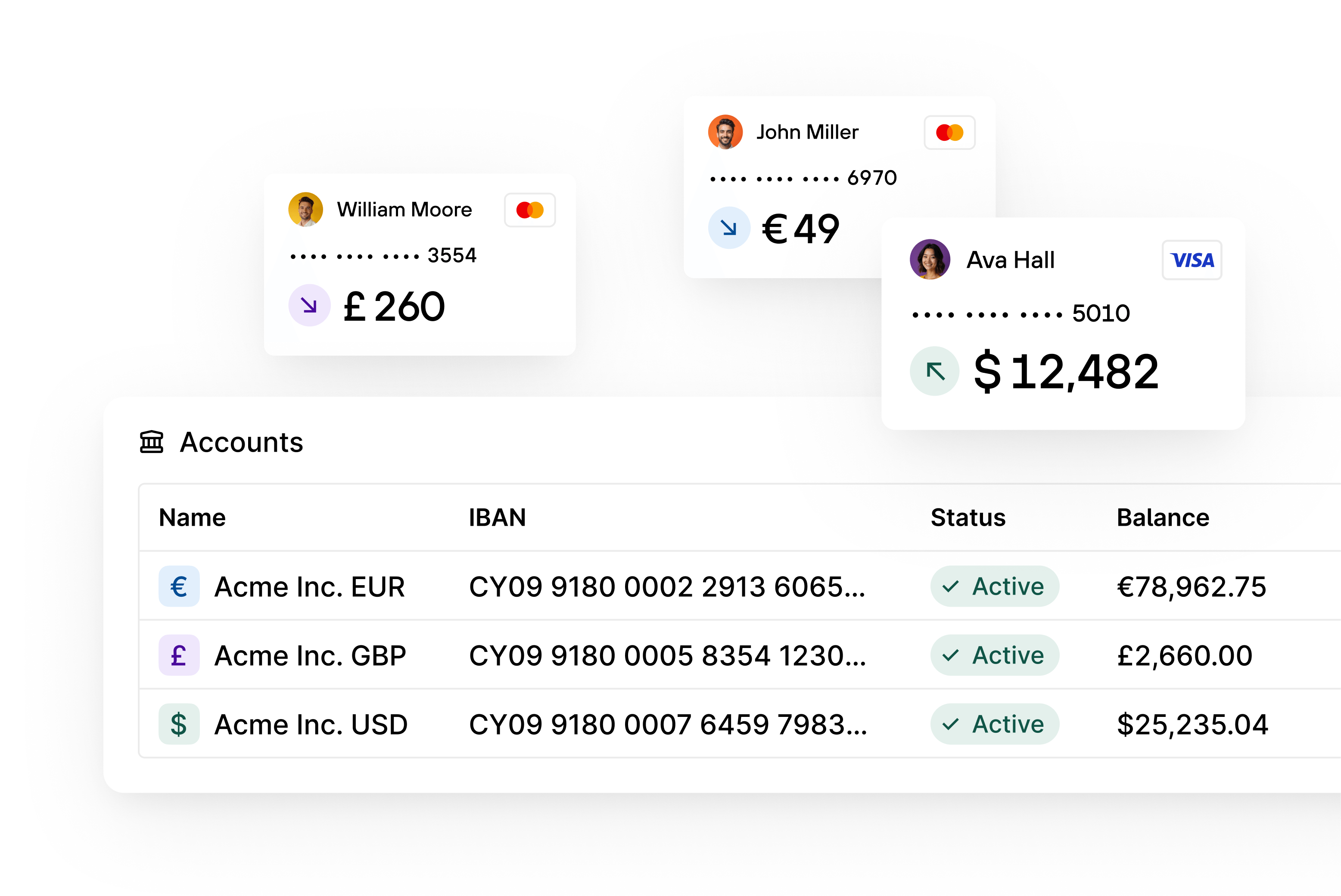

- Automatically reconcile payments across providers

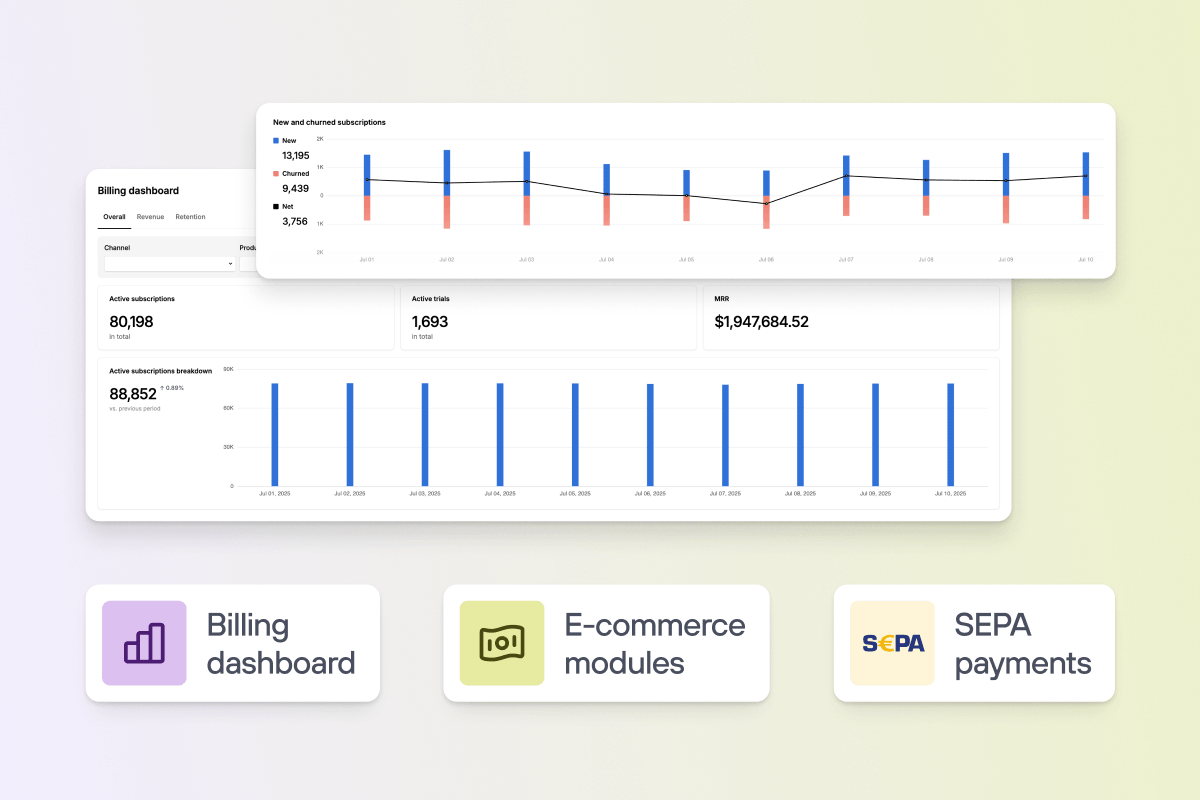

- Track performance, fees, balances, and payouts in one dashboard

- Streamline tax reporting and compliance workflows

Infrastructure you don't have to think about

99.99% uptime SLA

Guaranteed availability across all supported regions – even during peak traffic and high load.

Multi-region infrastructure

Low-latency performance and automatic failover with active-active global architecture.

Secure by design

Enterprise-grade security with tokenization, encryption, and PCI DSS 4.0 compliance.

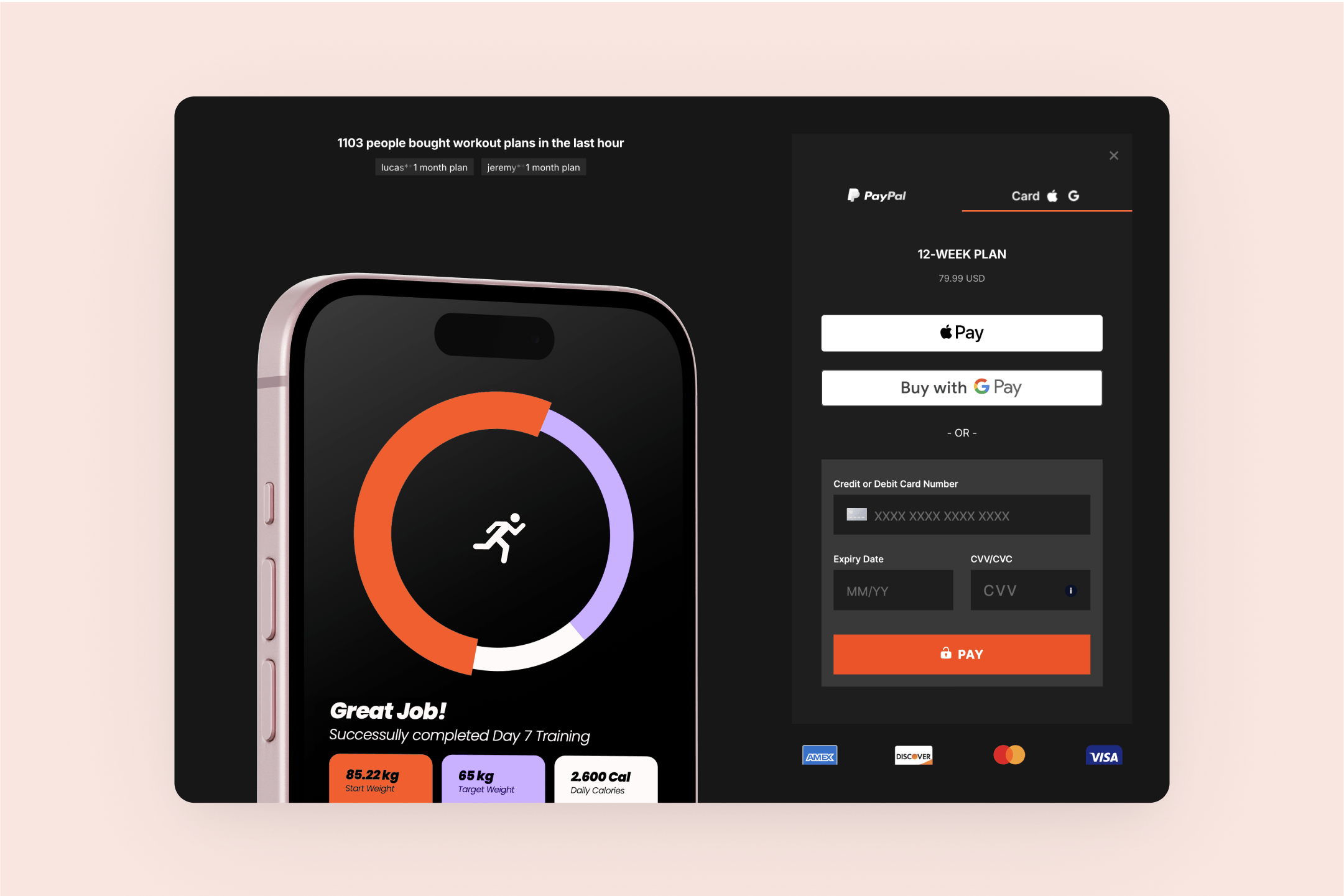

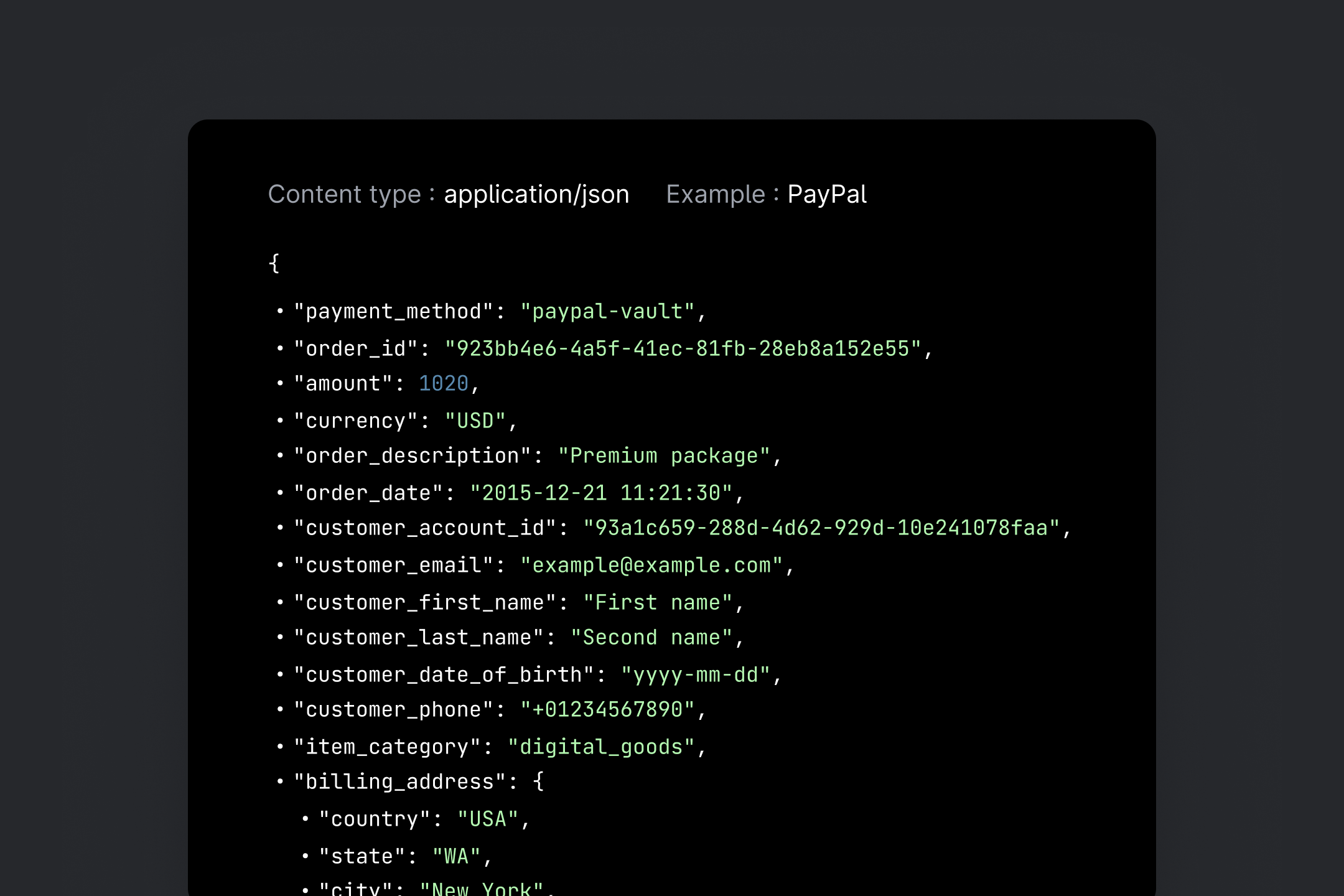

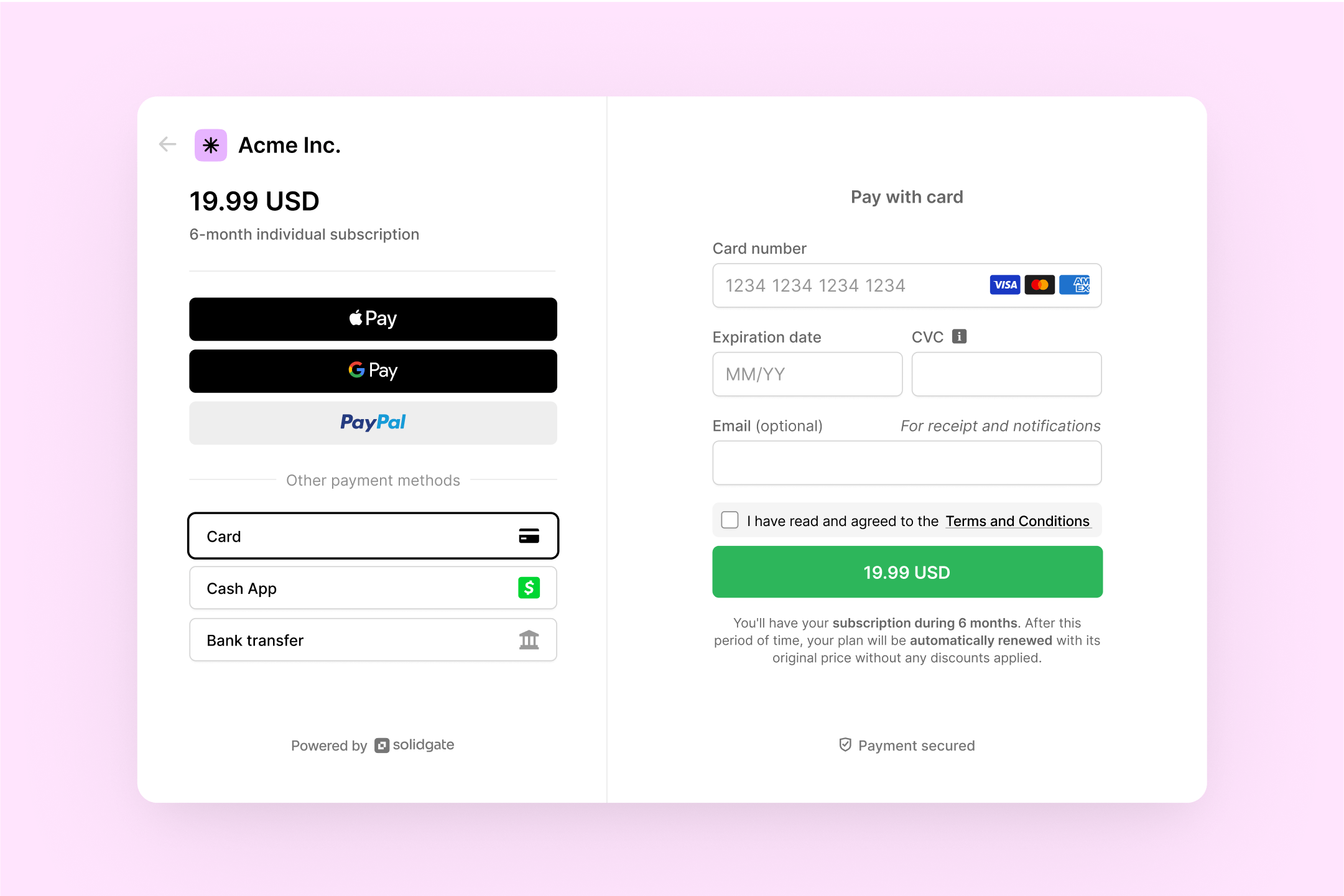

Integrate the way you want

From hosted payment pages to full API control. Go live the way that works for your team.

Not just software. A team behind your success.

- Fast, human support – real help provided in minutes, not hours.

- Dedicated account manager – a partner who knows your business and helps you move faster.

- Long-term partnership – we go beyond troubleshooting to help you scale smarter.

Recent articles