Buy Now, Pay Later (BNPL) for businesses: A merchant’s guide in 2025

Payments 101

10 Jun 2025

10 min

More options, better cash flow, and wider reach—BNPL drives merchant growth. Klarna, Affirm, and Afterpay help boost sales, reduce risk, and win new customers.

In recent years, Buy Now Pay Later (BNPL) has gone from a niche payment option to an expected offering at e-commerce merchants' checkouts. With over 360 million BNPL users worldwide, and projections soaring to by 2028, it's clear BNPL is here to stay.

If you run an e-commerce targeting under-30 customers, not having a BNPL option naturally puts you at a disadvantage since many competitors will likely have it. Even beyond fashion or retail, BNPL providers offer a powerful tool for industries like travel, healthcare, automotive, and even subscriptions.

But how exactly does BNPL work, and is it right for your specific niche or business model? In this guide, we break down:

- How the ecosystem operates

- Whether adding BNPL to your payments stack aligns with your business objectives

- Practical tips for choosing the right BNPL provider to drive real results

Let’s dive in.

What exactly is BNPL

Buy Now, Pay Later is a short-term, interest-free loan that lets consumers immediately buy products and split payments into smaller, manageable installments. Unlike traditional credit, BNPL products are built for the digital era: mobile-first, integrated into checkout flows, and optimized for simplicity and speed.

For merchants, BNPL is a conversion engine, especially for purchases that fall between impulse buys and considered decisions, typically in the $50 to $500 range.

It's particularly popular for purchases like electronics, groceries, furniture, apparel, travel, and other lifestyle items.

What BNPL solutions are NOT: Traditional credit cards, long-term installment options, promotional installments, and rent-to-own. Although some BNPL providers already have their own long-term financing options and issue credit cards.

The BNPL ecosystem includes six key actors:

- Consumers who want to cover liquidity gaps and prefer paying over time.

- Merchants that integrate BNPL to drive growth and reduce cart abandonment.

- BNPL Providers originate and service BNPL loans for individual transactions.

- Sponsor Banks provide critical infrastructure by onboarding BNPL providers, holding deposits, and providing financing.

- Infrastructure Providers like gateways, PSPs, and orchestrators that embed BNPL into payment flows.

- Servicing & Underwriting Firms that manage underwriting algorithms, fraud prevention, and credit assessment.

This network allows consumers to pay later while merchants are paid upfront, with BNPL providers absorbing risk in exchange for .

Here’s how the Buy Now Pay Later mechanics work:

How is BNPL different from traditional credit options?

- BNPLs are mostly interest-free.

- BNPL loans can be more affordable than other forms of financing.

- They have a low barrier to entry – no hard credit checks, no card applications.

- They pass information to credit bureaus only in case of a user’s default.

- BNPLs DO NOT work with cash collection agencies due to the small amounts of loans, absorbing and writing off debt from their own balance sheets.

- In many countries, they are unregulated or partially regulated, although it’s beginning to change.

- They mostly monetize their services by merchant/consumer fees, rather than on loan interests.

BNPL is often used as an additional payment method rather than a replacement for credit cards or traditional bank loans. Customers traditionally rely on credit cards for larger purchases, while using BNPL to avoid putting extra charges on their credit cards.

Who is using BNPL and why?

BNPL consumers can be classified into two key types:

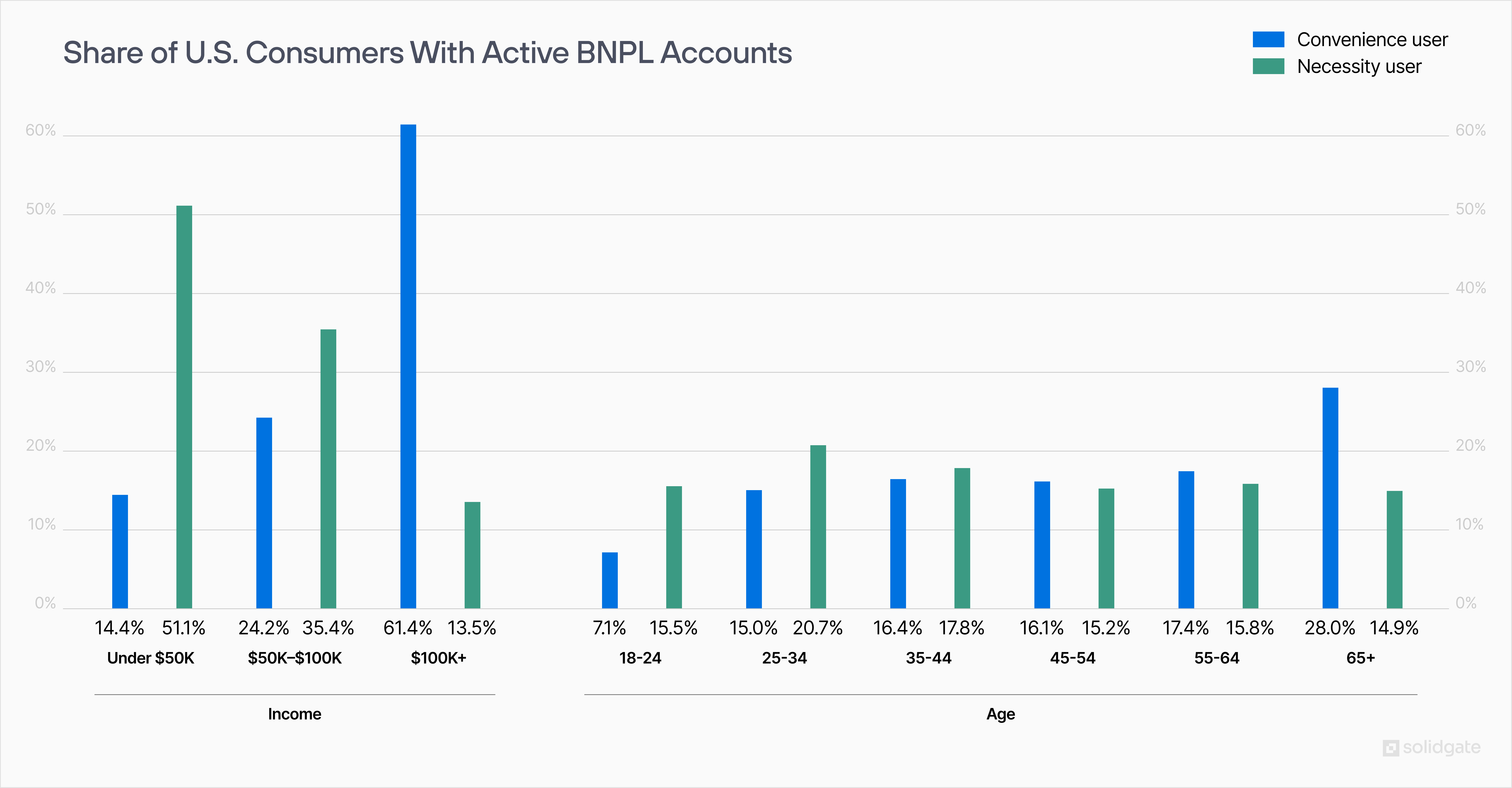

Initially, BNPL’s growth has been fueled by its adoption among younger, digital-first consumers. Now, its usage has expanded to older generations and diverse income groups, especially for high-ticket or occasional expenses.

Here's the latest customer data in the US:

- Nearly half of Gen actively used BNPL in the past year.

- of Boomers have also engaged with BNPL.

- More than U.S. BNPL users hold multiple active BNPL loans simultaneously, reflecting an increasing dependence on installment-based credit.

- Over half (51.2%) of BNPL users rely on it out of necessity.

BNPL initially gained the most traction in retail, helping remove the initial cost barrier and driving impulse purchases and higher basket sizes.

Today, BNPL spans industries like healthcare, travel, high-value discretionary goods, and even everyday purchases like groceries, food delivery, and household essentials. The model is the most effective for purchases that are slightly beyond a consumer’s immediate budget comfort, typically in the range of tens to a few hundred dollars.

Key players in the BNPL space

The BNPL market is getting more crowded, now hosting more than , with global heavyweights like Affirm, Klarna, Afterpay (Clearpay), Sezzle, and Zip leading the charge. Worth noting that PayPal has its own BNPL arm called .

There are also regional players that carved out niches by addressing unique local payment preferences and regulatory frameworks:

- Paidy in Japan 🇯🇵

- Alma and Riverty in Belgium 🇧🇪

- Viabill in Denmark 🇩🇰

- Tabby, Tamara, and Postpay in the UAE 🇦🇪

- Atome in Southeast Asia 🌏

Traditional banks like JPMorgan Chase and American Express also , embedding installment payment features into their platforms. These players bring strong brand credibility and familiarity, but tend to have slower innovation cycles, potentially higher fees, or less flexibility than pure BNPL companies.

Why care about adding BNPL?

According to Worldpay, BNPL e-commerce transactions ballooned from $2.3 billion in 2014 to a whopping $342 billion in 2024, representing over 5% of global online purchases. It’s clear that in 2025, integrating BNPL into your checkout flow isn't just convenient – it's smart business for the growing number of industries. Benefits of buy now, pay later for merchants include:

- Conversions boost: Offering BNPL can lift your conversion rates by . By breaking a larger price into smaller installments, BNPL reduces sticker shock and encourages add-ons and upsells, leading to clear bottom-line improvements.

- Reduce cart abandonment: Merchants typically see cart abandonment drop by up to 35% when offering installment payments. In fact, of shoppers have said they would have abandoned their cart if interest-free installment options weren’t available.

- Higher Average Order Values (AOV): According to Klarna, customers tend to spend around 40% more when they have the flexibility of BNPL. As a rule of thumb, the higher the AOV, especially above ~$100, the more BNPL can move the needle on conversion. For smaller tickets (like a $20 purchase), BNPL may not be as critical, but even there, it can encourage upsells, as customers might add a few more items when they know they can pay over time. It also simplifies BNPL bill payment, helping consumers manage expenses more predictably.

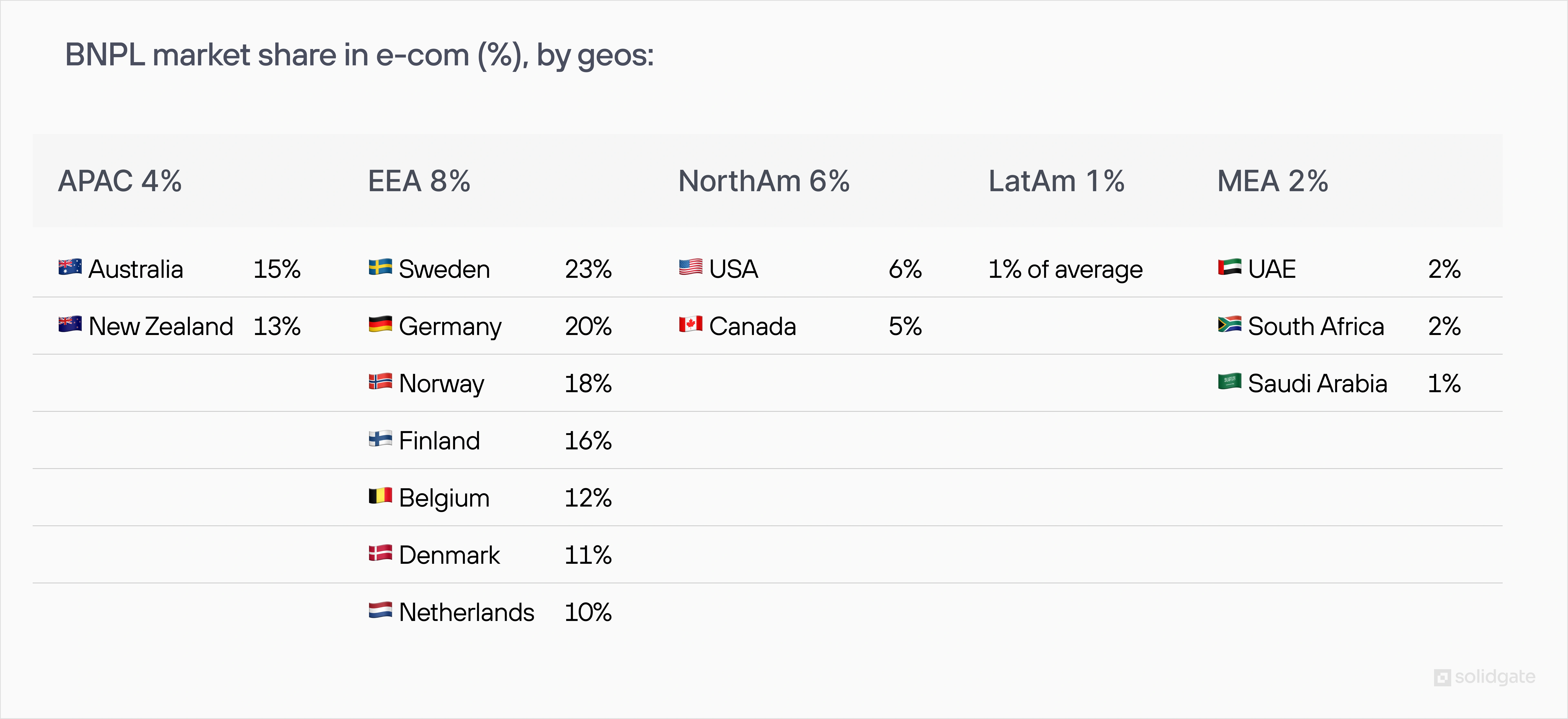

- Attract new customers: Adding BNPL makes your products accessible to more buyers, especially those who might hesitate at the upfront cost. It also helps appeal to younger, tech-savvy buyers, especially in markets like Scandinavia and Australia, where these methods have become part of the payment culture.

- Get paid upfront without the repayment headaches: With BNPL, businesses get the full payment immediately, no waiting around or chasing after payments later. Plus, your BNPL provider shoulders the risk of customer defaults and fraud, giving your cash flow and peace of mind a big boost.

Top-3 providers: Klarna, Affirm, Afterpay

Klarna, Affirm, and Afterpay lead the buy now, pay later space, each offering unique strengths, customer reach, and payment flexibility. The summaries below highlight their key details so you can match the right provider to your business needs and customer expectations.

Klarna

- Merchants (2024): Over 600,000 businesses, including H&M, IKEA, Nike

- Geo prevalence: EEA, Australia, UK, US, New Zealand

- Repayment options:

- Pay in 3 or 4 installments (interest-free)

- Pay in 30 days

- Pay in full with stored details

- Monthly payments up to 36 months

- Active customers (2024): ~100 million

- Merchant fees: 3.29%–5.99% + fixed fee

- Transaction limits: $10 minimum, $5,000+ possible depending on financing

- Key strengths: Global reach, strong brand, robust app ecosystem

- Trade-offs: Higher fees, lower approval for large items, complex products

- Best for: Mid-size AOV, fashion, retail, consumer goods, international merchants

- Registration/onboarding: App or partner checkout sign-up, email verification, user-friendly app

- Payment process: Choose Klarna at checkout, app manages schedules and reminders

- Post-payment management: Returns/disputes in-app, real-time updates, chat/phone support

- Account settings: Manage payment methods, notifications, early repayments, personal info

Affirm

- Merchants (2024): Over 358,000 businesses

- Geo prevalence: Canada, US

- Repayment options:

- Pay in 4 installments (interest-free)

- Monthly payments up to 36 months

- Active customers (2024): ~21 million

- Merchant fees: 2%–6% depending on terms

- Transaction limits: $50 minimum, $30,000 maximum

- Key strengths: Flexible financing, AOV lift, transparent fees

- Trade-offs: Higher fees for 0% APR, US-focused, complex integration

- Best for: High-value items (electronics, furniture, travel)

- Registration/onboarding: Website/app sign-up, soft credit check, clear loan terms

- Payment process: Pick Affirm at checkout, choose loan plan, tracked via app

- Post-payment management: Merchant refunds handled via Affirm, app updates, support available

- Account settings: Manage payments/personal info, tracking tools, early payment options

Afterpay (Clearpay in UK/EU)

- Merchants (2024): ~348,000 businesses

- Geo prevalence: Australia, Canada, New Zealand, UK, US

- Repayment options:

- Pay in 4 installments (interest-free)

- Monthly payments up to 12 months (US only)

- Active customers (2024): ~24 million

- Merchant fees: 4%–6% + fixed fee

- Transaction limits: $1 minimum, typically $1k–$4k maximum

- Key strengths: Youth appeal, fashion focus, high repeat usage

- Trade-offs: Limited to small/mid purchases, delayed payouts until delivery confirmation

- Best for: Small-ticket items, younger shoppers, lifestyle/fashion merchants

- Registration/onboarding: App/checkout registration, basic info, guided clean setup

- Payment process: Four automatic payments over six weeks, dashboard shows orders/payments

- Post-payment management: Returns via merchant, app updates schedule, in-app dispute support

- Account settings: Edit payment methods, reschedule payments, manage orders/history

Overall, Afterpay leads in Australia and New Zealand and is great for smaller purchases and younger shoppers, Affirm leads in the US and is great for larger purchases and full-spectrum financing needs, and Klarna sits in between with a strong global presence and a mix of short and long-term options.

How to select BNPL provider

✓ Does it cover your target location?

Pick a provider that aligns with where your customers are. Leverage the brand recognition – e.g., European shoppers trust Klarna heavily, while Australian and New Zealand shoppers know and trust Afterpay. If you operate in multiple countries, you may need different BNPL solutions for each region, as offering a familiar local option can increase uptake and trust at checkout.

✓ Does it have vertical and industry fit?

High AOV, infrequent purchase (travel, luxury retail, electronics): Lean towards providers that support longer-term financing. Affirm is a strong candidate here, as many travel sites use Affirm to offer 6-12 month payment plans for trips. Klarna’s financing option can also work for high AOV in markets where it’s available. Afterpay might not approve a $5,000 luxury watch purchase, but Affirm might.

Low-to-mid AOV, frequent purchase (fast fashion, cosmetics, everyday goods): Here, interest-free, short-term BNPL shines. Afterpay or Klarna Pay in 4 are ideal as they encourage add-on sales without fear of debt. These providers also have features like loyalty or rewards integrations.

Subscription & services: If you’re a SaaS or service with annual plans, offering a split-pay for an annual subscription could be attractive, effectively locking in a year commitment while the customer pays in installments. This can increase the uptake of longer-term plans. Evaluate if the BNPL provider supports your revenue model; some may not allow financing of certain services or digital goods. Klarna, for example, already supports subscription payments.

B2B or high-volume purchasing: Note that the mainstream BNPL players are consumer-focused. If you sell to small businesses or have a B2B angle, there are emerging B2B “BNPL” providers as well. But that might be outside our scope here. For completeness: if you are an enterprise merchant selling to consumers, stick to consumer BNPL solutions. If any portion of your sales is B2B, you’d look at net-terms providers instead.

✓ Does it fit your customer profile & UX?

Think about your typical customer’s preferences. For instance, Gen Z customers might already have the Klarna or Afterpay app on their phone. If so, providing that same method on your site is a big win.

Also, consider the psychology of your brand: If your brand plays into luxury or exclusivity, offering a “layaway” might seem off-brand, but framing it as financing or “split into easy payments” can still work. Choose a provider whose typical user base overlaps with your customer base for maximum uptake. If unsure, you could survey your customers – “Would you be interested in paying in installments? If so, which services have you used?”

✓ Does it provide a reasonable cost vs. benefit?

If one provider offers a significantly lower fee for your volume, that saves real money. But don’t just look at the percentage – consider the uplift each provider might bring. For example, maybe Klarna charges you 3.5% and Afterpay 5%. But if Afterpay is far more popular with your audience, the conversion lift might justify its higher fee. Or if Affirm lets more customers finance big baskets, the larger average order size might pay for itself.

Some merchants do a trial run: e.g., enable Klarna for 6 months and see metrics, then try Affirm, etc. If you use a solution that can host multiple BNPL options, you could even offer two at once and see which gets used more by customers.

✓ Is it easy to integrate and deploy?

Evaluate your own capabilities and the provider’s integration options. If you have a modern platform or use a popular commerce system (Shopify, WooCommerce, etc.), many BNPL providers will be plug-and-play. But if you have a custom stack, consider the quality of the provider’s APIs and documentation. A practical tip: check if your primary payment gateway or orchestrator already offers a BNPL solution.

Frequently asked questions

Adding BNPL to your checkout can be straightforward – just pick a provider like Klarna, Affirm, or Afterpay and embed their widget or API directly into your payment flow. However, if you integrate directly, you'll need to manage separate APIs, checkout flows, and reconciliation processes individually for each provider.

The easier route: leverage payment gateways or orchestrators like Solidgate, Adyen, PayPal, or others, which often come pre-loaded with BNPL integrations and can simplify these aspects.

The easier route: leverage payment gateways or orchestrators like Solidgate, Adyen, PayPal, or others, which often come pre-loaded with BNPL integrations and can simplify these aspects.

BNPL helps customers feel more comfortable pulling the trigger on purchases by breaking the total cost into smaller, manageable payments. This reduces hesitation, boosts conversion rates, and often leads to higher average order values (AOV) since customers feel less friction in choosing pricier or additional items.