The subscription economy is booming. The rise of the subscription business model has led to a corresponding increase in the necessity for subscription billing management platforms.

According to Zion Market Research, the subscription and billing management market was valued at $3.8 billion in 2018 and is expected to reach $10.5 billion by 2025.

In this article, we’ll determine the benefits of the subscription business model and how it works, explore free trial subscriptions, and discover proven ways to retain customers and avoid churn with recurring payments.

Table of Contents

What is a Subscription Business Model?

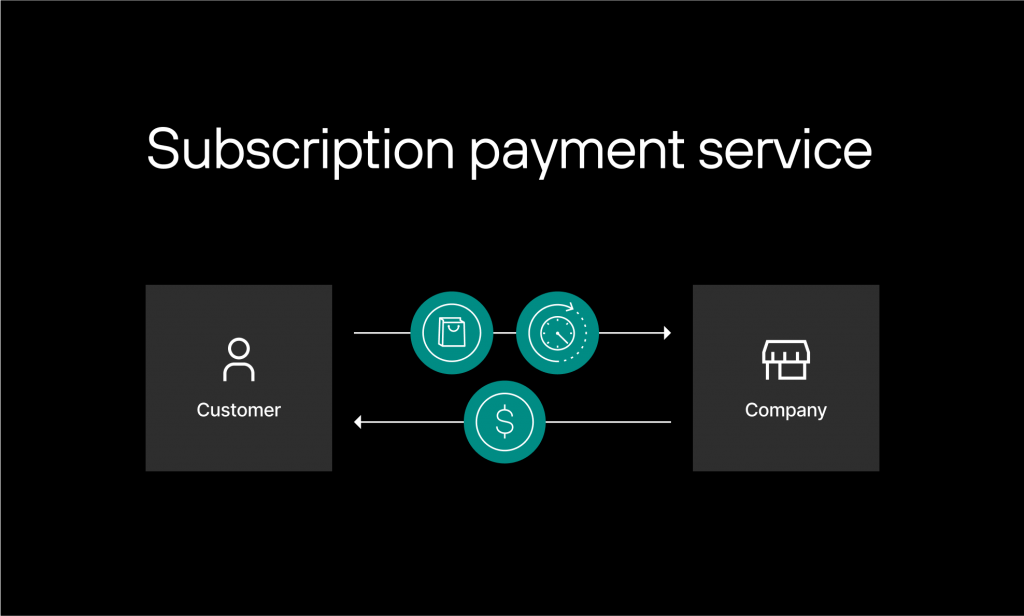

A subscription model is a business model in which a company provides customers recurring access to its products or services, typically for a monthly or annual fee.

In a subscription model, customers make a recurring payment to receive ongoing access to the company’s offerings, including physical goods, digital content, or services.

The recurring payment structure provides businesses with a predictable and regular revenue stream, allowing them to build strong relationships with their customers and to plan for future growth and development.

Benefits of the Subscription Model

The subscription payment model offers several benefits for businesses, including:

- Predictable revenue: Subscriptions provide a predictable stream of recurring revenue, allowing businesses to plan and budget more effectively.

- Customer loyalty: Subscriptions can help build customer loyalty, as customers are likelier to stick with a business when they repeatedly pay for a service or product.

- Increased customer lifetime value: By charging customers on a recurring basis, businesses can increase their customer lifetime value and generate more revenue over time.

- Improved cash flow: Subscriptions help improve cash flow, as businesses receive payment for their services or products regularly rather than waiting for one-time payments.

- Better customer data: Subscriptions provide businesses with valuable customer data, such as payment history and behavior, which merchants can use to improve marketing and customer service efforts.

The subscription service provided by Solidgate allows you to create and maintain a stable and healthy subscription model for your business.

What is a Free Trial Subscription

A free trial subscription is a subscription model where a customer can sign up to use a product or service for a limited time without being charged.

This is an effective promotional tool used by businesses to attract new customers and showcase the value of their product or service.

A free trial’s purpose is to allow customers to try the product or service before committing to a paid subscription.

Benefits of a free trial:

- A free trial subscription allows customers to try a product or service without financial commitment. This eliminates the risk associated with making a purchase and provides a stress-free experience for customers who need to become more familiar with the product or service before purchasing;

- The free trial gives customers the opportunity to test the product or service and determine if it meets their needs before they are required to make a payment;

- This low-risk entry point can increase customer acquisition by removing barriers to entry and providing a positive customer experience, leading to increased customer loyalty and repeat purchases;

- Free trial subscriptions can allow businesses to upsell or cross-sell to customers. A trial period can provide valuable insights into customer needs and preferences, which can be used to offer additional products or services that complement their existing subscription.For example, if a customer signs up for a free streaming service trial, the business may offer an upgrade to a premium subscription with additional features or content. By upselling or cross-selling during the trial period, companies can take advantage of the customer’s engagement with the product or service to drive additional revenue and improve customer satisfaction.

- By providing a free trial, businesses can demonstrate their confidence in the product or service and build trust with potential customers, making it more likely that they will choose to make a purchase after the trial period.

How Subscription Billing Works

The process of subscription billing typically works as follows:

- Customer signs up for the subscription: The customer provides payment information and selects the subscription plan that best meets their needs.

- Payment processing: The payment information is processed, and the customer’s account is activated.

- Renewal: The subscription is automatically renewed at the end of each billing cycle unless the customer cancels the subscription. The customer is typically charged on a monthly, quarterly, or annual basis, depending on the terms of the subscription.

- Subscription management: The business manages the customer’s subscription, including updates to the payment information, changes to the subscription plan, and cancellation of the subscription.

- Record keeping: The business maintains records of the customer’s payments and subscription history, including handling declined payments and managing customer disputes.

By using a subscription billing model, businesses can generate a predictable and recurring revenue stream.

How to Increase the Likelihood of Collecting Subscription Payment?

Card Updater

A card updater is a service that helps to keep credit card information up-to-date, reducing the likelihood of failed payments in subscription billing.

Here’s how a card updater can help process subscription payments:

- The card updater service receives real-time updates from credit card issuers, such as changes to the card number, expiration date, or status of the card.

- Automated Updates: Solidgate automatically updates the customer’s payment information in the subscription billing system, ensuring that the latest and most accurate information is being used for payments.

- Reduced Failed Payments: Keeping credit card information up-to-date helps reduce the likelihood of failed payments, ensuring that customers’ subscriptions remain uninterrupted and reducing the risk of customer churn.

- Increased Revenue: By reducing the number of failed payments, a card updater helps increase business revenue by ensuring that customers’ subscriptions are being billed correctly and consistently.

A card updater can play a critical role in improving the reliability and efficiency of subscription billing by keeping credit card information up-to-date and reducing the likelihood of failed payments. This can help businesses to collect payments more efficiently and reduce the workload associated with payment collection, allowing them to focus on other aspects of their operations.

Redemption Period and Smart Retries

A subscription redemption period is the time frame after failed subscription payment, while a subscription is trying to renew by automatically attempting to process a customer’s payment.

In Soligate, we use smart retries. The process works as follows:

- Payment Failure: If a customer’s recurring payment attempt fails, the subscription billing system is notified of the failure.

- Automated Retries: The subscription billing system then automatically retries the payment a few times for several days, using the customer’s saved payment information.

- Method of Retry: What method should be used for the retry? For example, should the retry be attempted using the same payment method as the initial attempt, or should a different method be used?

- Optimized Retry Scheduling: Past payment information is used to determine the best time and frequency for retrying failed payments. Smart retries are scheduled at the optimal time for collecting payment from the customer. This can increase payment conversion and reduce the number of manual interventions required by the business.

- How many retries should be attempted before giving up? This will depend on the business’s policy and the type of payment failure.

- Action: There are automated failed payment emails. Alternatively, the business can take manual action, such as reaching out to the customer to resolve any payment issues or updating the customer’s payment information to ensure successful future payments.

With Solidgate Smart Retries, 23% of rejected transactions got accepted after resubmission. You can ensure that payments are being collected efficiently and effectively.

Who can Benefit from the Subscription Payment Service?

Subscription-based business models are becoming increasingly popular across various industries as companies look to provide customers with convenient, predictable, and recurring access to their products or services. Many types of businesses can use the subscription payment model, including:

Software and Technology Companies

Companies that provide cloud-based software, such as customer relationship management (CRM) systems, project management tools, and productivity software, often use the subscription model to provide customers with access to their products.

Streaming Services

Streaming services, such as music, video, and gaming platforms, use the subscription model to provide customers unlimited access to their content for a monthly or annual fee.

Online Magazines and Newspapers

Digital media companies, such as online magazines and newspapers, use the subscription model to give customers access to their content and generate recurring revenue.

E-Commerce Businesses

Subscription-based e-commerce businesses, such as monthly product boxes and clothing rental services, provide customers with a convenient and predictable way to access products and services.

Health and Wellness Companies

Companies in the health and wellness industry, such as gym memberships and nutrition plans, use the subscription model to give customers access to their services and products on an ongoing basis.

Home Services

Companies that provide home services, such as cleaning and landscaping, often use the subscription model to provide customers with recurring access to their services.

Education and Training Providers

Providers of online education and training programs, such as language learning platforms, use the subscription model to provide customers with ongoing access to their content and services.

Professional Services

Professional services companies, such as accounting and legal firms, often use the subscription model to give customers access to their services on a recurring basis.

By using a subscription-based business model, companies can build strong customer relationships and generate recurring revenue from customers over time.

SaaS Providers

SaaS completely revolutionized the software business. Instead of trying to convince consumers and businesses to shell out thousands of dollars or more for a lifetime or multi-year software license that they aren’t fully convinced they need, the subscription model allows businesses and consumers to access the latest software for a reasonable monthly fee.

If a business or consumer no longer needs the software or wants to switch providers, they can stop paying the monthly fee and only end up paying for the months where they used the software. The SaaS model has allowed software companies to scale much faster and made winning new customers much easier.

Subscription Box Businesses

Subscription box businesses save people from having to do boring chores so they can focus on more important things. For example, instead of going to the supermarket to buy razors, you can sign up to Dollar Shave Club, instead of wondering what you are going to cook for dinner, you can sign up to Blue Apron. The subscription payment model has allowed these businesses to provide customers with reliable and consistent products for a small monthly fee.

How to Select the Best Subscription Payment Option for Your Business?

Before you choose a subscription payment option, you need to ask yourself the following questions:

- How big is my business?

- Where does my business operate?

- Who are my customers?

- What is my pricing strategy?

Once you have clear answers to these questions, then choosing a subscription payment option becomes easy! To learn how the above questions influence your subscription payment decision process, keep reading.

Business Size

Business size can have a significant impact on the choice of subscription payment service as well as the variety of payment options offered to customers.

Smaller businesses may opt for simpler and more affordable payment processing services, as they may not have the resources to manage a complex payment system. These services typically offer a basic set of payment options, such as credit and debit cards, but may not support more specialized payment methods, such as bank transfers or mobile payments.

Larger businesses, on the other hand, may require more advanced payment processing solutions that can handle a higher volume of transactions and support a wider variety of payment methods. They may also have more complex needs, such as multi-currency support, fraud detection and prevention, and customizable payment pages. In such cases, they may choose to work with payment processors, which offer more advanced features and support for a broader range of payment options.

Geographic Marketplaces

The geographic marketplaces where a business operates can have a significant impact on its subscription payment options. Here are a few examples of how:

- Payment method preferences: Different geographic regions have different payment method preferences. For example, credit cards may be more popular in North America, while e-wallets may be more popular in Asia. As a result, businesses may need to offer a variety of payment options to cater to the payment preferences of customers in different regions.

- Payment regulations: Payment regulations can vary widely between different geographic regions. For example, some countries may have strict regulations around data privacy or payment processing, which may impact the payment options that a business can offer. Businesses may need to work with payment processors that are compliant with local regulations in each geographic region.

- Currency support: Businesses operating in multiple geographic regions may need to support multiple currencies for their subscription payments. This may require them to work with payment processors that support multi-currency payments and provide tools for managing currency conversion rates.

Businesses need to collaborate with payment processors that can support their payment needs in each geographic region and may need to adjust their payment options and pricing strategies accordingly.

Size and Nature Of the Customer

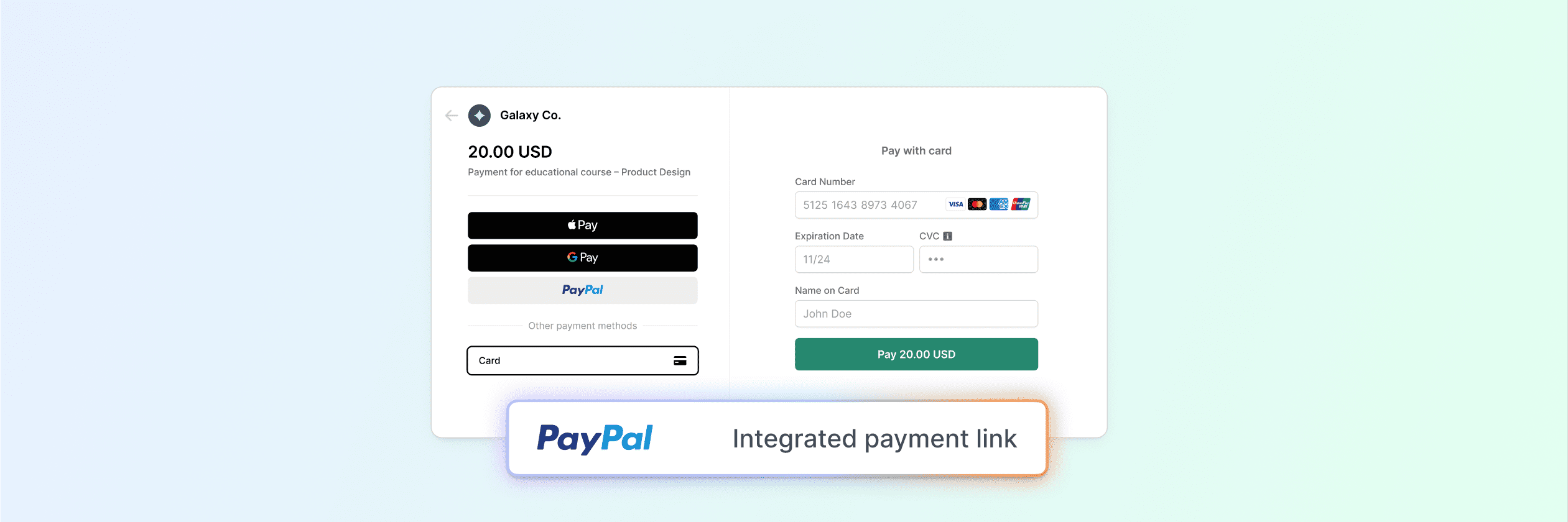

Before you select payment subscription options, you need to determine whether your customers are small/large and consumers/businesses. Larger customers typically have more negotiating power and may require more flexible payment options. For example, they may demand volume discounts, payment terms, or customized invoicing. In contrast, smaller customers may be more price-sensitive and prefer simple payment options like credit card billing or monthly subscriptions.

The nature of the customers can impact payment options. For instance, if a business serves enterprise-level customers, they may require customized payment integrations with their internal systems, such as ERP or procurement systems. Alternatively, if a business serves consumers or small businesses, they may prefer simple payment options, such as credit cards, PayPal, or other online payment systems.

Pricing Strategy

A business’s pricing strategy can influence its choice of subscription payment options in several ways. Here are a few examples:

- Perceived value: If a business is using a premium pricing strategy, it may want to offer payment options that align with the perceived value of the product or service. For example, a luxury brand might want to offer payment options that are seen as exclusive or prestigious, such as Apple Pay or American Express.

- Flexibility: If a business is using a value-based pricing strategy, it may want to offer flexible payment options that cater to a range of customer budgets. For example, offering the option to pay monthly, quarterly, or annually, or offering a discount for annual payments.

- User experience: A business may choose a subscription payment option that provides a better user experience for its customers. For example, a business might opt for a payment gateway that allows customers to save their payment details for future purchases or one that provides a one-click checkout experience.

- Transaction fees: Subscription payment options may come with transaction fees, which can impact the business’s bottom line. Depending on the pricing strategy, a business may choose to absorb the transaction fees or pass them on to customers as a separate charge.

Ultimately, the goal is to choose payment options that align with the business’s pricing strategy and provide the best possible experience for its customers.

FAQs

What is a subscription payment service?

A subscription payment service is a recurring payment model that allows customers to pay for products or services on a regular basis, typically monthly or annually. It enables businesses to offer subscription plans and ensures a predictable revenue stream while providing convenience for customers.

How does a subscription payment service work?

When using a subscription payment service, customers typically sign up for a subscription plan by providing their payment information. The service then automatically charges the customer’s chosen payment method at regular intervals, such as monthly or annually. Customers can enjoy uninterrupted access to the subscribed product or service as long as the payments are successfully processed.

What are the benefits of using a subscription payment service?

Using a subscription payment service offers benefits for both businesses and customers. For businesses, it provides a reliable source of recurring revenue, improved customer retention, and the ability to forecast revenue more accurately. For customers, a subscription payment service offers convenience, hassle-free payments, and often access to additional perks or exclusive content.