Buyers are often reluctant to enroll in subscriptions, as such a business model is perceived as a long-term financial commitment. But how can you show your customers that your subscription product is worth their money? The best way is to offer a trial period.

A trial period usually lasts for a shorter period than a full subscription and costs less money or can be provided for free. A new user can access the full or limited scope of services during this period.

Once it ends, services become unavailable until the user pays for them again, or customers may automatically enroll in the full subscription. The second case is called the negative option billing model in the banking language.

On September 20th, new Mastercard rules for Negative Billing Option Merchant came into force, so it’s more relevant than ever to recap the main requirements of both card schemes in this respect.

Table of Contents

What Is Negative Option Billing?

Negative-option billing, also known as automatic renewal, is a business practice in which a product or service is provided to a customer without their explicit agreement for recurring charges. Under negative option billing, the customer’s silence or failure to explicitly cancel or opt out is considered as consent to continue receiving the product or service and being charged for it.

In this billing model, the customer is often initially offered a free trial or introductory period, during which they can try out the product or service at no cost. However, unless the customer actively cancels or opts out before the trial period ends, they are automatically enrolled in a paid subscription or contract, and recurring charges are applied to their payment method.

Negative-option billing has been a subject of controversy and regulatory scrutiny, as it can lead to customers unknowingly or unintentionally incurring charges for products or services they may no longer want or need. In some cases, customers may find it challenging to cancel or opt-out, resulting in continued billing and frustration.

Who is Affected by the Latest Mastercard Rules on Negative Billing Option

To determine whether you need to fulfill the requirements for Negative Billing Option Merchants, just answer the following questions:

- Do you sell goods or provide services other than dietary supplements, healthcare products, utilities (gas, oil, water), telecommunications services, insurance policies, or existing debt (vehicle loan, e.g.)?

- Do you utilize recurring payments (subscriptions)?

- Do you suggest a trial period for customers?

- Do you automatically enroll the full subscription for customers after the trial period?

- Is your trial period 7 days or longer?

If you answered “yes” to everything above, you are a Negative Billing Option Merchant and fall under recently enforced changes.

Mastercard Rules Checklist: Negative Billing Requirements

As you may notice, both VISA and MasterCard took a course on improving the cardholder experience and better protection of customer rights. Negative-option billing business model provides an easy way to utilize it in the best favor of the merchant (but not the user sometimes) by enrolling the renewable subscription after the trial period ends.

Here is your to-do list to stay compliant with the requirements of card schemes:

- Add a proper disclosure to your checkout page. Describe the terms of the trial and subscription. The text may be like, “You will be billed USD 2.99 today for a 30-day trial. Once the trial ends, you will be billed USD 19.99 each month thereafter until you cancel.” We also recommend adding a checkbox for the user, links to T&C, and your support team email.

- Do not forget to send a confirmation letter after the first purchase. It needs to specify your company’s name, description of the product/services purchased, last 4 numbers of the customer’s card number, length of the trial period, clear disclosure on the automatically renewed subscription, its full price, the next charge date, and instructions on how to cancel the subscription. We also encourage you to add links to the website page with Terms and Conditions, Cancellation Policy (if any), and support email.

- Send a warning to customers before the end of the trial period. If your trial period lasts more than 7 days, customers need to receive a reminder no less than 3 days and no longer than 7 days before its end. If your subscription lasts for six months or more, a reminder must be sent at least seven days and no more than 30 days before the billing date.

- Provide your customers with a receipt after the purchase/enrollment of a trial and after all subsequent charges. Each receipt needs to include the information specified in point 2 above.

- Develop and implement an easy way to cancel subscriptions. We recommend using a separate Cancel subscription button in the user’s profile or a similar link on your website. You can also ask customers to cancel via support; however, in this case, please include the support email address and direct link to the Cancellation Policy or Terms of Use to the email. Make sure everything works properly, and users’ requests are being processed quickly.

How to Be Compliant With Visa and Mastercard Rules

While negative option billing can be a convenient way for customers to receive ongoing services or products, it has also been associated with consumer protection issues, including deceptive practices and unauthorized charges.

To address these concerns, Visa and Mastercard have established rules and guidelines for negative option billing (Visa Negative Option Billing Rules, Mastercard Negative Option Billing Rules), which require businesses to obtain explicit consent from customers before enrolling them in recurring payment plans or subscriptions.

Taking into account that these requirements are the current trend in the FinTech world, we’ve prepared the main points for merchants to be compliant with the VISA and Mastercard rules:

1. Contact details. The following contact information must be displayed on the website:

- mailing address (for correspondence);

- customer support number OR customer support email in the website footer or on a separate Contact page.

2. Merchant location disclosure.

- the address of the legal entity (at least the city and country) should be indicated on the website or on the checkout screen;

- EU Merchants are recommended to specify the full address.

3. Subscription Terms Disclosure (Disclaimer) should contain:

- Description of the service to be purchased (e.g., subscription to the website, trial access, premium plan);

- Cost and frequency of charges (monthly, weekly, annual).

- How to cancel or opt-out (e.g., link to the Cancellation Policy or straightforward instructions);

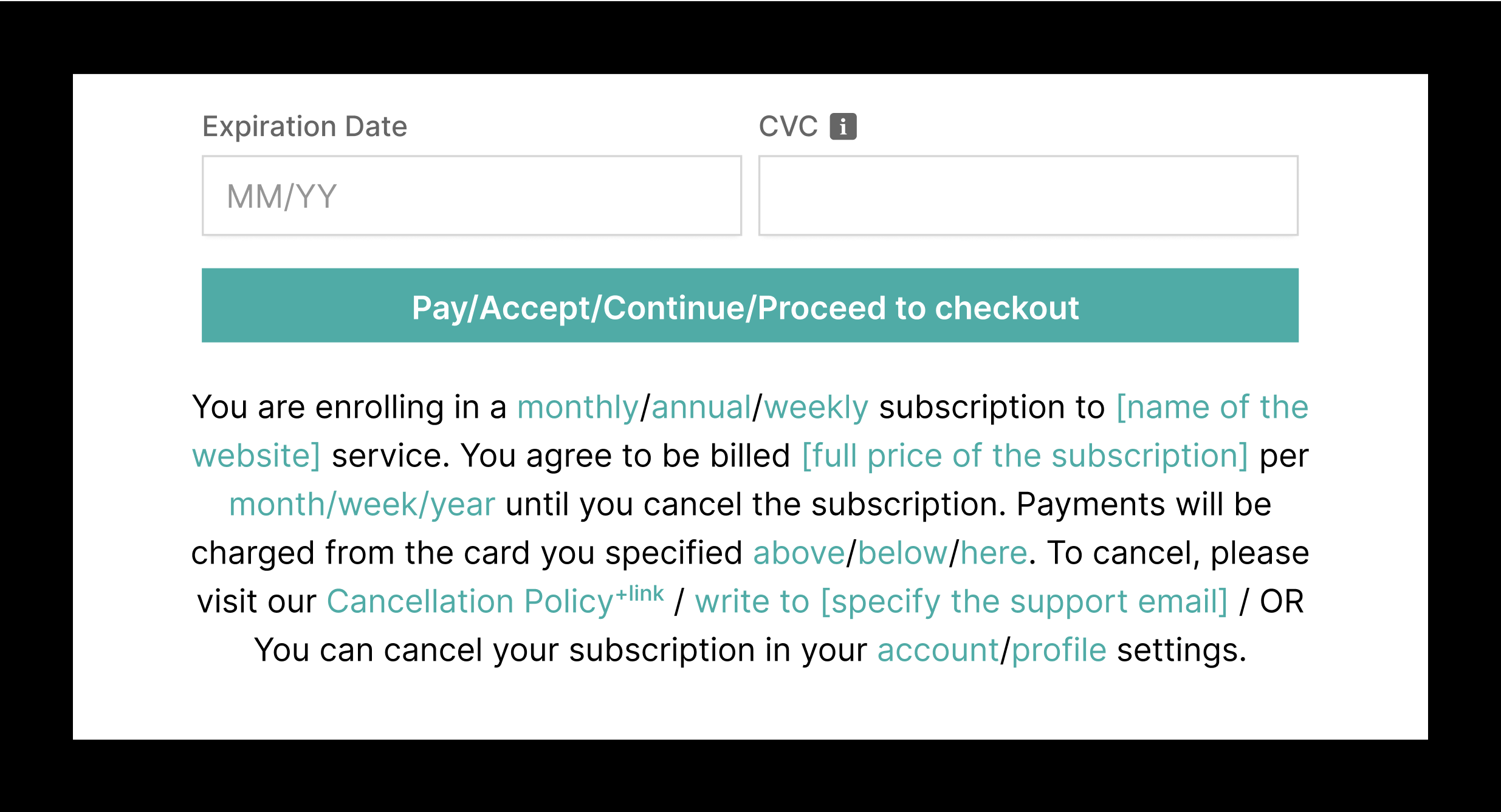

- Customer consent (e.g., adding the appropriate disclaimer under the “Pay/Accept/Continue/Proceed to checkout“ button);

- There is no strict requirement to use a checkbox; however, such an approach will be appreciated by the acquirers and schemes.

- The example of a 100% compliant disclaimer: “You are enrolling in a monthly/annual/weekly subscription to [name of the website] service. You agree to be billed [full price of the subscription] per month/week/year until you cancel the subscription. Payments will be charged from the card you specified above/below/here. To cancel, please visit our Cancellation Policy+link / write to [specify the support email] / OR You can cancel your subscription in your account/profile settings.”

4. Transaction Receipts & Notifications.

- Note that the transaction receipts must be provided after each charge (even if it was unsuccessful for some reason – then the reason needs to be specified). Usually, the receipts and mandatory notifications are united and sent to the customers in one email.

- So, the merchant should send the following notifications:

Initial disclosure. This email must include:- The Merchant’s legal name and location (at least country, state (if any), and city) of the merchant;

- The description of the ordered service;

- Transaction amount and the date of purchase + Card network/scheme name (VISA or Mastercard, accordingly).

- Payment credentials (the last four digits of the card that was used).

- The name (email) of the subscriber;

- Subscription/trial terms (the billing period, its length, auto-renewable nature, price, etc.).

- How to cancel or opt out (e.g. link to the Cancellation Policy or straightforward instructions);

Reminder of charges:

- Merchants must remind customers of the charges that will be applied if they do not cancel before the end of the trial/subscription period.

- This reminder should be sent at least 24 hours before the end of the subscription period (+no less than 3 days and no more than 7 days before the trial ends).

- It should state the points listed for the initial disclosure above.

Confirmation of cancellation:

- This email should include the effective date of the cancellation, any applicable refunds, the Merchant’s legal name and location, the user’s name (email), and the confirmation of the subscription’s cancellation.

5. Cancellation procedure.

- The Merchant must provide an easy cancellation online method. Cancellation may be performed via:

- separate cancellation button placed on the website;

- cancellation button in the user’s account on the website;

- via support email, but in this case, relevant instructions along with the email need to be displayed in the Cancellation Policy and in the User’s profile (preferably).

- Inform users of the Cancellation and Refund Policy and collect their acceptance prior to the checkout page. It may be realized either by:

- adding a clickable “click to accept button“ along with the disclosure of the cancellation & refund terms;

- by including a separate clickable link to the Cancellation and Refund Policies (or Terms & Conditions, if the Cancellation Policy is a part of it) to the disclaimer of the general payment term.

- by specifying the rules of cancellation and refund (or a separate clickable link to the Policies) in the email notifications (or Transaction Receipts).

It’s important to comply with Visa and Mastercard’s subscription and negative option billing requirements to avoid potential fines (Visa may impose a fine of up to $50000 and Mastercard – up to $20000 for the violations) and other negative consequences.

Benefits & Risks of the Updated Mastercard Rules

The main benefits for you as a merchant from staging complaints are the following:

- Fewer chargebacks and refunds

- Better user experience

- Compliance with Mastercard and VISA rules

- Maintaining a good reputation with your acquirers

When it comes to risks, note that failure to comply with Mastercard and VISA rules may lead to financial liability for your acquirers. In turn, they will try to seek compensation from you. Apart from chargebacks and refunds, you may suffer from financial losses, negative reputational consequences, and even termination of business relations with your partners.

![Product Update—Less Fraud, More Payment Efficiency [July'24]](https://solidgate.com/wp-content/uploads/2024/07/Product-update-Solidgate-scaled.jpg)