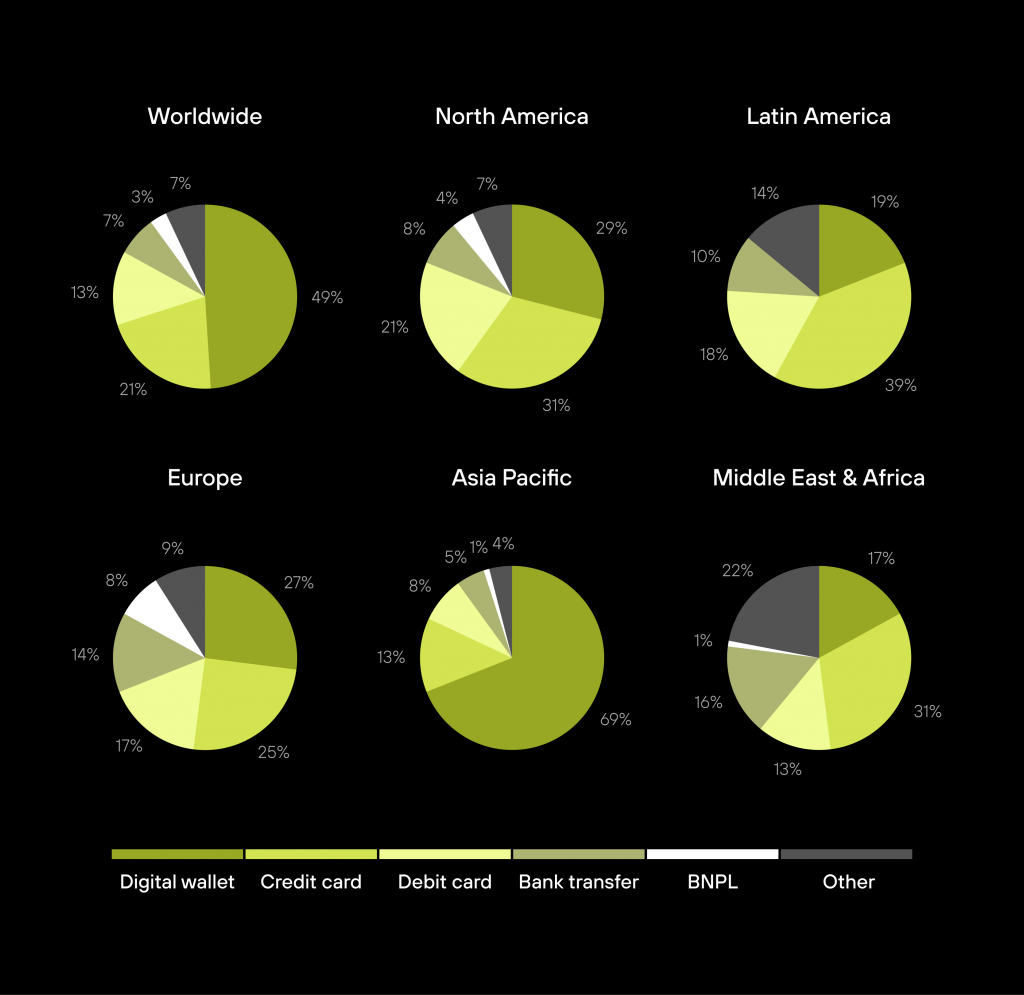

As an online merchant, you surely want to stay ahead of the curve in the e-commerce world and unlock new potential for your business benefiting from up to 20% more sales by offering the right mix of payment methods. And different types of payment methods help you with it.

Table of Contents

Introduction to Online Payment Methods

Payment methods are the various methods used to pay for goods and services. A variety of payment methods have become increasingly important today.

With the rise of e-commerce, companies need to be able to accept payments from customers in different countries and currencies. Payment methods vary significantly across countries and regions, as other countries and regions prefer different payment methods.

There are many different types of payment methods around the world. The most common payment methods include cash, checks, credit cards, debit cards, prepaid cards, e-wallets, mobile payments, bank transfers, and cryptocurrency.

In many countries, conventional debit and credit cards are surprisingly rare, and bank accounts are only available to some. Around the globe, over 500 alternative payment methods can divide into different categories.

For example, one of Latin America’s most popular online payment methods generates a voucher that can be paid offline in cash. At the same time, iDEAL (a bank transfer system) is covered by all Dutch banks and is used to complete over 60% of all e-commerce transactions in the Netherlands.

In a series of articles in our blog, we will discuss the payment methods commonly used globally and how they differ across countries.

Types of Global Payment Methods

There are currently over 200 different payment methods available in the world. The key value online payment methods can be divided into several groups.

Cards (credit or debit)

Credit cards are one of the most widely used payment methods globally, as they are accepted in almost every country. They offer convenience, security, and flexibility when it comes to payments.

Debit cards are also widely used and accepted in most countries. They provide the same comfort, safety, and flexibility as credit cards but without the risk of accumulating debt.

Wallets

E-wallets are becoming increasingly popular as they offer a secure and convenient way to make payments. They are trendy in certain regions, such as Asia and Africa, as they allow customers to make payments without entering personal or financial information.

The e-wallet provider processes the payment, and the funds are transferred to the merchant’s bank. Key global players include many big names such as PayPal, ApplePay, Google Pay, and WeChat Pay.

Bank Transfer Payment Methods

Bank transfers are also a standard payment method, as they are secure and allow customers to transfer money directly from their bank accounts. Direct online bank transfers are a popular payment method for e-commerce transactions, especially in Europe.

Meanwhile, electronic money transfers are popular in many markets with less established traditional banking systems. In many Latin American markets, a number of popular in-house payment methods allow shoppers to receive a code at checkout, which customers can then pay with cash or bank transfer at participating brick-and-mortar locations.

Buy Now Pay Later (BNPL)

BNPL offers customers to receive goods immediately and pay for them later. The BNPL supplier pays the transaction amount and bears any risk of fraud or non-payment. Buy Now Pay Later payment methods usually result in higher transaction costs and conversion rates.

Buy Now Pay Later methods is extremely popular in most European countries, especially in Germany, Scandinavia, Austria, Switzerland, and the Netherlands.

APMs – Alternative Payment Methods

As the online payment industry is undergoing rapid changes, more and more users are testing out alternative payment methods beyond traditional options like credit cards and bank transfers. The demand for alternative payment methods stems from the desire for convenience, security, privacy, lower fees, and flexibility. This has led to the rise of innovative solutions such as open banking options, peer-to-peer payments, and cryptocurrencies.

Open Banking Options

Open banking is a system that allows third-party financial service providers to access banking data and initiate transactions with the consent of the customer. Here’s a brief explanation of how open banking works:

Once authorized, the customer’s banking data, including account information, transaction history, and balances, can be securely accessed by authorized third-party providers. This allows these providers to offer innovative financial products and services.

Open banking enables third-party providers to initiate payments directly from a customer’s bank account on their behalf. This bypasses the need for traditional payment methods like credit cards or debit cards. Open banking empowers customers by granting them greater control over their financial data and opening up opportunities for innovative financial services.

Peer-To-Peer Payments

Peer-to-peer (P2P) payments enable individuals to transfer funds directly to one another using online platforms or mobile apps, eliminating the need for intermediaries like banks. The most famous providers are PayPal, Venmo, and Cash App. Here’s a brief explanation of how P2P payments work:

Users typically link their bank accounts, credit cards, or digital wallets to the platform. To make a P2P payment, the sender enters the recipient’s details (such as their email address or mobile number) and the amount to be transferred. The platform verifies the information and confirms the transaction. Once the payment is initiated, the platform securely transfers the funds from the sender’s account to the recipient’s account, usually within minutes or even seconds.

P2P payments provide a quick and convenient way to send and receive money digitally, eliminating the need for cash or physical checks. These platforms are user-friendly and accessible to a wide range of individuals. P2P payments cater to informal transactions between individuals, such as repaying friends or family, reimbursing expenses, or conducting small-scale business transactions, and offer features to split bills or expenses among friends or groups.

Cryptocurrencies

Cryptocurrency is a digital form of currency that utilizes cryptography for secure transactions and operates independently of central banks. They have exploded in popularity as they allow people from across the globe to instantly transact with each other privately, for a low cost and without the need for 3rd parties. The most popular cryptocurrencies are Bitcoin, Ethereum, Ripple, and Litecoin. Here’s a brief explanation of how it works as an online payment method:

Cryptocurrencies, such as Bitcoin and Ethereum, are built on blockchain technology, which is a decentralized ledger maintained by a network of computers, eliminating the need for intermediaries like banks. Cryptocurrencies use advanced cryptographic techniques to authenticate and authorize transactions.

Cryptocurrency transactions occur directly between users, known as peers, without the need for intermediaries and are recorded on the blockchain. Users store their cryptocurrencies in digital wallets, which also facilitate sending and receiving cryptocurrency payments.

Top 5 Online Payment Methods

In the digital age, online payment methods have become increasingly popular, offering convenience and security for consumers and merchants alike. Among the top choices for online transactions are credit and debit cards, PayPal, Google Pay, Amazon Pay, and Apple Pay.

Credit and debit cards remain the most widely used payment method, with over 70% of online shoppers relying on them. PayPal, a trusted digital wallet, boasts over 400 million active accounts globally, while Google Pay, Amazon Pay, and Apple Pay have gained significant traction due to their seamless integration with popular platforms and devices. Let’s delve into each of these top 5 online payment methods in more detail.

Credit And Debit Cards

Credit cards are issued by financial institutions or credit card companies. When a person makes a purchase using a credit card, the card issuer essentially lends them the money to complete the transaction. The cardholder receives a monthly statement detailing their purchases and any outstanding balance which they can pay back in full or monthly.

Debit cards are linked directly to a person’s bank account. When a transaction is made using a debit card, the funds are immediately deducted from the linked account.

Cards provide a convenient and widely accepted method of payment. They can be used in physical stores, online, and even for contactless transactions. Credit and debit cards come with security features such as chip technology and PIN numbers, reducing the risk of fraud and unauthorized transactions. Many credit card providers offer rewards programs, cashback incentives, airline miles, or other benefits to cardholders.

The most popular credit and debit card providers globally are Visa and Mastercard. Visa processes $10 trillion worth of transactions annually. There are over 343 million Visa credit cards in circulation in the U.S. 140 billion Mastercard transactions are made annually across the globe, and there are over 250 million Mastercards in the US.

PayPal

PayPal is a widely recognized digital payment platform that enables individuals and businesses to send and receive money securely over the internet. It acts as a digital wallet, allowing users to link their bank accounts, credit cards, or debit cards to their PayPal account. PayPal has over 400 million users and in 2022, processed over $1.35 trillion in global payments Here’s how PayPal works:

- Account Creation: Users can sign up for a PayPal account by providing their email address and creating a password. They can then link their preferred payment methods to their account.

- Sending and Receiving Payments: To send money, users simply need the recipient’s email address or mobile number linked to their PayPal account. They can choose to send funds from their PayPal balance, linked bank account, or associated credit/debit card. Recipients receive a notification and can access the funds in their own PayPal account.

- Buyer and Seller Protection: PayPal offers buyer and seller protection, reducing the risk of fraud and disputes. Buyers can request refunds for eligible purchases that didn’t meet their expectations, while sellers are protected against unauthorized transactions or chargebacks.

- Online Checkout: PayPal provides an option for online merchants to offer PayPal as a payment method during the checkout process. Customers can select PayPal and log in to their account to complete the transaction securely without sharing their payment details with the merchant.

Google Pay

Google Pay is a digital payment platform developed by Google that allows users to make payments securely and conveniently using their smartphones or other compatible devices. It combines multiple Google services, including Google Wallet and Android Pay, into a unified platform. Google Pay has 150 million users, is available in 40 countries, is accepted at over 800,000 websites, and is responsible for 20% of mobile purchases.

To make a payment, users can simply unlock their device, hold it near a contactless payment terminal, and authorize the transaction using biometric authentication (such as fingerprint or face recognition) or a PIN code. Google Pay uses near-field communication (NFC) technology to securely transmit payment information.

Google Pay facilitates in-app and online purchases. Users can select the Google Pay option during checkout on supported websites and apps. The payment information stored in their Google Pay account is used to complete the transaction securely.

Google Pay also enables users to send and receive money from friends and family within the app. They can easily transfer funds by entering the recipient’s email address or phone number.

Amazon Pay

Amazon Pay is a digital payment service launched by Amazon in 2007, allowing customers to make online payments on third-party websites using their Amazon credentials. It simplifies the checkout process by utilizing the payment information already stored in the customers’ Amazon accounts. Amazon Pay is accepted at over 1,000,000 websites across the world, has over 50 million users globally, and processes over 70 million transactions annually.

Customers can link their preferred payment methods, such as credit cards or debit cards, to their Amazon Pay account. Participating websites offer Amazon Pay as a payment option during the checkout process. Customers can select Amazon Pay and log in using their Amazon credentials to complete the transaction.

Amazon Pay allows customers to make online transactions without sharing their payment details with merchants. They also offer a measure of buyer protection, ensuring that customers can receive refunds or dispute transactions if there are issues with the purchase.

Apple Pay

Apple Pay is a mobile payment and digital wallet service developed by Apple Inc. It allows users to make payments securely and conveniently using their devices, such as iPhone, Apple Watch, iPad, or Mac. Apple Pay has almost 400 million users, is accepted by 85% of retailers in the US, and processes $6 trillion worth of transactions just behind top dog Visa with $10 trillion.

Users can add their credit or debit cards to the Wallet app on their Apple device. Card information can be manually entered or added by scanning the card using the device’s camera. To make a payment, users simply hold their device near a contactless payment terminal or select Apple Pay as a checkout option for online transactions. Authentication is done through biometric verification (Touch ID, Face ID) or a passcode.

Apple Pay uses tokenization to protect payment information. Instead of transmitting the actual card details, a unique token is generated for each transaction, ensuring that the user’s card information remains secure. In addition to payments, Apple Pay can also store digital tickets, boarding passes, loyalty cards, and more within the Wallet app, providing a convenient all-in-one digital wallet experience.

How To Select The Top Payment Options

Choosing the best online payment methods for businesses and customers involves careful consideration of various factors. Here are some key points to consider:

- Security: Both businesses and customers should prioritize secure payment methods to protect sensitive financial information. Look for payment providers that utilize robust encryption and fraud prevention measures to ensure secure transactions.

- Customer Preferences: Understanding the preferences of your target customers is essential. Consider their preferred payment methods, such as credit cards, digital wallets, or alternative payment options, to provide a seamless and convenient checkout experience.

- Integration and Compatibility: Businesses should assess the compatibility of payment methods with their e-commerce platforms, point-of-sale systems, and mobile apps. Integration ease and flexibility can save time and effort when setting up and managing payment processing.

- Cost and Fees: Evaluate the cost structure and fees associated with each payment method. Consider transaction fees, setup costs, monthly fees, and any additional charges that may impact profitability. Choose options that offer competitive pricing and transparent fee structures.

- Global Reach: If your business operates internationally, consider payment methods that support cross-border transactions and cater to a global customer base. Ensure compatibility with different currencies and consider localized payment options for specific regions.

- Customer Support: Look for payment providers that offer reliable customer support. Prompt and efficient assistance can help resolve any issues or concerns that arise during payment processing.

- Reputation and Trust: Consider the reputation and trustworthiness of the payment provider. Research customer reviews, industry ratings, and security certifications to ensure you are partnering with a reputable and reliable company.

Businesses and customers should choose online payment methods that align with their specific needs, preferences, and objectives by considering factors such as security, customer preferences, integration, cost, global reach, customer support, and reputation.

Differences in Payment Methods Across Countries

Payment methods vary significantly across countries and regions, as different countries and regions prefer additional payment methods. The most common payment methods are credit cards, debit cards, e-wallets, and bank transfers.

Despite the similarity of payment methods globally, some distinct differences exist across countries. In addition to the differences in payment methods, there are also differences in the types of cards that are accepted across countries.

Which payment methods are best for your business? Read more in our articles or book a call with our Sales manager using the form below.