Payment Gateway vs Payment Processor: Key Differences Explained

Payments 101

15 Sept 2023

5 min

Clearer roles, secure data, and efficient flows—see how gateways and processors work together. Learn how they facilitate safe and seamless online transactions.

Are you running an online business and wondering how to accept customer payments?

You may have heard the terms payment gateway and payment processor before. But what do they mean? Let’s clear the payment gateway vs payment processor fog. We’ll delve deep into their functionalities, explore their vital roles within the online payment ecosystem, and shed light on how they harmoniously interact to ensure that transactions are swift, secure, and seamless.

What is a Payment Gateway?

A payment gateway serves as the technological conduit through which merchants facilitate the acceptance of debit or credit card payments from their customers. This term encompasses not only the physical card-reading devices typically found in traditional brick-and-mortar retail establishments but also the virtual payment processing portals prevalent in online commerce.

are an absolute necessity in physical retail. They are point-of-sale (POS) terminals that are used for inputting credit card information. They can handle various payment methods such as swiping, inserting, or using smartphones with the necessary technology.

These terminals are essential for in-store transactions to be smooth and reliable. They play a crucial and non-negotiable role in ensuring the seamless processing of financial data.

The digital domain relies on online payment gateways, commonly known as “checkout” portals. These virtual gateways provide customers with the means to input their credit card information or login credentials for various services. This way, they enable a secure and convenient payment process in the e-commerce arena.

Payment gateways are distinct entities from payment processors. They primarily focus on gathering and transmitting consumer payment information to complete transactions on behalf of the merchant. On the other hand, go a step further. They orchestrate the actual collection of funds from the customer.

Specialized payment gateways are designed to accommodate transactions involving cryptocurrencies such as Bitcoin, extending their utility to digital currencies. These gateways open new avenues for secure and efficient financial interactions in the ever-expanding realm of digital commerce.

How Payment Gateways Work

The payment gateway is pivotal in the electronic payment processing system. It serves as the forefront technology for transmitting vital customer information to the merchant’s .

The landscape of payment gateway technologies is in a constant state of flux, perpetually adapting to the ever-evolving preferences of consumers and advancements in technology. In days gone by, terminals predominantly accepted credit cards equipped with magnetic strips, often accompanied by the customary request for a paper signature from the customer.

The rise of chip technologies started a new era. The need for signatures decreased. This allowed personal identification numbers (PINs) to be entered directly into payment machines. In today's world, more people are choosing contactless payments. Many customers now use their smartphones to pay. This change has made plastic credit cards less common.

The architecture of a payment gateway diverges depending on its setting, whether it’s an in-store gateway or an online payment portal. Online payment gateways necessitate the presence of application programming interfaces (APIs). They facilitate seamless communication between the respective website and the underlying payment processing network.

In-store payment gateways rely on point-of-sale (POS) terminals that electronically connect to the payment processing network, typically via a phone line or an internet connection, ensuring the smooth flow of transactions within the physical realm of commerce.

What is a Payment Processor?

A payment processor serves as a crucial service provider for businesses in the intricate realm of card payment management. Its primary function is to efficiently shuttle card data from various points of origin, whether customers are tapping, swiping, or entering their card particulars, to the extensive network of payment giants like Visa, Mastercard, American Express, and Discover, as well as the involved banking institutions.

For any business aspiring to embrace card payments, enlisting the services of a payment processor is an indispensable prerequisite. Some enterprises, exemplified by Square, offer a comprehensive package by seamlessly integrating payment processing into their point-of-sale systems and hardware.

Entities such as Payment Depot specialize in the domain of payments exclusively. The choice between these options hinges mainly on your business’s sales volume and the method employed for accepting payments.

The payment processor functions as the intermediary that meticulously manages the transaction flow between the payment gateway and the merchant’s bank account. This encompassing role includes vital tasks like verifying the accuracy of customer payment information and orchestrating the seamless transfer of funds from the customer’s account into the merchant’s account.

Payment processors work hand-in-hand with payment gateways to harmonize the payment process. Together they ensure the reliability and efficiency of every financial interaction.

How Do Payment Processors Work With Payment Gateways?

To enable online transactions for your business, you require a payment gateway and a payment processor. They work hand in hand to facilitate .

The payment gateway serves as a transaction’s entry and exit point. Here, the customer provides their credit card details. Than the gateway sends them to the payment processor for verification. The payment processor then moves the transaction data between the customer and merchant banks.

It’s crucial to understand that every online transaction requires both a payment gateway and a payment processor. These two components are interdependent and work together to ensure the smooth processing of payments.

The payment authorization process involves several steps:

- The customer purchases a product using a credit or debit card. The payment gateway encrypts the data and sends it to the payment processor.

- The payment processor sends a request to the customer’s issuing bank to confirm if they have enough funds to pay.

- The issuing bank responds with an approval or denial, which the payment processor sends back to the merchant.

- The payment processor informs the merchant bank to credit the merchant’s account, indicating that the sale was approved.

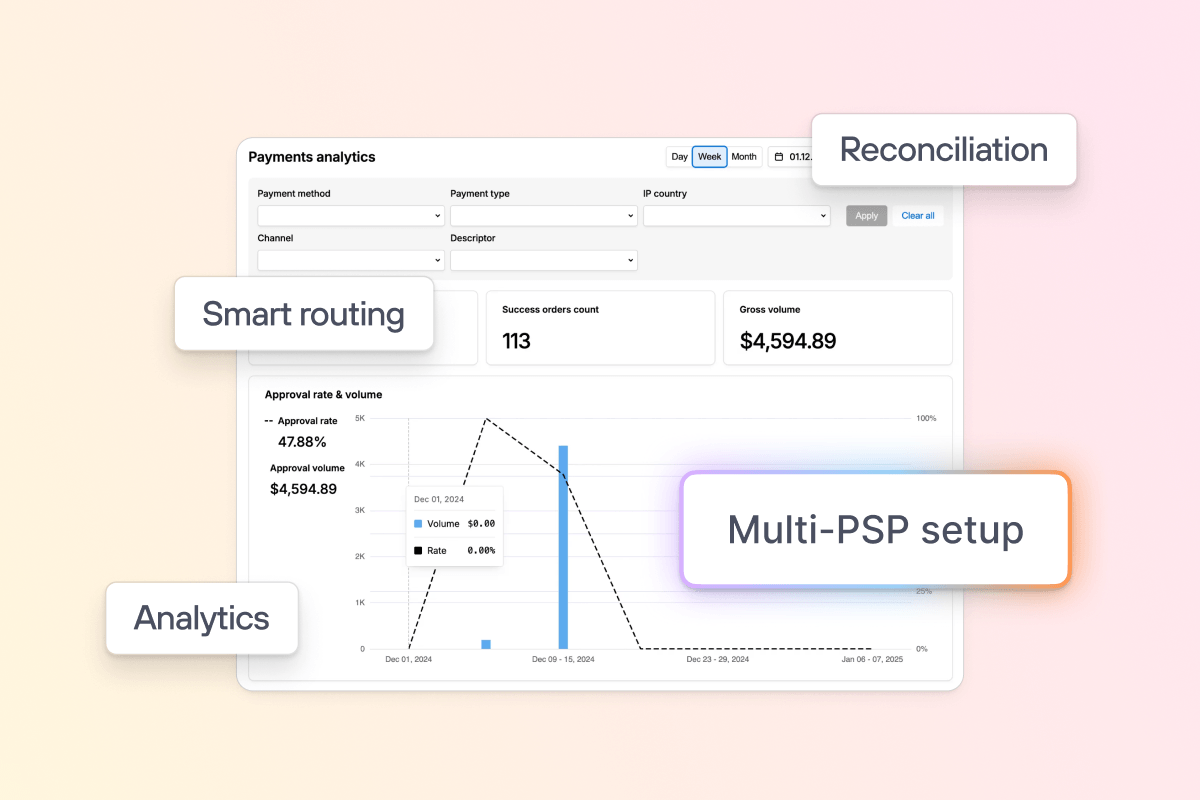

What’s the Main Difference Between Payment Gateway and Payment Processor?

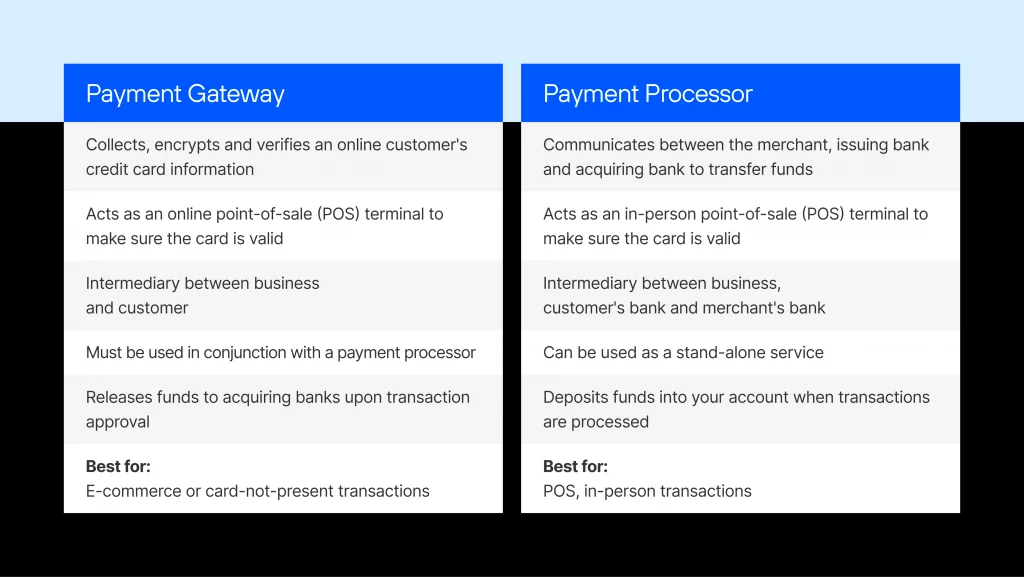

- A payment gateway is an online service that allows merchants to accept electronic payments from customers on their website or mobile app. In contrast, a payment processor is a company that manages the payment transaction between the customer’s bank and the merchant’s bank.

- A payment gateway acts as a middleman between the merchant and the payment processor, providing a secure channel for transmitting the transaction data. On the other hand, a payment processor performs various functions like capturing, processing, and settling payment transactions.

- A payment gateway integrates with the merchant’s website, providing a user-friendly interface for customers to enter their payment information. Payment processors usually integrate with payment gateways to process the transactions.

- Payment gateways provide a secure layer of encryption that keeps the customer’s payment data safe from unauthorized access. Payment processors also offer various security features to protect against fraud and chargebacks.

Payment Gateway VS Payment Processor: Conclusion

In summary, payment gateways and payment processors work together to process online transactions securely.

Payment gateways facilitate the transaction between the customer’s payment method and the merchant’s bank account, while payment processors verify and transfer the payment information.

Now you know the difference between a payment gateway and processor. Choosing a suitable payment processor and gateway for your business ensures that your online transactions are processed smoothly and safely.

Frequently asked questions

A Payment Processor manages the financial aspects of transactions, including authorization, settlement, and fraud prevention, in collaboration with banks and card networks like Visa or Mastercard. Payment Gateway serves as a secure bridge between the merchant’s website and the Payment Processor. Its primary role is to securely transmit transaction data and provide essential security features such as encryption.

The Payment Processor is responsible for verifying transactions, managing funds, providing transaction reports, and implementing fraud protection measures. Payment Gateway ensures secure data transmission, facilitates user-friendly online payments on websites or apps, and seamlessly integrates with a variety of e-commerce platforms.

Yes, in most cases, you need both. The Payment Gateway securely collects payment data from customers and forwards it to the Payment Processor, which handles the financial transaction. This dual system ensures seamless and secure online payments.