PayPal recently implemented a brand-new feature – a separate dispute channel alert indicating the possibility of receiving a chargeback. This way, merchants can identify transactions with an increased chance of a chargeback claim and use a 20-hour window to issue refunds.

Table of Contents

What’s a Pre-Chargeback Alert?

A pre-chargeback alert is a case notification sent to merchants to inform them about the possibility of receiving a chargeback. Warnings don’t necessarily mean the actual chargebacks are sure to happen but serve as an indicator of a chargeback that could follow.

How to Respond to PayPal Pre-Chargeback Alerts?

Responding to pre-chargeback alerts in the PayPal Resolution Center is a process managed by Solidgate. Let’s see how it works step by step:

Step 1 Receiving a Pre-Chargeback Alert

When a pre-chargeback alert is generated, it appears as a new case in the PayPal Resolution Center. PayPal will notify you about the case using the chosen notification channels.

Step 2 Accessing and Filtering Alerts

Solidgate views pre-chargeback alerts by applying the “Case type” filter in the Resolution Center. Each row containing a pre-chargeback alert is marked as High Priority.

Step 3 Issuing a Refund

Solidgate must provide a refund within the 20-hour window after receiving the notification. This action is necessary to prevent the chargeback from being filed and to avoid any associated chargeback fees.

Note: It is important to recognize that Solidgate performs these actions on behalf of its clients. Clients do not have direct access to the Resolution Center and rely on Solidgate to efficiently manage these pre-chargeback alerts to protect their interests.

Why Can I Receive a Pre-Chargeback Alert?

The customer can suspect a fraudulent PayPal payment due to billing confusion or be likely to commit friendly fraud themselves. Alternatively, the payment could be unauthorized or processed multiple times.

A chargeback can also be initiated when the item was wrong, turned out significantly not as described, shipped damaged, or never arrived. These are the main reasons buyers may want their money back on a purchase.

Is it Possible to Respond Outside the 20-Hour Window?

You’ll be able to respond after 20 hours as well. Outside this timeframe, you get the regular additional 10 days to provide a response but must face the risk of getting chargeback and the fees that apply in your case.

Can I Provide Evidence of the Successful Order?

If the order is successfully fulfilled, within or outside the 20-hour window, the alert allows you to provide evidence for PayPal to contest the chargeback when it arrives. Note that chargeback decisions can take around 75 days to process.

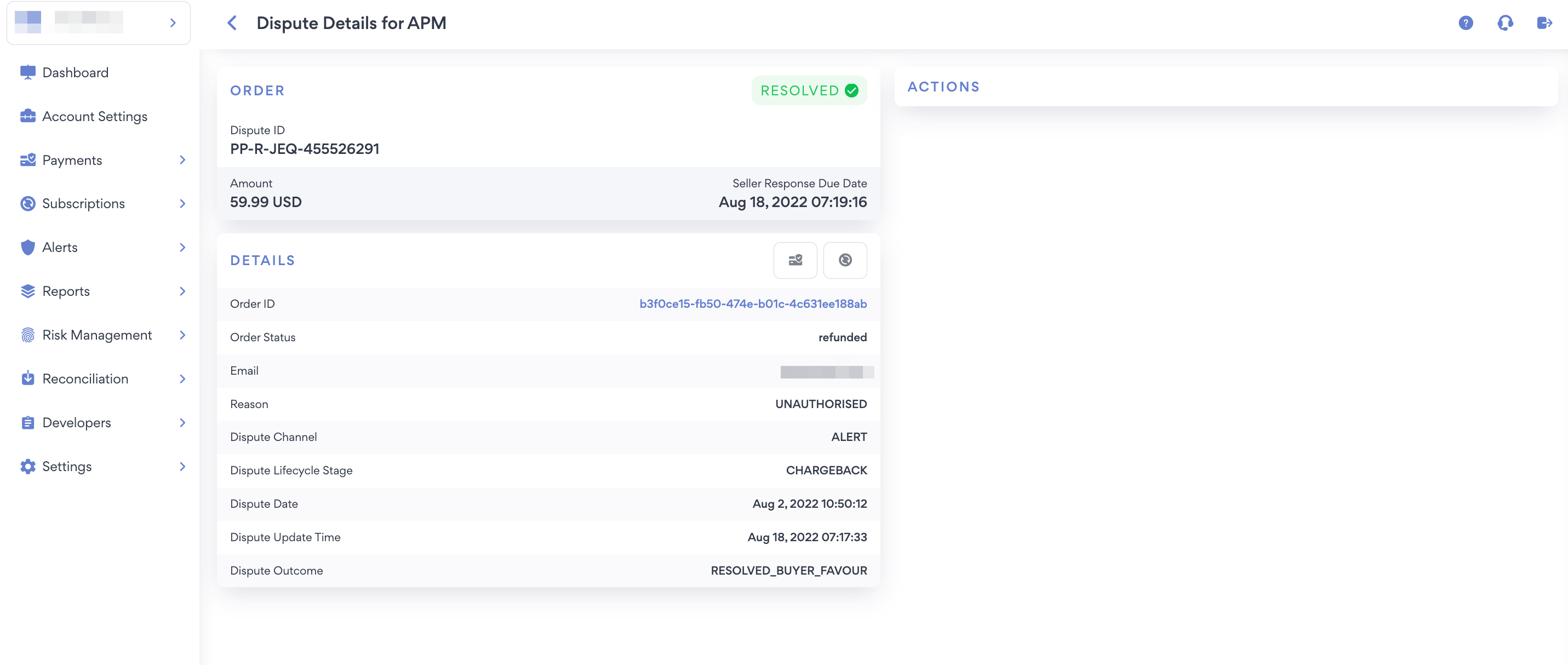

How to Indicate the PayPal Pre-Chargeback Alerts in Your Solidgate HUB?

Here’s how such an alert is displayed in your Solidgate account:

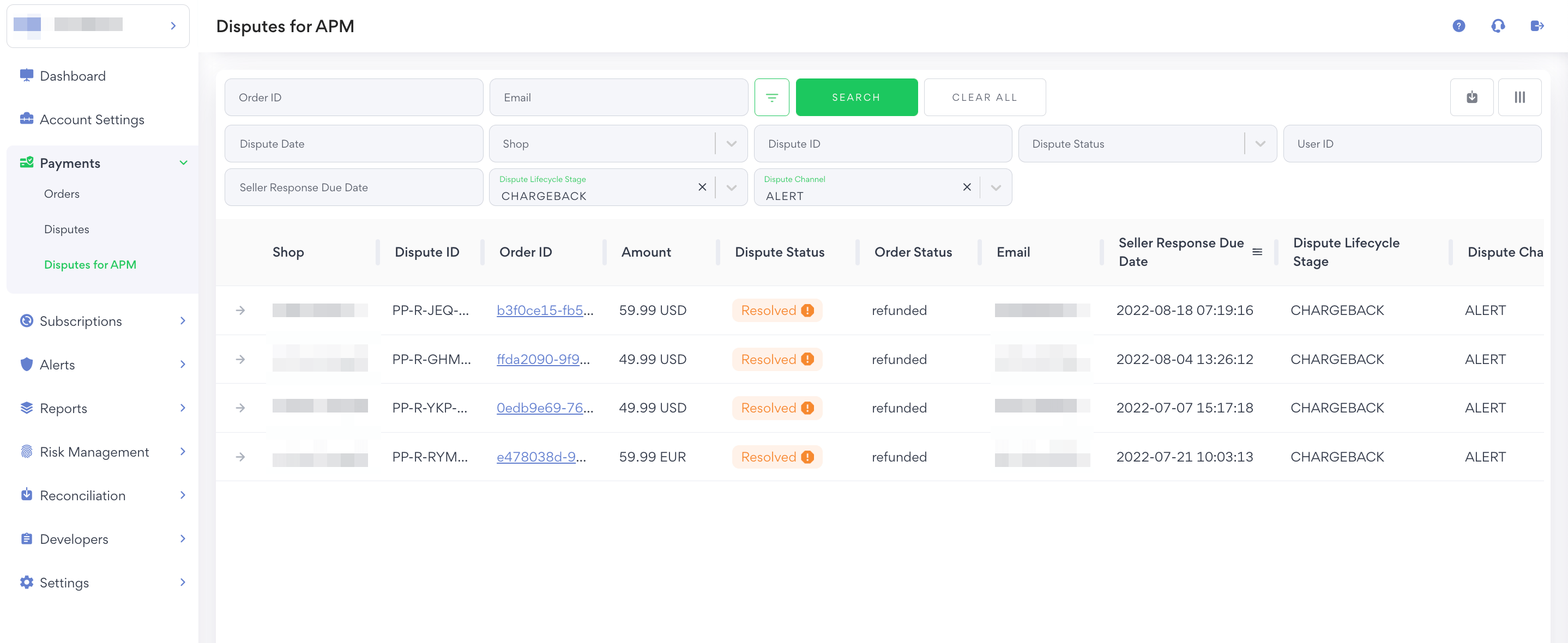

To find PayPal pre-chargeback alerts in the HUB, go to the sidebar menu and select Payments > Disputes for APMs. Then, use the filters listed below before clicking the Search button:

- Channel: ALERT

- Lifecycle stage: CHARGEBACK

Solidgate’s chargeback management service also allows you to:

- Get chargeback alerts from major card networks;

- Enhance transaction information to avoid customer confusion;

- Prevent chargeback abuse and criminal fraud by analyzing customer behavior;

- Customize risk thresholds based on purchase amount or volume to auto-resolve disputes and more.

How To Prevent Paypal Chargebacks?

PayPal chargebacks can seriously eat into a business’s profit margin and are a nightmare to deal with. Fortunately, you can significantly reduce your PayPal chargeback percentage by implementing these tips:

- Clear Product and Service Descriptions: Provide detailed and accurate descriptions of your products or services on your website or sales platform to set clear expectations of what your product is and does. Include high-quality images, specifications, and any relevant terms and conditions.

- Prompt Customer Communication: Establish open lines of communication with your customers. Respond to inquiries, concerns, and complaints promptly and professionally. Timely and effective communication can help address any issues before they escalate to a chargeback.

- Clear Refund and Return Policies: Clearly outline your refund and return policies on your website or sales platform. Ensure that they are easily accessible and written in plain language. This transparency can help manage customer expectations and reduce the likelihood of chargebacks resulting from misunderstandings about returns or refunds.

- Accurate Order Fulfillment and Shipment: Ensure accurate and timely order fulfillment and shipment. Provide tracking information to customers, so they can monitor the progress of their shipments.

- Secure Payment Processing: Implement strong security measures to protect customer payment information. Use secure payment gateways, SSL certificates, and other encryption methods to safeguard customer data during transactions. This helps prevent unauthorized access to sensitive information and reduces the risk of fraudulent chargebacks.

- Document Evidence of Transactions: Keep detailed records of all transactions, including order information, customer communications, shipping confirmations, and delivery receipts. This documentation serves as valuable evidence in case of a chargeback dispute.

- Use Delivery Confirmation and Signature Requirements: Consider using delivery confirmation or requiring a customer’s signature upon receipt. This provides an extra layer of proof that the order was successfully delivered to the customer, making it more difficult for them to dispute the transaction.

PayPal chargebacks can still occur despite preventive measures. In such cases, promptly respond to chargeback notifications, provide compelling evidence, and follow PayPal’s dispute resolution process to present your case effectively.

What Is Paypal Chargeback Fraud?

PayPal chargeback fraud refers to instances where a buyer initiates a chargeback through PayPal fraudulently, with the intention of unjustly obtaining a refund while keeping the product or service. Chargebacks can be a legitimate recourse for buyers to dispute unauthorized transactions or instances of fraud, but when used dishonestly, they can lead to financial losses for businesses. The main types of PayPal chargeback fraud are:

- Friendly Fraud: This type of fraud occurs when a buyer intentionally files a chargeback despite having received the product or service and not having a valid reason for a refund. Friendly fraud can happen due to buyer’s remorse, an attempt to avoid payment or an intentional abuse of the chargeback system. Signs of friendly fraud include customers placing frequent chargebacks, inconsistent or contradicting statements, and a lack of cooperation or communication from the buyer when you try to resolve the issue.

- Unauthorized Transaction Chargebacks: In this type of fraud, a buyer claims that the transaction was unauthorized, suggesting that their PayPal account was compromised or that their payment information was used without their consent. It’s crucial to verify the legitimacy of such claims by checking IP addresses, shipping addresses, and any other evidence that can support or dispute the buyer’s claim.

- Merchandise Not Received Chargebacks: This type of chargeback occurs when a buyer claims that they never received the purchased item despite it being delivered or shipped. To combat this fraud, maintain detailed shipping and delivery records, including tracking numbers and proof of delivery.

You can quickly identify PayPal chargeback fraudsters by implementing the following measures:

- Monitor Chargeback Patterns: Keep track of chargeback ratios and patterns to identify any unusual or suspicious activities. Frequent chargebacks from the same buyer, a sudden increase in chargeback rates, or chargebacks involving high-value transactions can be indicators of potential fraud.

- Review Customer Complaints: Pay attention to customer complaints, inquiries, and communications. Look for inconsistencies or red flags in their claims, behavior, or order history that may suggest fraudulent intent.

- Verify Transaction Details: Scrutinize transaction details, including shipping addresses, IP addresses, and any other available data points. Compare this information with the buyer’s claim to identify discrepancies.

Without proper chargeback management tools like pre-chargeback alerts, merchants have to face hidden costs associated with chargebacks. Aside from lost sale revenue, they come from time-consuming manual operations, wasted labor costs, lower authorization rates, and customer friction. So be sure to benefit from solutions like Solidgate and enjoy guaranteed ROI.