Solidgate AI Dispute Representment

Product

18 Nov 2024

3 min

Faster resolution, higher win rates, and lower costs—Solidgate AI dispute representment automates evidence, prioritizes cases, and protects merchant revenue.

According to , online fraud is growing twice as fast as transaction volumes, with global payment fraud set to hit $400 billion in the next decade. By 2026, losses from card-not-present fraud are expected to top $28.1 billion—a 40% spike from $20 billion in 2023.

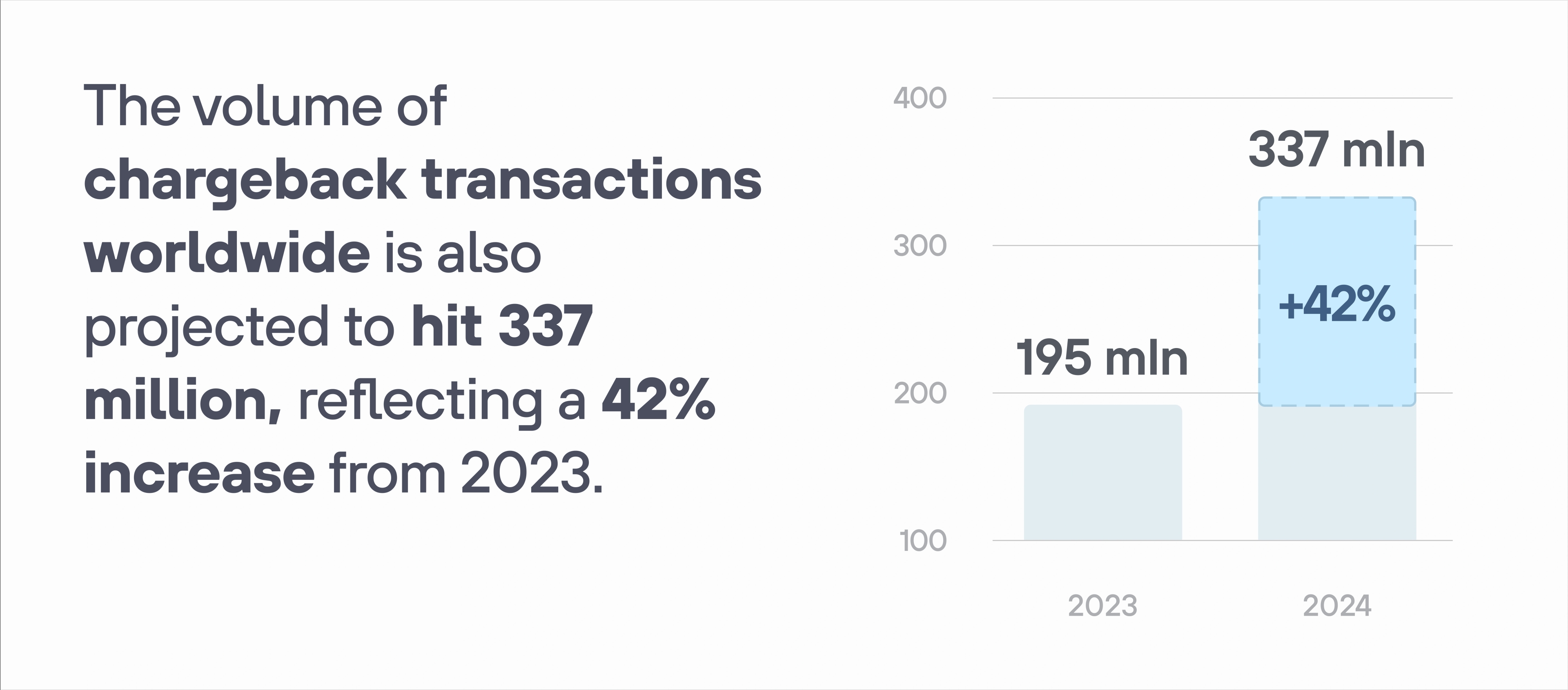

The number of chargeback transactions globally is expected to reach 337 million—a 42% jump from 2023.

On top of that, first-party (friendly) fraud is predicted to make up 75% of all fraud incidents faced by digital goods merchants.

Problems with manual dispute representment

While fraud is a serious challenge for merchants, it’s just one part of the bigger problem:

- Revenue loss and fees: Disputes lead to direct revenue loss from reversed payments and incur additional fees from banks and payment providers, cutting into profit margins and posing significant financial strain.

- Manual workload and limited automation: Handling disputes often requires time-intensive manual processes due to limited automation, pulling resources away from growth and increasing the chance of costly human errors.

- Complex guidelines and expertise requirements: Navigating the complex and varying dispute rules across payment networks requires deep domain knowledge, which is difficult to maintain and results in inconsistent win rates.

- Low win rates: Many merchants face discouragingly low win rates on disputes, making the process feel frustrating and expensive, leading to less investment in resolving them.

- Fragmented processes across banks and providers: Each bank or payment provider has its own set of dispute rules, creating a fragmented dispute management experience that complicates response standardization and increases workload.

As fraudulent transactions rise, the need for streamlined, effective dispute handling becomes crucial to protect merchants’ profits and ensure sustainable growth. Addressing this urgent need, Solidgate has introduced its Dispute Representment solution, designed to transform how digital businesses manage disputes.

Meet Solidgate AI dispute representment

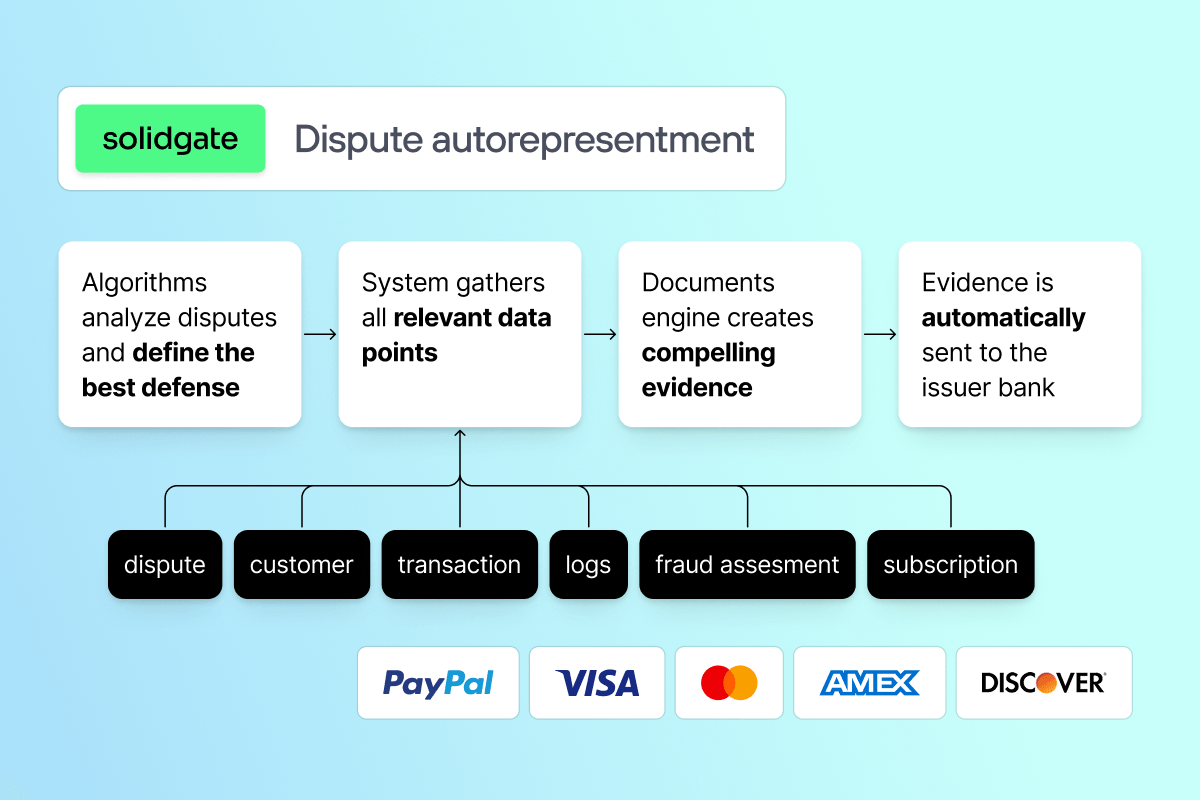

Solidgate is thrilled to announce the launch of its groundbreaking , a unified platform that redefines the dispute management experience for digital merchants. With an emphasis on simplicity, automation, and higher win rates, Solidgate’s new offering aims to alleviate the burdens of dispute handling, empower merchants, and secure revenue with unparalleled efficiency.

Key features of Dispute include:

- AI-powered dispute insights: Using the latest AI technology, we monitor and analyze your disputes, assess win probabilities, and provide strategic recommendations. This helps you focus on the most promising cases, maximizing revenue retention.

- AI-powered Compelling Evidence enrichment: Solidgate’s solution enhances each dispute with AI-optimized documents and content, ensuring strong to boost win rates and help merchants recover lost revenue.

- No-code solution: Solidgate’s Dispute Representment automatically works immediately upon onboarding—no complex integrations required. Access the full power of our solution through either the Solidgate Hub or Disputes API, tailored to fit your operational needs.

- Higher win rates, lower costs: We help you prioritize high-probability disputes, preventing resource drain on unwinnable cases. Save time and reduce costs with targeted, strategic dispute responses - with maximized win rates.

- Unified approach across all banks and PSPs: Solidgate Dispute Representment simplifies the process across all connectors within our engine. Solidgate data interface ensures consistent handling of disputes, eliminating the hassle of varying guidelines so you can focus on growing your business.

How do you start?

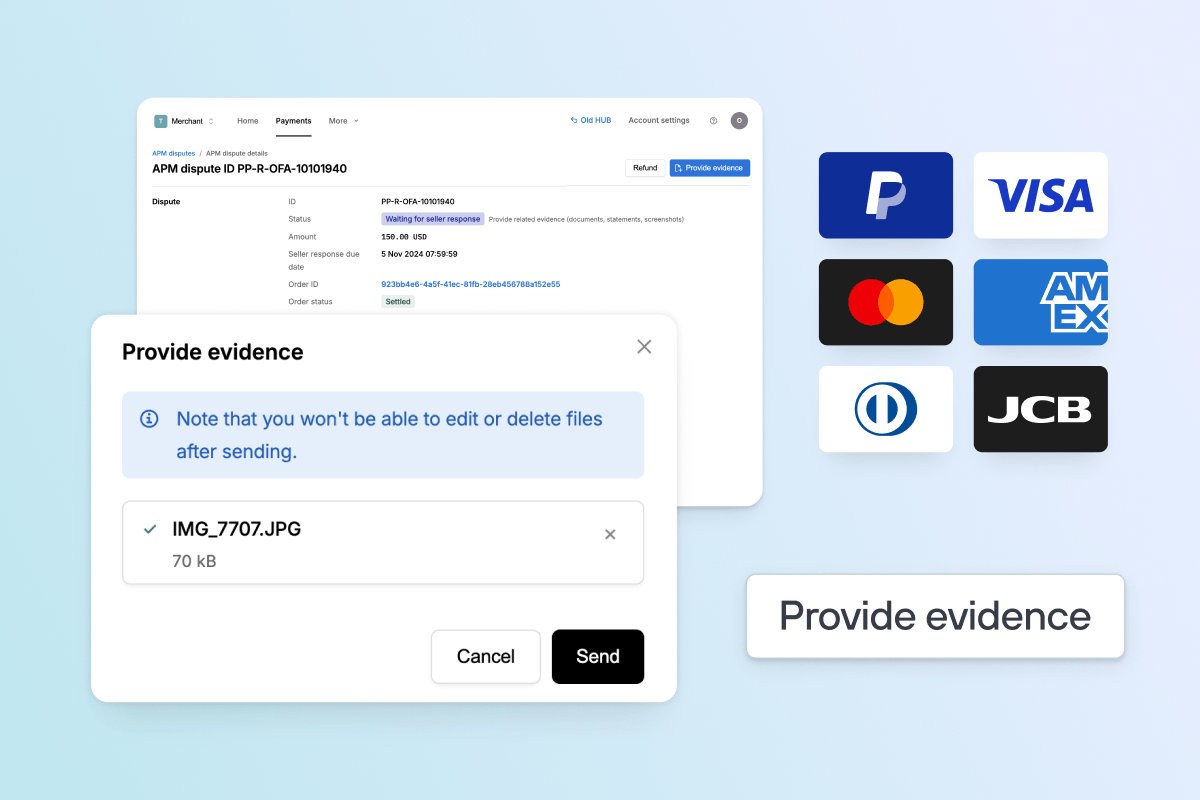

AI dispute representment functionality is available to all merchants processing with Solidgate directly through the or Disputes API. Just , go to the Payments section, and challenge all disputes by uploading compelling evidence directly from the dispute page. Once you upload the necessary files, we automatically submit them to the provider. This automated process is fast, easy, and secure—just the way dispute management should be.

Solidgate Dispute Representment is a game-changer for businesses seeking more effective dispute management and minimizing fraud losses. Fully integrated within your payment stack, it provides complete coverage across banks and payment providers for seamless operation. Designed to scale with growing online businesses, Solidgate Dispute Representment helps you protect revenue, cut costs, and simplify operations. We’ll handle the complexity so you can focus on what matters most—your growth.