Solidgate Tax compliance service: Simplifying global tax reporting

Product

25 Dec 2024

6 min

Automated tax, real-time updates, and flexible billing—that’s Solidgate Tax. Businesses save time, reduce compliance risks, and manage VAT and sales tax with ease.

For global businesses selling online, tax compliance is a necessary aspect of daily operations, and a great source of headaches. As your business expands, the complexity of managing tax compliance services increases exponentially.

The demands of navigating ever-changing tax laws and regulations, diverse jurisdictions, and the inefficiencies of outdated technology solutions can quickly overwhelm even the most organized finance teams.

In 2024 alone, over 50 VAT adjustments were made across European countries, and local sales tax rate changes in the US surged to a ten-year high. Without the right global tax compliance solution, meeting your tax obligations and navigating all these changes can turn into a resource-draining nightmare, potentially leading to unpaid taxes and penalties from tax authorities.

At Solidgate, we believe tax compliance shouldn't be an obstacle to your success. That's why we developed —a comprehensive tax compliance service designed to simplify every aspect of managing indirect and sales taxes for online merchants.

But before we dive into how our tax compliance solution works, let's break down the key challenges businesses face with managing VAT and sales tax compliance.

Challenges with tax compliance

The list of challenges with tax compliance includes:

- Variable rates and frequent regulation changes: Tax rates and regulations are in constant flux, and every jurisdiction has its own playbook. Without real-time updates, staying up-to-date and maintaining compliance becomes a full-time job, leaving businesses scrambling to avoid penalties and maintain compliance.

- 13,000+ tax jurisdictions: In the United States alone, there are over 13,000 tax jurisdictions spanning federal, state, and local levels—each with its own rates and rules. Keeping track of these differences becomes overwhelming as your business expands to new locations or handles cross-border transactions, making global tax compliance increasingly complex.

- Manual processes: Relying on manual tax calculations and reconciliation for each and every location eats into your time and budget while opening the door to errors. Many merchants find themselves sinking valuable time and effort into tax compliance instead of focusing on growth.

- Outdated provider solutions: Legacy tax providers often rely on outdated technology that's difficult to integrate with modern workflows. These systems require constant support and attention, creating inefficiencies and stretching internal resources thin, ultimately failing to deliver the tax compliance services digital businesses need.

- Annual commitments: Many tax compliance solutions demand long-term annual contracts, often with upfront payment requirements. These rigid commitments limit flexibility for fast-growing businesses that need to scale or adapt their operations dynamically.

How Solidgate Tax simplifies things

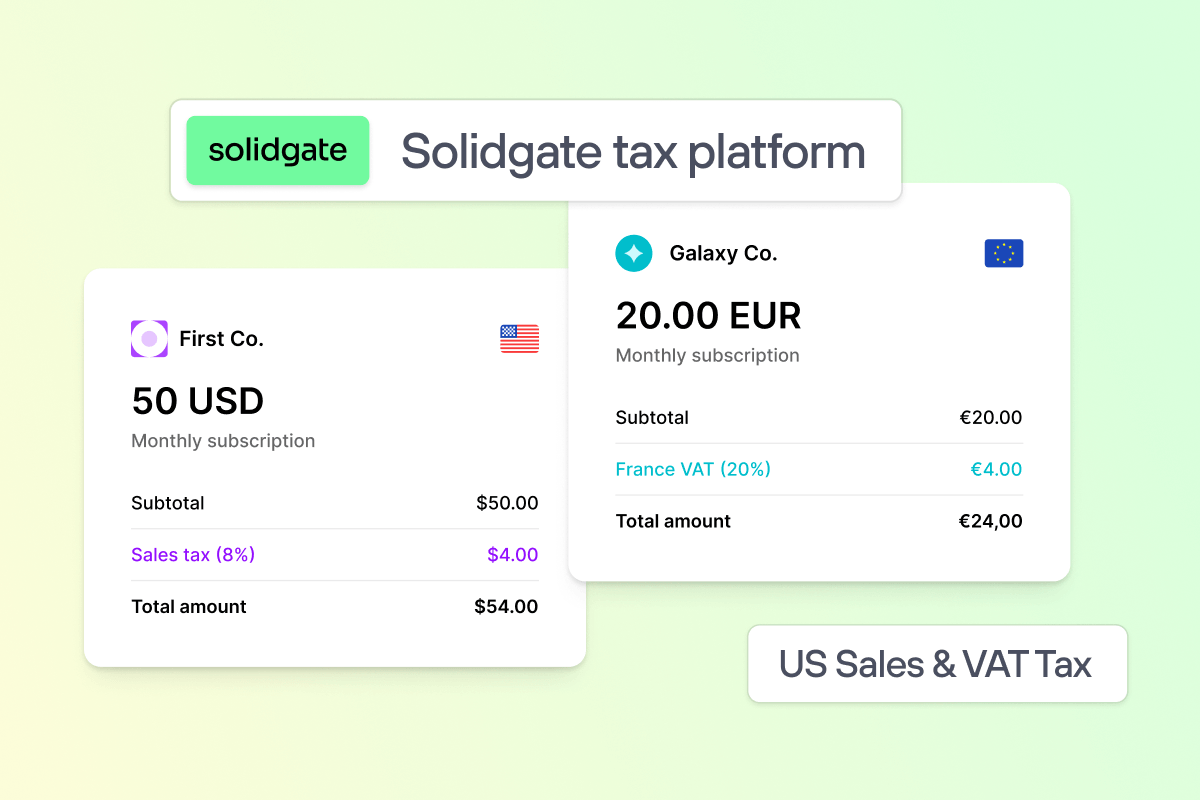

Solidgate Tax platform is purpose-built to address these challenges, offering an automated, efficient, and flexible tax compliance solution for digital businesses. Our global tax compliance technology helps merchants navigate complex tax and compliance requirements across multiple jurisdictions.

Automated tax calculation

Solidgate Tax integrates directly with your payment processors to deliver seamless, automated tax calculations across borders. By eliminating manual processes, our tax compliance solution reduces errors and ensures you meet your tax obligations with minimal effort. This automation is a particularly big win for businesses managing cross-border transactions where tax compliance becomes exponentially more complex.

Real-time regulatory updates

Our platform constantly monitors changes from tax authorities across jurisdictions, automatically updating tax rates and rules in real-time. This keeps your business compliant with tax laws and regulations without requiring frequent manual interventions or monitoring.

The system adapts quickly to new tax compliance requirements, ensuring your business never falls behind on regulatory changes that could impact your operations.

Easy no-code/low-code integration

Whether you're a startup or an established digital business, our tax compliance services offer an easy integration process with no-code or low-code options. This flexibility minimizes technical setup time, allowing you to implement global tax compliance quickly.

Unlike other tax compliance solutions that require extensive development resources, Solidgate Tax can be operational within days, not months.

User-friendly Solidgate Hub interface

Solidgate Tax is managed through the Hub—a centralized, intuitive admin panel where you can configure tax profiles, track compliance status, and access detailed tax returns reporting.

This user-friendly interface gives you full control and transparency without a steep learning curve. The dashboard provides comprehensive visibility into your tax and compliance status across all markets, helping identify potential issues before they become problems.

Usage-based billing, no annual commitments

Solidgate Tax operates on a usage-based billing model, so you only pay for the tax compliance services you use. You gain the flexibility to scale your operations at your own pace without being locked into annual agreements.

This approach makes our tax compliance solutions accessible to businesses of all sizes—from startups to enterprise organizations—with pricing that grows proportionally with your needs.

Comprehensive tax reporting

Our tax compliance solution provides accurate data for tax filing, easy reconciliation, and real-time tax data export—all to save you time, reduce stress, and minimize filing errors in your tax returns.

The reporting capabilities include detailed breakdowns by jurisdiction, tax type, and time period, giving your finance team everything they need for efficient global tax compliance management. These reports can be customized to align with your internal accounting systems, creating a seamless workflow for tax compliance processes.

Advanced API for custom tax compliance workflows

For businesses with specific requirements, our tax compliance API allows for custom implementations while maintaining the core benefits of automated calculations and regulatory updates.

This flexibility makes Solidgate Tax ideal for companies with unique business models or those operating in specialized industries with specific tax compliance challenges. The API supports the full spectrum of tax compliance services while allowing your development team to maintain control over the user experience.

Why simplified tax compliance matters

Simplifying tax compliance is about running your business better. By streamlining tax processes, you can cut costs, improve accuracy, and save valuable time that’s better spent scaling your business. Automation tools handle the complicated parts, reducing errors and keeping you compliant with tax laws without the need for constant manual effort. It’s a practical way to stay on top of your obligations without getting bogged down in the details.

Simplified tax compliance also benefits your customers by ensuring accurate tax rates and smooth transactions. When things just work, it builds trust and reliability—two things every business needs to succeed. The less time you spend worrying about taxes, the more time you can spend focusing on what really matters.

Why choose Solidgate Tax

One of the key advantages of Solidgate Tax is its seamless integration with a wide range of and through our . This ensures tax compliance is embedded directly within your payment workflows, offering a consistent and efficient experience across regions and eliminating the need for separate tax compliance solutions.

Solidgate Tax is designed specifically for digital businesses, SaaS companies, and startups, providing a scalable and efficient tax compliance service that adapts as you grow. It can act as an extension of your company's internal tax department, supporting you in managing your indirect and sales tax compliance responsibilities.

Our solution helps businesses:

- Stay compliant with complex and ever-changing global tax regulations

- Reduce the risk of penalties and interest from tax authorities

- Streamline tax calculation and reporting processes

- Improve accuracy in tax returns and financial reporting

- Free up valuable resources to focus on core business activities

Want to simplify your global tax compliance? with our experts and start automating your tax calculations. Our team will help you implement a customized solution that addresses your specific compliance needs.