Dispute

Dispute is a formal disagreement initiated by a cardholder or issuing bank to challenge the validity of a payment transaction. Disputes are a key part of consumer protection in the payment ecosystem. They allow to contest charges they believe are unauthorized, , or linked to a problem with the transaction.

Disputes may arise from various issues, including:

- Unauthorized transactions due to stolen card data

- Merchant fraud involving false or misleading information

- Processing errors like duplicate charges or incorrect amounts

- Goods not received after payment

- Services not delivered as described

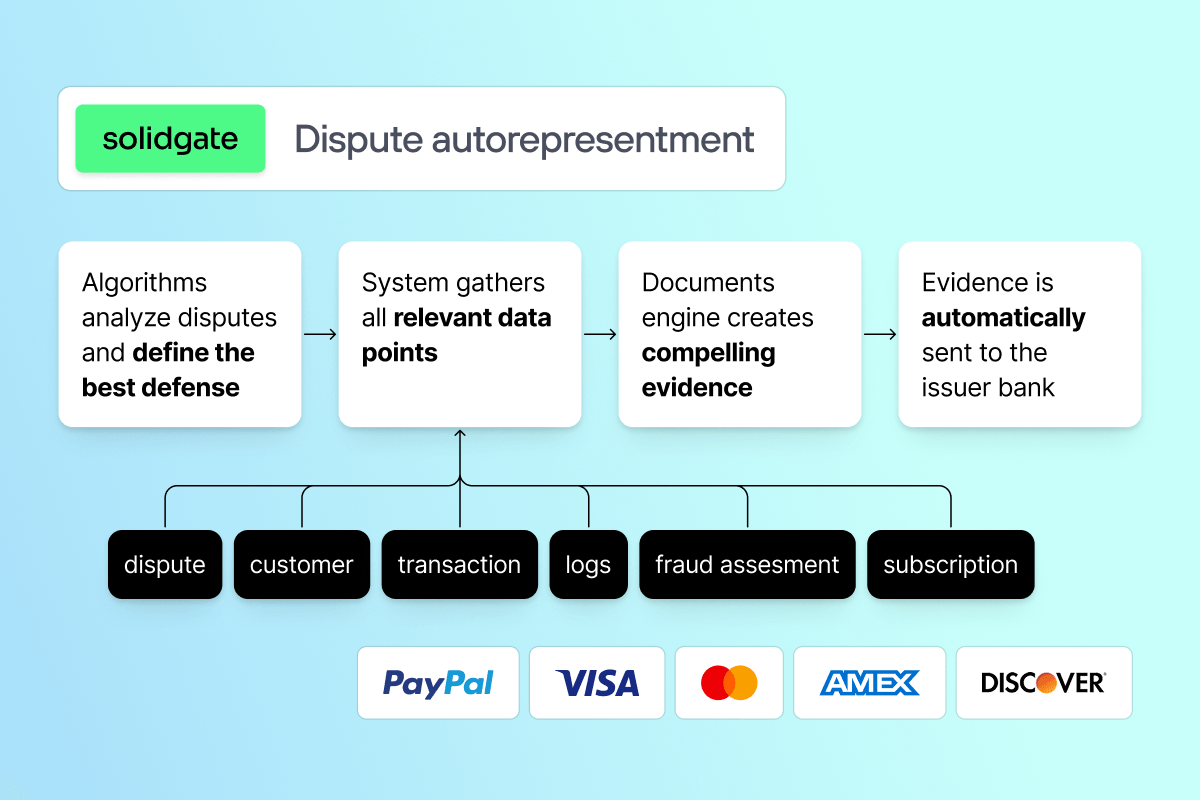

The process usually begins when the customer contacts their or card provider to question a charge. The bank may issue a provisional credit while investigating the claim, a process that typically takes 30–90 days. During this time, the merchant is notified and asked to submit supporting evidence, such as transaction logs, delivery records, and customer communication.

Dispute resolution relies on robust case management systems to review evidence and decide the outcome. like Visa and Mastercard define clear procedures, timelines, and reason codes that classify disputes by type. The process may end in one of the following ways:

- Chargeback

If the issuer finds in favor of the cardholder, the merchant loses the funds, and the provisional credit becomes permanent.

If the merchant provides strong evidence, the charge may be reinstated, and the dispute is closed in the merchant’s favor.- Arbitration

If neither side agrees, the card network may step in to make a final ruling, often involving additional fees. - Withdrawal or resolution

The cardholder may cancel the dispute if the issue is resolved directly with the merchant.

Disputes carry a significant operational and financial impact. Effective dispute handling helps reduce revenue loss, improve customer satisfaction, and ensure compliance with card network requirements.