3RI authentication: Why merchants are making the switch

Industry

20 Nov 2024

5 min

Secure payments, smoother transactions, and less friction—3RI automates recurring authentication, reduces fraud risk, and improves customer experience.

Today’s customers don't just want payments to be easy, secure, and fast—they expect it. Merchant-initiated authentication, or 3RI (3D Secure Request Initiated by the merchant), is a technology that helps businesses meet these demands, enabling security without sacrificing the customer experience. This article explores how 3RI works, what it does, and why it can be a smart addition for merchants seeking to elevate payment security and convenience.

What is 3RI?

At its core, 3RI, or merchant-initiated authentication, is part of the (3DS) framework—a standard designed to add security to online credit and debit card payments. But unlike traditional customer-initiated methods, 3RI allows merchants to initiate authentication on behalf of their customers. This means your customers don’t have to approve every single transaction manually—instead, for subscriptions, installment plans, or services billed later are authenticated in the background.

How does 3RI work?

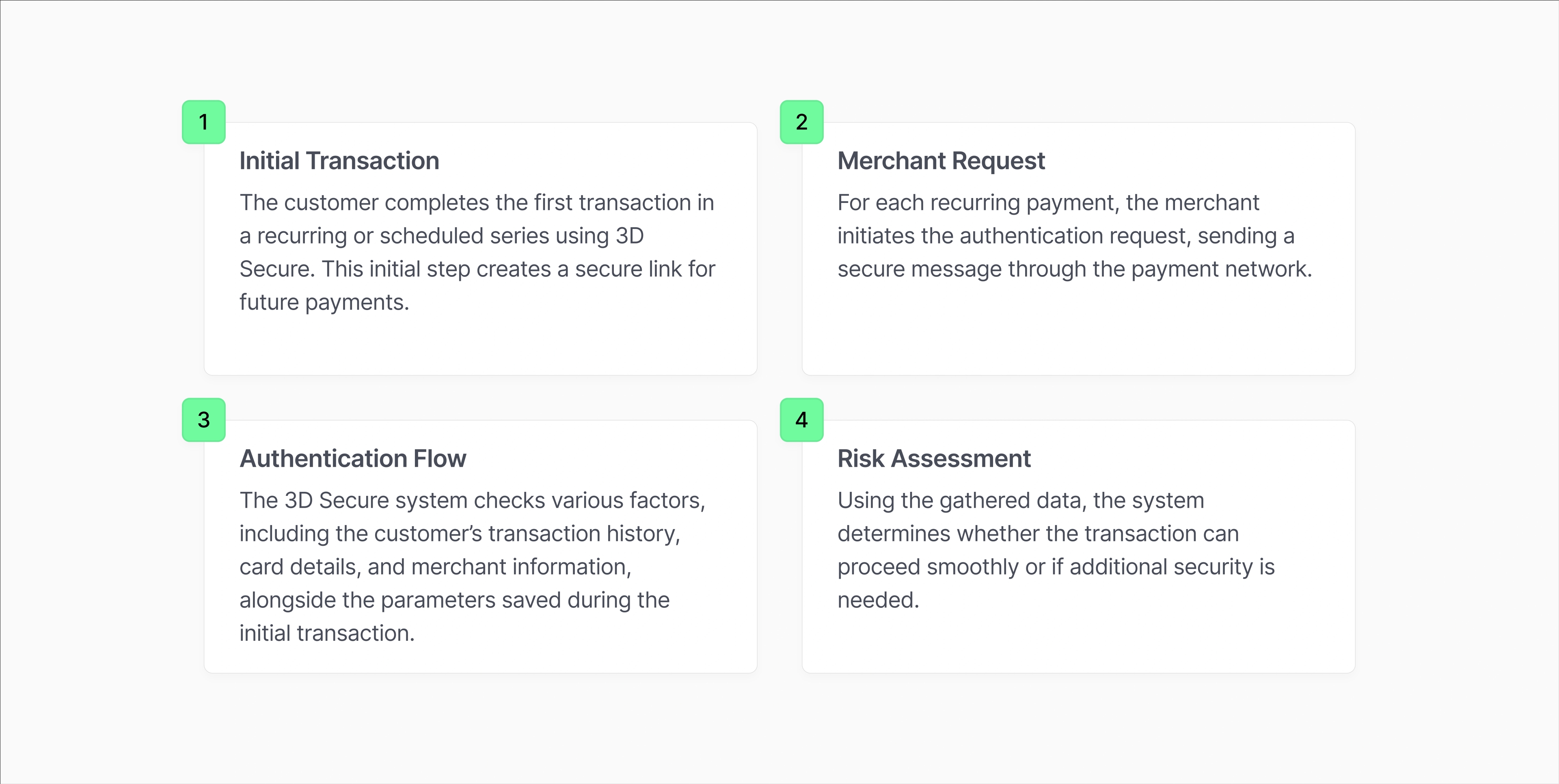

The 3RI process is simple:

- Initial transaction: The customer completes the first transaction in a recurring or scheduled series using 3D Secure. This initial step creates a secure link for future payments.

- Merchant request: For each recurring payment, the merchant initiates the authentication request, sending a secure message through the payment network.

- Authentication flow: The 3D Secure system checks various factors, including the customer’s transaction history, card details, and merchant information, alongside the parameters saved during the initial transaction.

- Risk assessment: Using the gathered data, the system determines whether the transaction can proceed smoothly or if additional security is needed.

Once authenticated, the payment is processed, ensuring the customer enjoys a secure and seamless experience.

With 3RI, each transaction in a series securely references the initial one, enhancing security while maintaining convenience.

Key advantages of 3RI for businesses

- Boosted security for CNP transactions

With the increase in online transactions, particularly for recurring and scheduled payments, 3RI offers additional protection. By evaluating each transaction, the 3D Secure system helps reduce the risk of fraud. - Streamlined customer experience

3RI allows merchants to handle authentication, eliminating the need for customer approval on each recurring charge. This helps avoid interruptions and makes the payment experience feel effortless. - Regulatory compliance

3RI aligns with standards like the EU’s (SCA) requirements under . Businesses can meet these regulatory demands while maintaining a streamlined payment experience. - Better revenue potential

With fewer hurdles in the payment flow, customers are less likely to abandon their purchases, which can lead to improved retention and revenue, especially for recurring services.

Business use cases for 3RI

Here’s where 3RI shines for businesses:

- Recurring subscriptions

Subscription services—like streaming, software, or utilities—can use 3RI to authenticate recurring payments automatically. This ensures uninterrupted billing cycles, improving retention and reducing disruptions. - Adjustments or refunds

If an item in return is missing or damaged, 3RI allows merchants to reauthorize charges without extra customer input. This flexibility helps resolve discrepancies quickly. - Split shipments

When an order has items shipped separately, 3RI enables a secure payment each time an item is ready. This way, customers don’t need to re-enter payment details, simplifying the experience for multi-part deliveries. - Installment payments

For models like Buy Now, Pay Later (), 3RI helps merchants authenticate each installment payment without involving the customer each time. This is particularly useful for high-value items and longer-term payment plans. - Multi-merchant transactions

When one agent handles orders across multiple merchants (like a travel agent booking flights and hotels), 3RI allows a single authentication, with each merchant processing separate authorizations, simplifying complex purchases. - Open-ended costs

For transactions where the final amount is unknown—such as a hotel stay—3RI enables initial authentication, with the final amount adjusted as needed.

3RI vs traditional methods

Nobody wants to jump through hoops every time they make a payment, especially for something like a subscription renewal. This is where 3RI really shines. It handles those recurring and merchant-initiated transactions quietly in the background, sparing your customers from the hassle of one-time passwords (OTPs) or biometric prompts every month. For businesses running subscription services or installment payment plans, this can be a game-changer. Imagine the churn you'd avoid by keeping the experience smooth and interruption-free.

That said, 3RI isn’t the universal answer for all transactions. For high-risk, one-off purchases—think big-ticket items or payments flagged by fraud detection—customer-initiated methods like OTPs or biometrics are still your best bet. These add an extra layer of security when it really counts.

The secret sauce for making it all work is knowing when to use what and blending 3RI with other methods based on the type of transaction.

Technical must-haves for setting up 3RI authentication

To get started with 3RI, you need to integrate it into your payment system via your or gateway. You must ensure that your system supports the 3D Secure protocol and can handle the secure messaging required for merchant-initiated transactions.

Most providers, like Solidgate, offer documentation and APIs to simplify this process. For example, if you’re running a subscription service, your system must send recurring transaction requests with consistent customer data, e.g., card details and transaction IDs, to enable seamless authentication.

Getting started with 3RI on Solidgate

Solidgate supports 3RI within our solutions, making it easy to implement secure, efficient recurring payments. Here’s how to get started:

- Consult with your Solidgate account manager: Solidgate offers 3RI within our 3D Secure solutions. Connect with your account manager to review our documentation and discuss the setup process, ensuring that 3RI aligns with your business needs.

- Configure recurring and scheduled payment parameters: Identify transactions suitable for 3RI, such as subscriptions or other recurring payments, and configure your system to handle these parameters effectively.

- Ensure compliance with data requirements: For smooth 3RI authentication, ensure accurate customer and transaction data are passed to the 3D Secure system. This step is vital for ensuring compliance and seamless processing.

Final thoughts

Managing recurring or scheduled payments securely can be a complex task, but 3RI can be one of the ways to simplify it. By removing the need for customers to repeatedly approve transactions, it streamlines payment processes while maintaining high levels of security, leading to a smoother customer experience and higher trust in your business.

For businesses looking to optimize their payment systems, integrating 3RI into a broader 3D Secure strategy can be an effective step. Platforms like offer the tools and support needed to implement this feature, helping businesses navigate the evolving digital payment landscape and better meet customer expectations.