Card account updater (CAU): How it works, and why businesses need it

Payments 101

26 Sept 2025

5 min

If your business model relies on full payment continuity, automating card account updates is key. Here's how a real-time card updater service helps reduce payment failures, cut churn, and enhance customer experience.

For SaaS and subscription-based businesses, a single missed payment means lost revenue and sets the stage for customer churn—something every CFO and payment manager fears.

With up to 15% of payment declines coming from outdated card details, such payment disruptions can quickly impact your bottom line as your transaction volume grows.

Card account updaters (CAU) solve this problem by ensuring that payment information is always up to date by automatically refreshing card details. This allows businesses to retry payments seamlessly, without requiring customers to take any action. As a result, the billing cycle remains intact, and revenue continues flowing.

In fact, 99% of Solidgate merchants use this service because it’s proven to minimize payment failures and improve customer retention.

In this article, we’ll walk through how real-time card updater service works, why they’re essential for subscription models, and how they help close revenue gaps, reduce churn, and drive customer retention.

What is a card account updater?

Card account updaters were introduced by major like Visa, Mastercard, Amex, and Discover to help merchants keep their payment information up to date.

Different card networks use varying methods to update payment information. For example, relies on a push/pull model, actively seeking out changes, while receives direct updates through participating acquirers

Before, CAUs relied on batch updates, where account data was refreshed at scheduled intervals. While effective, batch methods often created delays, leaving businesses with outdated information for extended periods.

Real-time card account updater represents the next step, allowing businesses to retrieve updated payment data as soon as it changes. This means no more waiting for scheduled updates—businesses can instantly access current card details to process payments, reducing the risk of .

This new iteration of the account updater automatically updates payment data whenever a customer’s card details change—making it faster and more reliable compared to traditional methods.

Here’s how it works:

- The system automatically retrieves updated account details from payment networks like Visa or Mastercard in real time whenever a transaction fails

- Once fresh information is found, the payment is automatically retried, often without the customer even noticing it.

- By automating updates, businesses ensure customers don’t have to manually update their payment details. This creates a smooth and hassle-free transaction process, making the experience more convenient for everyone.

Additionally, when paired with or businesses benefit from updated Digital Primary Account Numbers (DPANs). These tokens are refreshed when card details change, allowing businesses to continue processing payments with secure, up-to-date data.

How businesses benefit from a real-time card account updater service

Card account updaters are a valuable revenue recovery tool for any online business, but especially for models depending on recurring payments. Businesses using this service see the following benefits:

Reduced churn

Payment failures are a leading cause of subscription cancellations. With a real-time updater, your payments are processed without delays. As a result, customers don't leave due to payment issues, which boosts customer retention and lifetime value (LTV).

Revenue recovery

Our shows that up to 70% of subscription-based businesses lose revenue due to payment issues. Real-time updates help businesses tackle one of these issues by ensuring the most current payment details are always available.

Enhanced user experience

No more "update your card" emails. Real-time updates eliminate the need for customers to manually update their payment information. This reduces payment interruptions and improves customer satisfaction, which is key to customer retention.

Lower operational costs

Automating payment updates reduces the need for manual intervention, leading to lower operational costs. With fewer chargebacks, less customer support intervention, and fewer manual retries, businesses can focus more resources on growing their operations.

Improved data security

Storing and manually updating card details increases the risk of data breaches. Real-time card account updaters securely manage sensitive data, ensuring compliance with . These systems also identify suspicious activity in real-time, minimizing fraud and reducing the risks associated with outdated card information.

Better scalability

As your transactional volume and customer data grow, scalable payment optimization becomes critical. Real-time card account updaters scale with your business, handling increased transaction volumes without requiring additional manual effort. This means your businesses can maintain smooth payment processing as you expand.

In practice, Solidgate merchants have reported up to a 4% increase in annual subscription revenue. For example, a SaaS company that experienced recurring payment failures due to expired cards integrated a real-time updater, resulting in a 30% reduction in failed payments and a noticeable boost in revenue and customer satisfaction.

The challenges of integrating a card account updater service

Integrating a real-time card account updater directly with card networks isn’t simple. Each payment network has its own requirements, and connecting with multiple networks means your team will need the right expertise. This can take months of setup and testing to get everything working correctly.

Building the infrastructure for real-time updates can also be time-consuming, often taking between 6 and 12 months, depending on your current setup and available team resources. It’s a major project that can pull engineering focus away from other priorities.

Once integrated, the system requires constant maintenance. You’ll need to manage regular updates, security patches, and network changes. These tasks can consume 20-30% of your engineering team’s bandwidth, just to keep everything running smoothly.

Handling sensitive payment data without the right safeguards exposes you to data breaches and compliance failures, which can lead to significant fines and reputational damage. Staying compliant with regulations often means bringing in outside experts or consultants, adding additional costs to the process.

For most businesses, it’s more practical to partner with a payment provider to handle these complexities and avoid the risks involved.

How Solidgate helps businesses optimize billing and payment performance

Real-time card account updaters are just one part of the shift. Businesses will increasingly rely on AI and machine learning to predict payment success, enhance customer experiences, and reduce dependence on manual retry strategies.

As tokenization and end-to-end become the norm, businesses will need unified platforms that streamline payment routing, retries, and subscription management—all while securing sensitive data and reducing friction for customers.

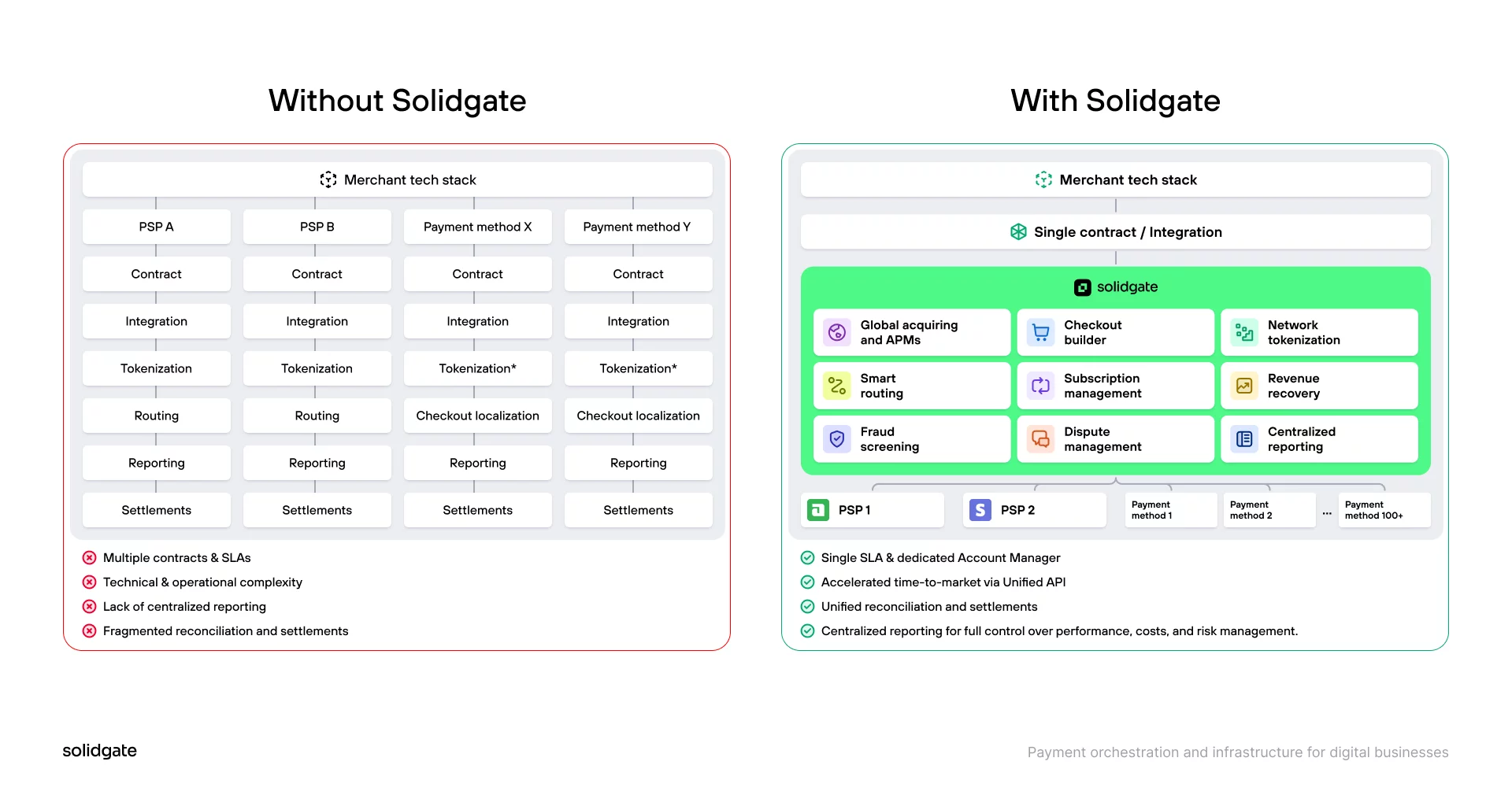

Solidgate offers a unified designed to help growing digital businesses optimize payment performance.

Through a single integration with Solidgate, you can:

✓ Expand rapidly by easily integrating with multiple PSPs and local/alternative methods, streamlining your entry into new markets.

✓ Ensure payment continuity with agnostic network tokenization and real-time card account updater services, so your business keeps running smoothly even when customers update their card details or you change PSPs.

✓ Increase payment success with and logic that automatically adjusts payment paths and retry strategies based on responses, customer payment cycles, and past retry success.

✓ Streamline by automating billing cycles, minimizing involuntary churn, and enhancing customer retention through automated retry strategies and payment optimizations.

Frequently asked questions

A card account updater (CAU) is a tool that automatically updates your customers' credit card information when things change—like an expiration date or if their card gets reissued. It instantly pulls updated card details whenever something changes, like when a card expires or gets replaced. Unlike older methods, this one doesn’t make you wait for updates to be processed in batches.

Yes, it can! A card updater service works with multiple payment processors, so whether your customers are paying with Visa, Mastercard, Amex, or Discover, it keeps their payment details up to date across the board.

Definitely. Card account updaters follow the strictest PCI-DSS standards to keep your customers’ payment data safe. Since everything happens in real-time, it both ensures payments go through and helps minimize the risk of fraud.