Web Apple Pay won’t be stuck in the Safari bubble anymore—and Solidgate merchants are among the first to take advantage of this!

Beginning September 16, 2024, with the launch of iOS 18, iPhone users can finally use Apple Pay in any desktop web browser—Chrome, Edge, Firefox, you name it—even on Windows PCs. Until now, Apple Pay was limited to Safari on Macs, so this long-awaited update brings the cross-platform payment experience users have been asking for. Here’s why this update is such a big deal:

- Apple Pay handles roughly $6 trillion in payments annually, accounting for 5% of all global card transactions.

- Apple devices make up about 48% of the mobile devices in our merchant portfolio.

- Globally, only 18% of users choose Safari as their go-to desktop browser, and most iPhone users still prefer shopping on Chrome.

That’s why we at Solidgate are thrilled to have rolled out this feature for our merchants within only 24 hours from its release by Apple! This feature is already available on our Payment Page and needs only a small tweak for Payment Form integrations.

Table of Contents

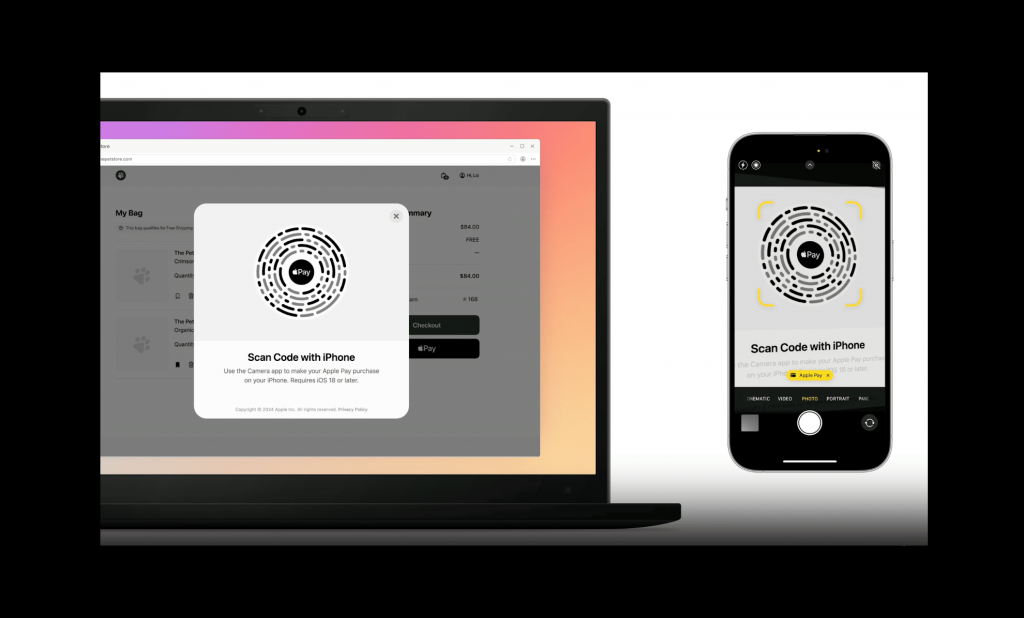

Here’s what the new checkout flow looks like

When a customer selects Apple Pay on a non-Safari desktop browser, a QR code will appear on the screen. To complete the payment, the user scans the code with their iPhone (running iOS 18 or later) using the Camera app.

(Source: developer.apple.com)

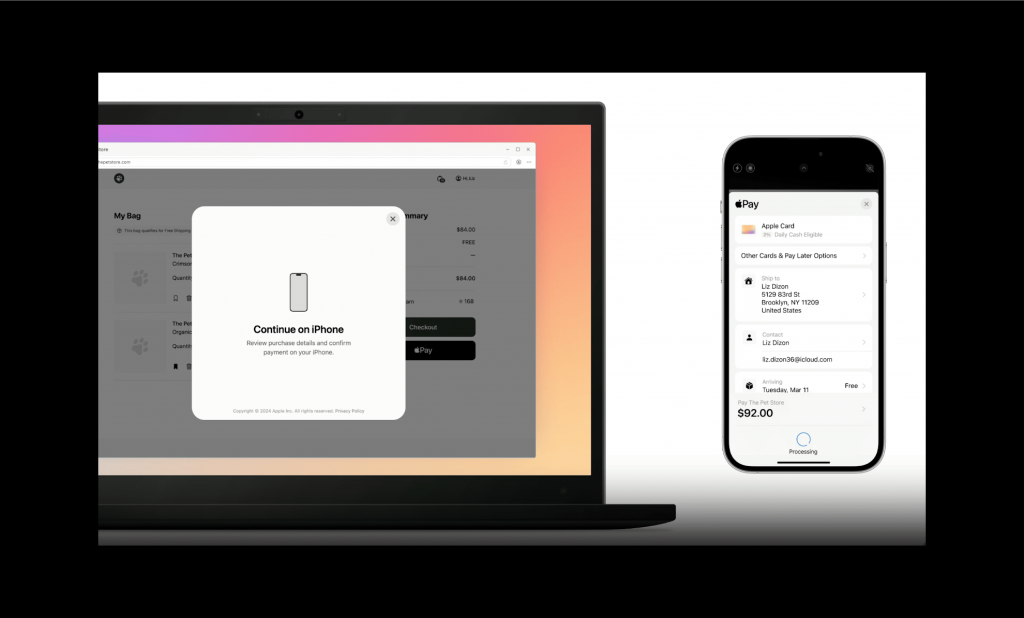

Once scanned, the user follows the familiar Apple Pay steps to finish the transaction. The whole transaction flow takes about 30 seconds to complete.

(Source: developer.apple.com)

This workaround exists because many browsers don’t—and likely won’t—natively support Apple Pay. While it adds a couple of extra steps compared to the traditional Apple Pay experience (grabbing your iPhone, opening the camera, scanning the QR code), the predominantly positive reaction from Apple users on the Internet suggests this won’t be that big of a deal for them. You can test this functionality in any environment by visiting the Apple Pay Demo page.

How to enable Apple Pay in non-Safari browsers with Solidgate

If you’re processing with Solidgate, here’s how you can enable Apple Pay in non-Safari browsers:

1. Add a new integrationType parameter for the applePayButtonParams object. By default, the integrationType is set to css, representing the previous, well-tested, and stable integration method.

2. Update the integrationType by setting it to js.

3. Check your website appearance after the changes. The new integration type uses the WebComponents approach, which could result in visual differences between old and new versions, depending on your website styling.

For more details on how to enable and customize your Apple Pay button with Solidgate, check our documentation.

Why Apple Pay everywhere = more paydays for online merchants

In our Apple Pay vs. PayPal post, we argue that if a significant portion of your customer base uses Apple devices, offering Apple Pay is a must, as it’s their go-to payment method. The same goes for web payments, bringing the following benefits:

First off, the checkout is much faster. Our data shows that, on average, Apple Pay’s median checkout time is around 22 seconds, compared to about 68 seconds for card payments— nearly three times faster! While the new web checkout flow will add some extra time to the original flow, Apple Pay still wins on speed. As a result, the user gets a much better experience.

Secondly, it decreases cart abandonment. With Apple Pay now rolling on all browsers, Apple users can pay with their preferred payment method without having to open Safari, reducing the number of hoops they need to jump through.

Next, it reaches a bigger audience. Apple Pay is now tapping into a much larger crowd of iPhone users than before. Whether your customers are loyal Chrome users or hang out on Windows, you’re giving them the payment option they love—no matter what browser they’re on.

Finally, less fraud and fewer chargebacks. With Apple Pay’s built-in security features like tokenization and Face ID, you’re not just making payments faster—you’re making them a bit safer, too. Fewer chargebacks, less fraud, and a liability shift are wins for both your peace of mind and profit margins.