Over the past few years, the global payments industry has experienced a remarkable change. Cashless payments have been a convenient substitute for billions of people worldwide. The new normal is to make payments through mobile wallets, P2P mobile payments, real-time payments, and cryptocurrencies.

The disruption of the traditional payment ecosystem has been fast and impetuous. According to the EY, the global payments market is estimated at $240 tln, with payment technologies’ value of $2.17 tln.

As the digital economy grows and customers’ demand for seamless payments increases, market players, including PSPs, provide consumers and merchants with integrated solutions to meet this demand.

Let’s consider the most common questions about payment service providers (or PSPs) to gain a holistic view of their importance for business.

Table of Contents

Q1: What is a PSP?

A payment service provider (or PSP) is a third-party organization that helps businesses accept all types of online payments, including online banking, credit cards, debit cards, e-wallets, cash cards, and more. In other words, PSP ensures online transactions make it from point A to point B efficiently and securely.

PSP brings together merchants, banks, and card networks to manage the entire transaction process to reduce transaction fees and fine-tune payments.

By combining payment volumes of multiple merchants under the same umbrella, PSPs negotiate extremely low processing rates with supporting banks. Then, they provide payment services to the merchants with flat-rate fees and low or no monthly costs. It benefits all parties since the merchant’s processing costs remain low even with the PSP’s fees.

Q2: How does a Payment Service Provider Work?

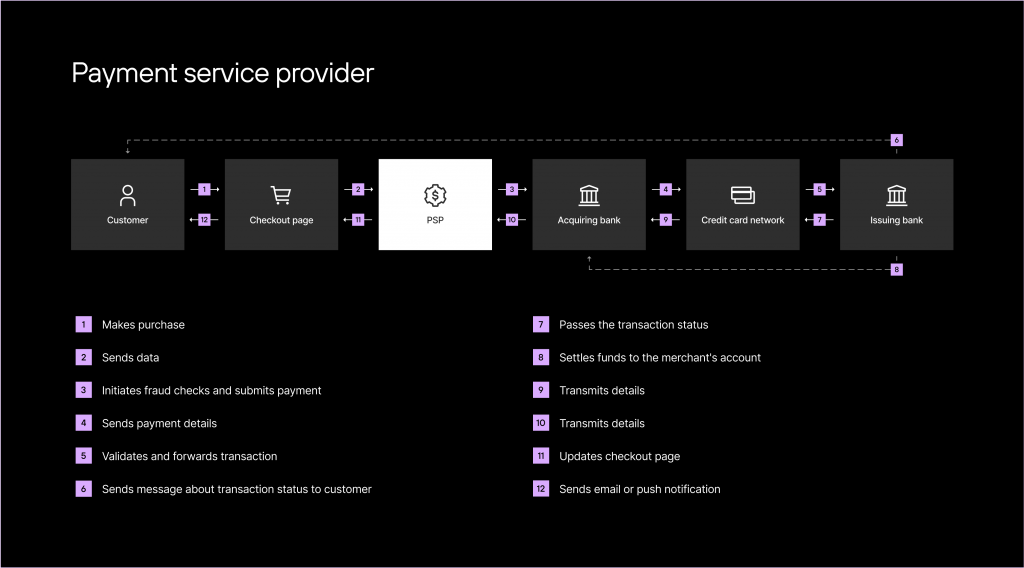

To understand what PSP does, it is essential to know a way of online payment – from the moment it’s initiated to the moment a merchant sees the funds in its account:

- Customers enter their card details on a checkout page and click Pay;

- The transaction details send to PSP. PSP verifies the customer’s card details and initiates fraud checks;

- After this, PSP sends the transaction information to an acquiring bank (merchant’s bank).

- The acquirer sends payment details to the relevant credit card network (e.g., Visa, Mastercard, AMEX, Discover, etc.).

- The credit card network validates the transaction and forwards all details to an issuing bank (customer’s bank).

- First, the issuer can request 3DS verification from the payer. After successful payment confirmation, the issuing bank checks the availability of funds to approve the transaction.

- Then the issuer passes the decision to the credit card network with the transaction status/error details, and the credit card network notifies the acquiring bank.

- At the same time, the appropriate funds are transferred from the issuer to the acquirer, and the first one sends a message about the transaction status to the customer.

- The acquiring bank sends the following data to the PSP.

- The PSP shares the outcome with the merchant and updates the checkout page with the transaction status.

- The merchant sends an email or push notification to the customer with the final status of the transaction.

Q3: What are the Types of PSP?

There are two types of PSP:

- Collecting PSP

A collecting PSP collects all the online sales revenue from the different payment methods the merchant accepts. Then it’s sent via an acquiring bank as one payment settlement to the merchant. Using this model, a merchant only has to deal with one provider.

- Switching PSP

A switching PSP takes on the only technical part of the process. It means a merchant needs a contract with an acquiring bank, which will pay out the funds from online transactions. It makes the process far more complicated for a merchant as it deals with multiple providers.

Q4: What are the Differences between PSPs and Payment Gateways?

A payment service provider is a financial institution that facilitates online transactions. It connects merchants to card networks and payment processors for payment processing. PSPs provide merchant accounts and payment gateways for collecting and managing payments.

On the other hand, a payment gateway is software behind credit card payments between a merchant and its customers. After the transaction details are entered on a merchant’s website, the payment gateway connects to the PSP for processing the transaction. In essence, in PSP finance, payment gateways are only part one part of the entire process.

Businesses with high sales primarily use payment gateways, and SMBs tend to turn to full-fledged PSPs to simplify their payment needs.

Q5: How Can a PSP Help Merchants?

A PSP covers a significant part of a merchant’s payment processing needs. It can offer many services for securely accepting, processing, and managing payments. Here are some of them:

Secure and Compliant Payments

PSPs must be PCI DSS compliant (Payment Card Industry Data Security Standard). It includes various security measures that help keep customer data safe and secure.

Support for Multiple Payment Methods

Only one integration with PSP allows a merchant to accept a wide range of payment methods – credit cards, debit cards, digital wallets, local payment methods, online banking, etc. A merchant improves customer experience by providing an opportunity to pay with Apple Pay, Google Pay, Click to Pay, PayPal, SWIFT, SEPA, and other alternative payment methods.

Ability to Accept Multiple Currencies

With a PSP, merchants can accept international transactions in multiple currencies to allow fast and secure payments from customers worldwide. This is important if a merchant is planning to break into the global market.

Increase Transaction Approval Rates with Payment Orchestration

With one PSP’s integration, merchants can set up payment routing rules (also known as payment orchestration) to send transactions to the best-performing processor. It helps to decrease failed payments due to technical issues/downtimes and increase transaction approval and conversion rates.

Transaction Reporting

Usually, PSP provides two kinds of reports: real-time and weekly/monthly. This makes it much easier to track transactions and understand trends.

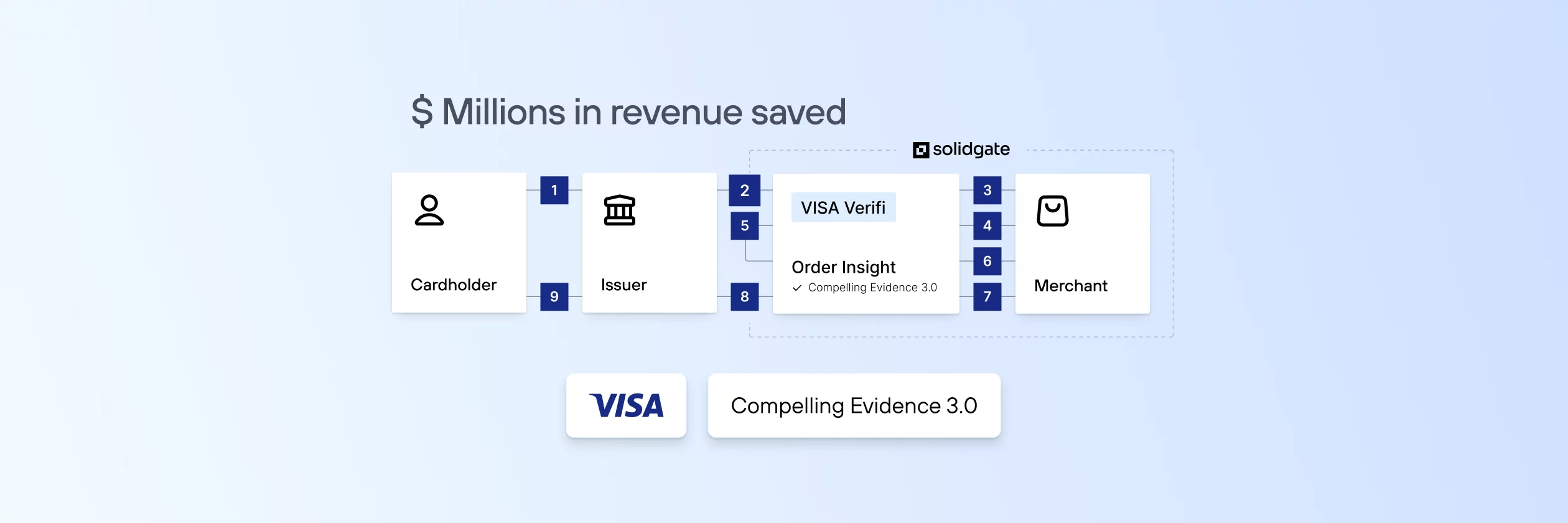

Credit Risks

PSP often takes on credit risks for fraud activities and chargebacks for its clients. Provider checks a customer’s card information and transaction details for signs of suspicious activity. After the verification, PSP approves or rejects transaction requests and informs a customer and merchant of its decision.

Opening Accounts with Acquiring Banks

PSP can help a merchant set up a business account with an acquiring bank by applying on their behalf and speeding up the application process. PSP can also have preexisting accounts with acquiring banks. Once integrated with a PSP, a merchant can get subaccounts under these preexisting accounts. It makes setting up merchant accounts much easier, as they are already approved and functioning.

Q6: How to Choose the Best PSP for Your Business?

There are many factors to consider when choosing PSPs:

Fees and Commercial Terms

Fees and collaborative contracts are an essential part of the selection process. The typical PSP’s cost model consists of variable and fixed fees. Fixes costs are a one-time setup fee and a predetermined monthly fee. Variable costs are transaction fees. It depends on the number of transactions and the expected sales revenue. Usually, it is 1.5-3% of a merchant’s sales but can peak at 9%.

For small transaction volumes, some PSPs charge a specific flat fee for each transaction. This might work well for businesses with low-value transactions. However, if a merchant deals primarily in high-value transactions, it should look for PSPs with a set monthly fee and a low transaction fee. Other PSP’s paid services include сhargebacks, dispute management, currency conversion, early termination of contract charges, and minimum/maximum transaction thresholds.

Popularity of Payment Service Providers

A merchant is better to ensure that chosen PSP is available to all stakeholders who want access to the system. Ideally, a PSP should specialize in the merchant’s business market or target markets and be able to provide insights regarding the payment process, common payment methods, and customer needs within the given market. It is worth requesting statistics from a PSP on statistics on metrics such as approval ratios by country and merchant category code (MCC).

Onboarding Process

It’s important to understand all details of the onboarding process. This includes the timelines (how long it will be before the merchant can start accepting payments after onboarding), the required documentation, the required settings and accesses on the client’s part, and the providing level of support from PSP during the process.

Level of Security

Merchants should request details about PSP’s policies and accreditation related to payment services security regulations. PSP must meet worldwide data security standards like Payment Card Industry Data Security Standard (PCI DSS). It helps ensure customer credit card data is protected from theft or fraud and saves merchants a lot of time attempting to obtain this certification.

Conversion-Optimized Checkout

Customizing the merchant’s checkout process affects the flow and user experience. Most PSPs provide this opportunity for their clients. Merchant’s logo, branding, mobile optimization, and website URL improve customer experiences during the payment flow. The more flexibility and customization available, the more aligned the journey can be with business and customer needs.

Integration with Other Systems

When choosing a provider, it is vital to consider the possibility of connecting PSP with the merchant’s invoicing or accounting software. This function saves a lot of time and effort because the merchant doesn’t need to manually update the payment information in its accounting system as it comes in.

Level of Support

The best PSPs offer extensive support to resolve any issues that may arise. A merchant should consider this aspect in its full-service contract with PSPs. It is crucial to get a clear picture of the support available with different providers: a ticketing system, a live chat, account managers, the average response times and SLAs, etc.

Holding Time

A merchant should determine how quickly it will receive funds from sales to its account. Even though payments are usually approved almost immediately, some PSPs hold onto funds for handling refunds and chargebacks. Depending on the provider, these holding periods can vary from a month to 1-3 days. Waiting for long periods for payment settlement can be problematic for some businesses, so a merchant should consider choosing a provider.

Examples Of Payment Service Providers

Payment Service Providers (PSPs) are companies that offer a range of services to businesses, enabling them to accept and process payments from customers. Here are some prominent PSPs:

Adyen:

- Adyen is a global payment company based in the Netherlands.

- It provides payment solutions for businesses across various industries and supports multiple payment methods.

- Adyen processed €421.7 billion ($453 billion) in payment volume in 2022, representing a 41% increase compared to the previous year.

- Its client base includes well-known brands like Uber, Spotify, and Microsoft.

Braintree:

- Braintree is a subsidiary of PayPal and offers a robust payment platform for e-commerce businesses.

- It provides services like payment processing, mobile wallet integration, and fraud detection.

- Braintree supports multiple payment methods, including credit/debit cards, digital wallets (such as Apple Pay and Google Pay), and Venmo.

- It processes billions of dollars in transactions annually, with a strong presence in the global e-commerce market.

PayPal:

- PayPal is one of the world’s leading digital payment platforms, allowing individuals and businesses to make online transactions securely.

- It supports various payment methods and operates in over 200 markets worldwide.

- In Q1 2023, PayPal reported 392 million active customer accounts globally.

- In 2022, PayPal processed over $1.35 trillion in global payments, indicating a substantial growth in digital transactions.

Stripe:

- Stripe is a popular online payment processing platform known for its developer-friendly tools and APIs.

- It enables businesses to accept online payments, set up recurring billing, and manage subscriptions.

- Stripe has a strong presence in the technology and e-commerce sectors and serves a wide range of businesses, from startups to enterprise-level companies.

- As of 2023, 105504 companies across the world use Stripe to process payments

Square:

- Square is a financial services and mobile payment company that offers various solutions for businesses of all sizes.

- It provides payment processing services, hardware devices (like card readers and POS systems), and financial tools such as loans and analytics.

- Square processed $33.1 billion in gross payment volume in Q1 2023, reflecting a significant increase compared to previous quarters.

- The company has expanded its offerings beyond payments, including services like Square Capital for small business loans and Cash App for peer-to-peer payments.

Differences Between PSPs And Merchant Account

A merchant account is a type of bank account that enables businesses to accept and process payments from customers via credit or debit cards. It is specifically designed for merchants and allows them to receive funds from customer transactions, which are then deposited into the merchant’s bank account.

A merchant account is typically set up with an acquiring bank or a payment processor. When a customer makes a payment using a card, the funds are first transferred to the merchant account. From there, they are settled and eventually transferred to the merchant’s regular business bank account.

On the other hand, a Payment Service Provider (PSP) is a company that offers a range of payment processing services to merchants. While a merchant account is an essential component of payment processing, a PSP provides additional services and functionality beyond just processing transactions, including payment gateway integration, fraud prevention tools, reporting and analytics, and support for various payment methods.

Differences Between PSPs And Payment Processor

A payment processor is a financial institution or a third-party service provider that facilitates electronic payment transactions between merchants and customers. It acts as an intermediary between the merchant’s acquiring bank (the bank that processes the payments on behalf of the merchant) and the customer’s issuing bank (the bank that issued the payment card). The payment processor securely handles the authorization, settlement, and transfer of funds between these parties.

Payment processors offer merchants the infrastructure and technology required to accept various payment methods, such as credit cards, debit cards, and digital wallets. They provide the necessary software, hardware, and security measures to process and transmit payment data securely.

On the other hand, a Payment Service Provider (PSP) is a broader term that encompasses various services related to accepting and managing payments. While payment processors focus primarily on the technical aspects of payment transaction processing, PSPs offer additional services that may include:

- Payment Gateway

- Merchant Account Services

- Payment Optimization

- Reporting and Analytics

Payment processors focus primarily on processing payment transactions, and PSPs provide a more comprehensive solution for merchants looking to accept and manage payments.

All-in-One Solution for Your Payment Processing Needs

Solidgate is a payment processing platform that enables frictionless monetization of online businesses worldwide. Solidgate helps you enter new markets time- and cost-efficiently with an ecosystem of fintech products: from card acquiring and APMs to anti-fraud and chargeback management solutions. Our products ensure your customers get a seamless purchasing experience, and your business gets paid online smoothly and swiftly while meeting the highest security, stability, and compliance standards.